Even after rising 19% this past week, CareCloud (NASDAQ:CCLD) shareholders are still down 78% over the past five years

CareCloud, Inc. (NASDAQ:CCLD) shareholders should be happy to see the share price up 19% in the last week. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Like a ship taking on water, the share price has sunk 78% in that time. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead.

On a more encouraging note the company has added US$9.7m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Our free stock report includes 3 warning signs investors should be aware of before investing in CareCloud. Read for free now.CareCloud isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over five years, CareCloud grew its revenue at 6.2% per year. That's a fairly respectable growth rate. So the stock price fall of 12% per year seems pretty steep. The market can be a harsh master when your company is losing money and revenue growth disappoints.

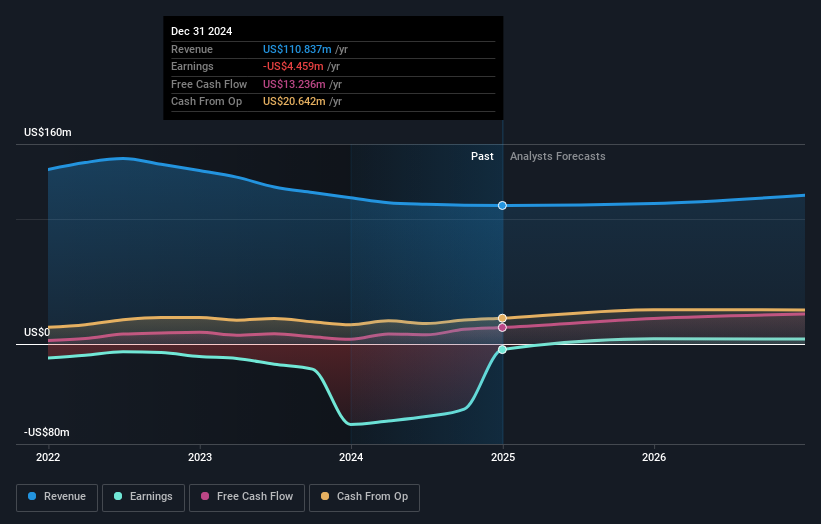

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling CareCloud stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that CareCloud shareholders have received a total shareholder return of 23% over one year. That certainly beats the loss of about 12% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand CareCloud better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with CareCloud (including 1 which is a bit concerning) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal