Benign Growth For Inseego Corp. (NASDAQ:INSG) Underpins Stock's 25% Plummet

Unfortunately for some shareholders, the Inseego Corp. (NASDAQ:INSG) share price has dived 25% in the last thirty days, prolonging recent pain. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 222% in the last twelve months.

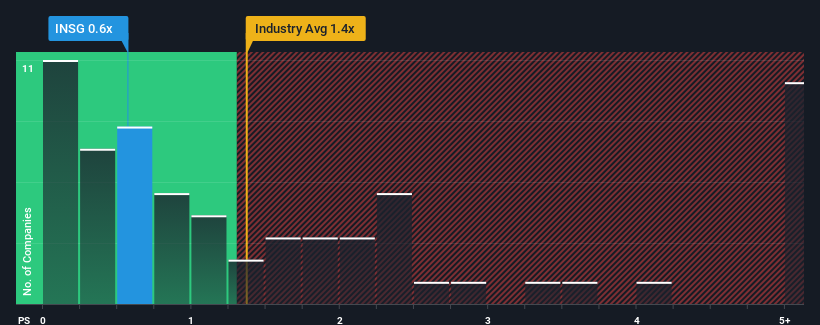

Since its price has dipped substantially, given about half the companies operating in the United States' Communications industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Inseego as an attractive investment with its 0.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Our free stock report includes 2 warning signs investors should be aware of before investing in Inseego. Read for free now.See our latest analysis for Inseego

What Does Inseego's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Inseego has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Inseego.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Inseego's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. However, this wasn't enough as the latest three year period has seen an unpleasant 27% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 0.5% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 9.5%, which is noticeably more attractive.

With this in consideration, its clear as to why Inseego's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

The southerly movements of Inseego's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Inseego's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 2 warning signs for Inseego (1 shouldn't be ignored!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal