More Unpleasant Surprises Could Be In Store For Luminar Technologies, Inc.'s (NASDAQ:LAZR) Shares After Tumbling 27%

To the annoyance of some shareholders, Luminar Technologies, Inc. (NASDAQ:LAZR) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 82% loss during that time.

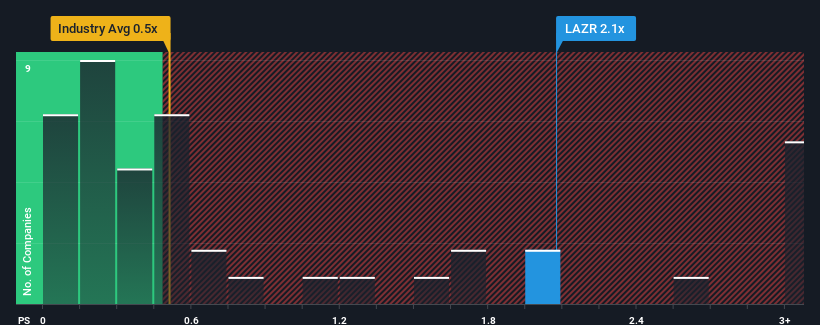

Although its price has dipped substantially, given close to half the companies operating in the United States' Auto Components industry have price-to-sales ratios (or "P/S") below 0.5x, you may still consider Luminar Technologies as a stock to potentially avoid with its 2.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

We've discovered 5 warning signs about Luminar Technologies. View them for free.View our latest analysis for Luminar Technologies

How Luminar Technologies Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Luminar Technologies has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Luminar Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Luminar Technologies?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Luminar Technologies' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.0% last year. The latest three year period has also seen an excellent 136% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 46% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 43% each year, which is not materially different.

With this in consideration, we find it intriguing that Luminar Technologies' P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Luminar Technologies' P/S?

There's still some elevation in Luminar Technologies' P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Luminar Technologies currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Having said that, be aware Luminar Technologies is showing 5 warning signs in our investment analysis, and 3 of those can't be ignored.

If these risks are making you reconsider your opinion on Luminar Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal