Some Shareholders Feeling Restless Over Mercury NZ Limited's (NZSE:MCY) P/S Ratio

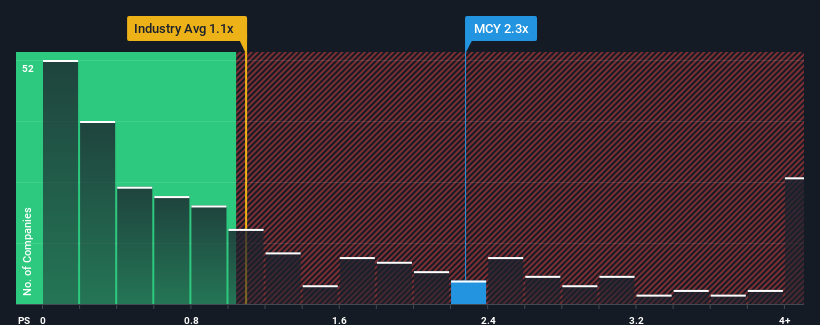

Mercury NZ Limited's (NZSE:MCY) price-to-sales (or "P/S") ratio of 2.3x may not look like an appealing investment opportunity when you consider close to half the companies in the Electric Utilities industry in New Zealand have P/S ratios below 1.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Our free stock report includes 2 warning signs investors should be aware of before investing in Mercury NZ. Read for free now.See our latest analysis for Mercury NZ

How Has Mercury NZ Performed Recently?

Recent revenue growth for Mercury NZ has been in line with the industry. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Mercury NZ's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Mercury NZ's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The latest three year period has also seen an excellent 81% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 1.1% per year during the coming three years according to the five analysts following the company. Meanwhile, the industry is forecast to moderate by 1.8% per annum, which suggests the company won't escape the wider industry forces.

With this in mind, we find it intriguing that Mercury NZ's P/S exceeds that of its industry peers. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Mercury NZ currently trades on a higher than expected P/S since its revenue forecast is in line with the struggling industry. At present, we are uneasy about the elevated P/S ratio, as the anticipated future revenues aren't likely to sustain such optimistic sentiment for the long-term. In addition, we are concerned whether the company can actually maintain this level of performance under these tough industry conditions, as it would be easy to have revenue growth slip further. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Mercury NZ is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Mercury NZ, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal