Britain's budget deficit “exploded” ahead of schedule, adding further variables to the dark clouds of the trade war

The Zhitong Finance App learned that the size of the British government's loans exceeded the official forecast made only last month. This highlights that the public finance situation was already very weak before the economic outlook became bleak due to the imposition of tariffs by the US.

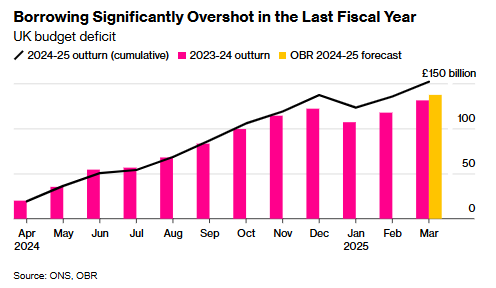

The UK Office for National Statistics said on Wednesday that the budget deficit for the fiscal year ending March was £151.9 billion (US$2020 billion), higher than the £137.3 billion forecast by the Office of Budget Responsibility, and the forecast itself has been revised upward.

Borrowings in March alone reached £16.4 billion. Economists expect an average deficit of £15.8 billion.

Last month, UK Chancellor of the Exchequer Rachel Reeves cut spending and raised taxes to avoid breaking her fiscal rules. However, as the trade war initiated by Trump threatens the global economy, outsiders are worried that she may have to announce further austerity measures later this year.

On Tuesday, the International Monetary Fund lowered Britain's economic growth forecast for the next two years, more than any major European country. This raised new doubts about whether the current fiscal year's deficit would drop as sharply as expected. Reeves will go to Washington this week to discuss with US Treasury Secretary Bezent to mitigate the direct impact of Trump's tariff policy.

Currently, Reeves is facing double pressure: on the one hand, welfare spending and public sector wage settlement are rising due to inflation; on the other hand, weak economic growth is affecting tax revenue. In the last year, the UK government's borrowing was £20.7 billion higher than in 2023-2024, spending increased by 4.1%, while government revenue increased by only 3.4%.

Ruth Gregory, UK Deputy Chief Economist at KITU Macro, said: “The Office of Budget Responsibility has yet to consider the possible upward impact of tariff shocks on borrowing. All of this means that Reeves may soon need to raise funds again through spending cuts and/or tax increases in the fall budget to meet the requirements of fiscal rules.” These rules require Reeves to ensure a balance between everyday expenses and tax revenue in the 2029-30 fiscal year.

Treasury Chief Secretary Darren Jones said, “In an ever-changing world, economic stability is critical. We must not be perfunctory about public finance. This is why our fiscal rules are not negotiable, and why we are reviewing taxpayer capital expenditure on a case-by-case basis for the first time in 17 years to prevent waste.”

Another indicator used to determine the size of Treasury debt sales also surpassed official forecasts in the past fiscal year. The central government's net cash requirement actually reached £1805 billion instead of the £172.6 billion forecast by the Office of Budget Responsibility in its March 26 spring statement.

However, the Debt Management Office decided to fill the £4.9 billion gap in this fiscal year's financing plan by issuing additional treasury notes rather than treasury bonds, and lowered the sales target of British Treasury bonds by £100 million to £299.1 billion. This will be achieved by reducing long-term bond auctions and syndicated underwriting, while increasing the issuance of short-term bonds. Affected by recent fluctuations in the bond market, the yield on 30-year British Treasury bonds fell sharply and fell 10 basis points to 5.27% after policy adjustments.

According to data from the UK Office for National Statistics, net borrowing in March increased from 13.6 billion pounds in the same period last year, mainly due to rising debt interest payments, welfare expenses, and personnel costs.

In March, the UK's net debt was £2.81 trillion, or 95.8% of GDP, close to the level of the early 1960s. The British government is currently targeting the broader measure of public sector net financial debt, and plans to reduce its share of the economy at the end of the current five-year parliamentary term. Last month, the public sector net financial debt target was £2.45 trillion, or 83.5% of GDP.

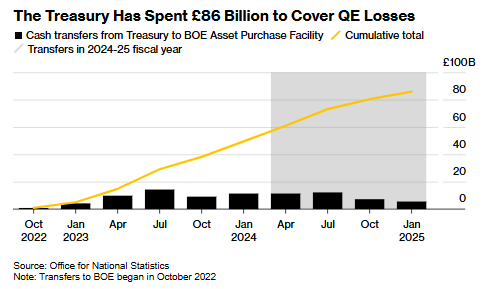

According to the UK Office for National Statistics, the Bank of England's bond operations lost 36.3 billion pounds this fiscal year, with a cumulative loss of nearly 86 billion pounds since 2022. This highlights the huge financial costs incurred when the central bank reduced its bond holdings accumulated during the quantitative easing period.

Wall Street Journal

Wall Street Journal