Abu Dhabi Ports Company PJSC's (ADX:ADPORTS) Price Is Out Of Tune With Earnings

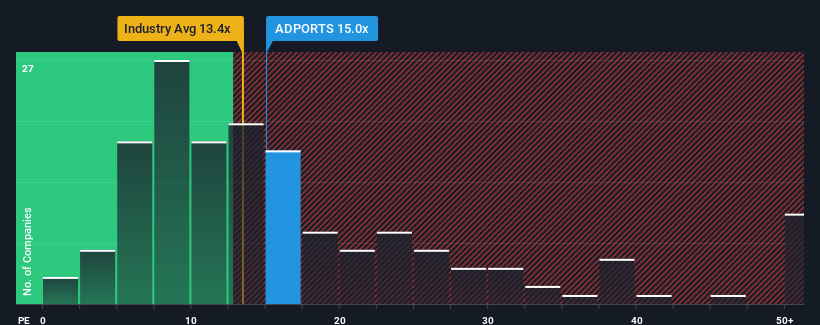

When close to half the companies in the United Arab Emirates have price-to-earnings ratios (or "P/E's") below 12x, you may consider Abu Dhabi Ports Company PJSC (ADX:ADPORTS) as a stock to potentially avoid with its 15x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

We've discovered 1 warning sign about Abu Dhabi Ports Company PJSC. View them for free.Recent times have been advantageous for Abu Dhabi Ports Company PJSC as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Abu Dhabi Ports Company PJSC

Does Growth Match The High P/E?

In order to justify its P/E ratio, Abu Dhabi Ports Company PJSC would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 28% last year. The latest three year period has also seen a 19% overall rise in EPS, aided extensively by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to climb by 7.5% during the coming year according to the three analysts following the company. That's shaping up to be similar to the 7.1% growth forecast for the broader market.

In light of this, it's curious that Abu Dhabi Ports Company PJSC's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From Abu Dhabi Ports Company PJSC's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Abu Dhabi Ports Company PJSC currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Abu Dhabi Ports Company PJSC is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal