More Unpleasant Surprises Could Be In Store For Kandi Technologies Group, Inc.'s (NASDAQ:KNDI) Shares After Tumbling 27%

Kandi Technologies Group, Inc. (NASDAQ:KNDI) shares have had a horrible month, losing 27% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

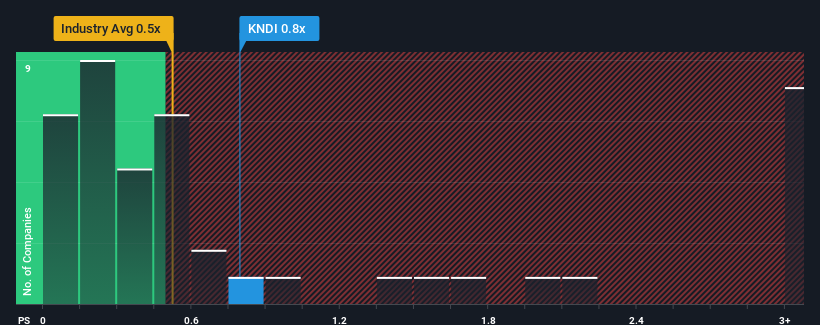

In spite of the heavy fall in price, it's still not a stretch to say that Kandi Technologies Group's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Auto Components industry in the United States, where the median P/S ratio is around 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Kandi Technologies Group

How Has Kandi Technologies Group Performed Recently?

As an illustration, revenue has deteriorated at Kandi Technologies Group over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kandi Technologies Group's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Kandi Technologies Group?

The only time you'd be comfortable seeing a P/S like Kandi Technologies Group's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 24% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it interesting that Kandi Technologies Group is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does Kandi Technologies Group's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Kandi Technologies Group looks to be in line with the rest of the Auto Components industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Kandi Technologies Group's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

You should always think about risks. Case in point, we've spotted 3 warning signs for Kandi Technologies Group you should be aware of, and 1 of them is a bit concerning.

If you're unsure about the strength of Kandi Technologies Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal