Lockheed Martin (NYSE:LMT) Reports Q1 Earnings Growth With US$750 Million Share Buyback

Lockheed Martin (NYSE:LMT) reported strong earnings growth for Q1 2025, with notable increases in sales and net income, alongside an update on its ongoing share buyback program. This solid financial performance helped the company's stock rise by 4% over the past month. The broader market experienced a mixed environment, with the Dow surging by 1,000 points amid a recovery from previous declines, while the S&P 500 showed volatility due to concerns about tariffs and economic impacts. Lockheed Martin's earnings and buyback news added positive weight amidst these market swings, contributing to its upward price movement.

The recent earnings growth and share buyback announcements from Lockheed Martin could further bolster its long-term business narrative. With a record-high backlog of $176 billion and increased F-35 deliveries, the company is poised for future success. Over the past five years, Lockheed Martin's total shareholder return, including dividends, was 38.54%. However, the company's recent one-year performance lagged behind the broader US market, which registered a 2.5% return in the same period, and underperformed the US Aerospace & Defense industry which saw a 16.3% gain. This contrast in performance highlights the importance of the latest earnings report, as it may signal an opportunity for improvement in the company's share price trajectory.

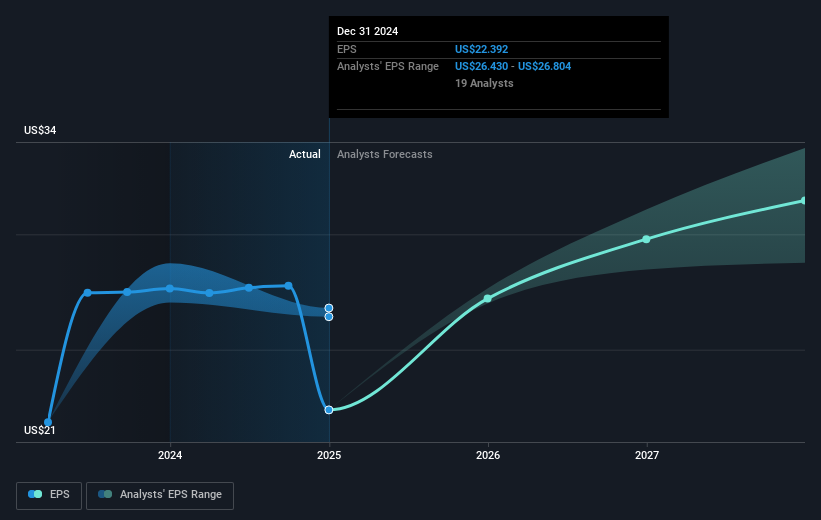

The strong financial results and share buyback program are expected to positively influence revenue and earnings forecasts. Current expectations suggest revenue growth of 3.8% annually over the next three years. Analysts see earnings rising to US$7.1 billion by 2028, supported by developments in high-margin revenue streams and operational efficiencies through R&D investments. With the current share price at US$477.08, the price movement remains in close proximity to the consensus analyst price target of US$523.08, indicating limited upside potential. Investors should continue to monitor Lockheed Martin's performance against these forecasts to assess alignment with long-term growth expectations.

Learn about Lockheed Martin's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal