With Rubrik, Inc. (NYSE:RBRK) It Looks Like You'll Get What You Pay For

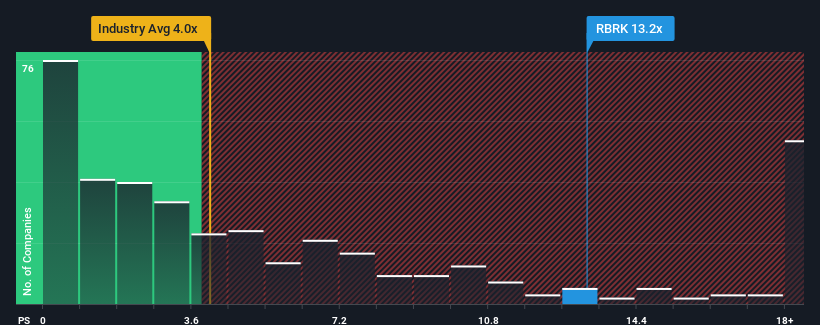

With a price-to-sales (or "P/S") ratio of 13.2x Rubrik, Inc. (NYSE:RBRK) may be sending very bearish signals at the moment, given that almost half of all the Software companies in the United States have P/S ratios under 4x and even P/S lower than 1.6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Rubrik

What Does Rubrik's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Rubrik has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Rubrik's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Rubrik?

Rubrik's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 41% last year. The latest three year period has also seen an excellent 75% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 28% each year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 15% per year growth forecast for the broader industry.

With this information, we can see why Rubrik is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Rubrik shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Rubrik (including 1 which is significant).

If these risks are making you reconsider your opinion on Rubrik, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal