It's Down 25% But Titan International, Inc. (NYSE:TWI) Could Be Riskier Than It Looks

Titan International, Inc. (NYSE:TWI) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

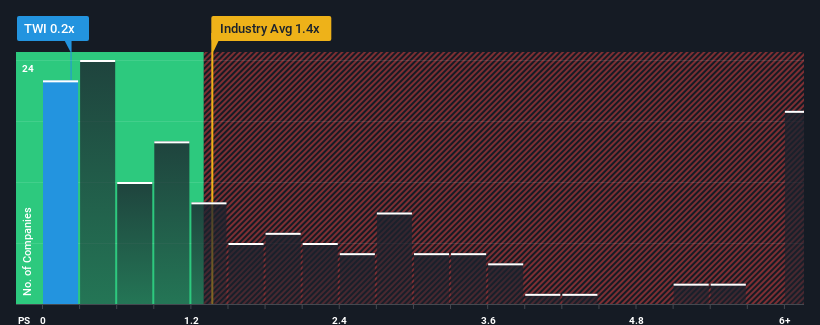

After such a large drop in price, when close to half the companies operating in the United States' Machinery industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Titan International as an enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Titan International

How Titan International Has Been Performing

Titan International certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Titan International.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Titan International's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.2% as estimated by the four analysts watching the company. With the rest of the industry predicted to shrink by 2.1%, it's set to post a similar result.

With this information, it's perhaps strange but not a major surprise that Titan International is trading at a lower P/S in comparison. We think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Titan International's P/S?

Titan International's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Titan International currently trades on a lower than expected P/S since its revenue forecast is matching the struggling industry but its P/S is struggling to keep up. Even though the company's revenue outlook is on par, we assume potential risks are what might be placing downward pressure on the P/S ratio. The market could be pricing in revenue growth falling below that of the industry, a possibility given tough industry conditions. It appears some are indeed anticipating revenue instability, because the company's current prospects should typically see a P/S closer to the industry average.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Titan International with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal