TSX's Promising Penny Stocks For April 2025

As the Canadian market navigates through a period of economic uncertainty influenced by global trade dynamics and potential inflationary pressures, investors are keeping a close eye on opportunities that can withstand volatility. Penny stocks, while an outdated term, continue to represent intriguing prospects for growth, particularly among smaller or newer companies with robust financial health. In this article, we explore several promising penny stocks that combine strong balance sheets with potential for long-term success amidst current market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.65 | CA$58.67M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.52 | CA$59.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$386.7M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.69 | CA$259.28M | ✅ 2 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.73 | CA$159.59M | ✅ 3 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.64 | CA$167.51M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$503.72M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.61 | CA$65.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.09 | CA$39.5M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Frontier Lithium (TSXV:FL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frontier Lithium Inc. is involved in the acquisition, exploration, and development of mining properties in North America with a market cap of CA$114.01 million.

Operations: Frontier Lithium Inc. currently does not report any distinct revenue segments, focusing on the acquisition, exploration, and development of mining properties in North America.

Market Cap: CA$114.01M

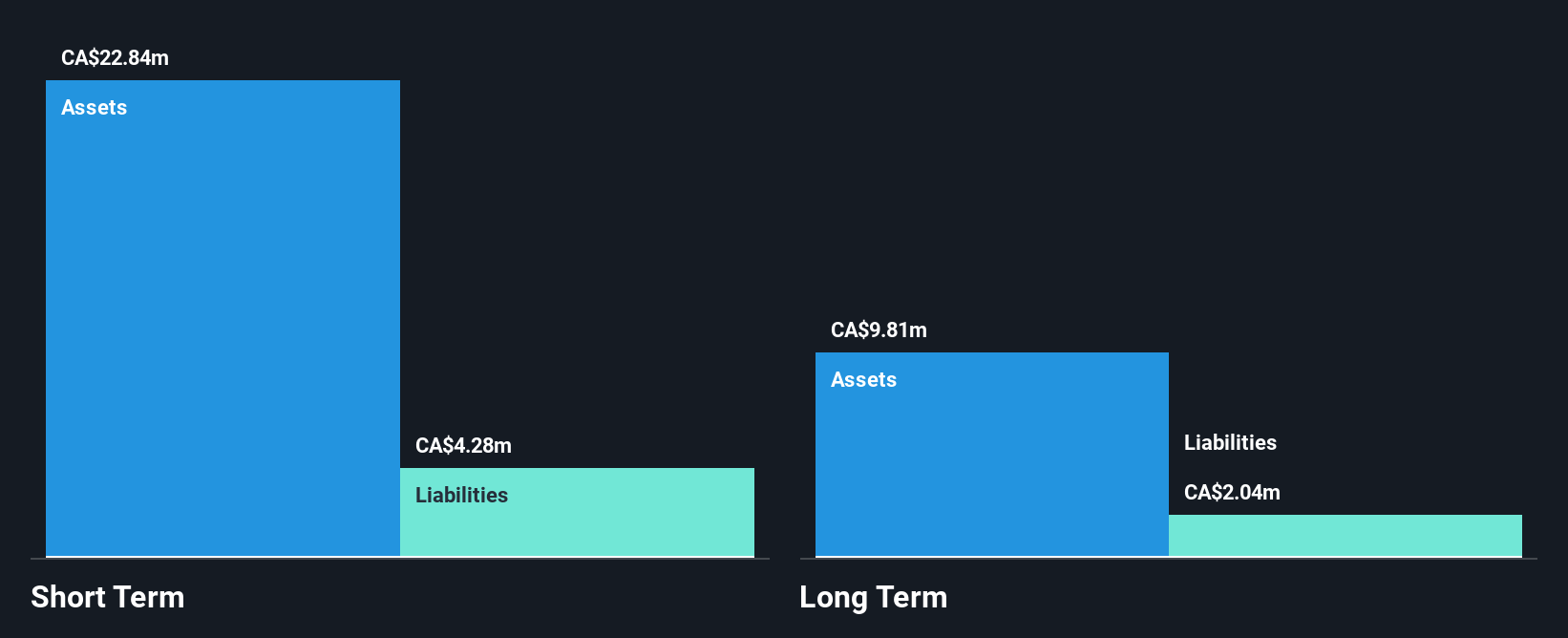

Frontier Lithium Inc., with a market cap of CA$114.01 million, remains pre-revenue and is focused on developing mining properties in North America. Despite its unprofitability, the company has not experienced shareholder dilution over the past year and maintains a debt-free status with short-term assets exceeding liabilities. Recent developments include government support for a planned Lithium Conversion Facility in Thunder Bay, Ontario, which could enhance Canada's critical minerals strategy. The facility aims to process materials from various lithium resources and support electric vehicle battery production. Frontier's management and board are considered experienced, providing strategic guidance during this expansion phase.

- Take a closer look at Frontier Lithium's potential here in our financial health report.

- Evaluate Frontier Lithium's prospects by accessing our earnings growth report.

Grande Portage Resources (TSXV:GPG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Grande Portage Resources Ltd. is an exploration stage company focused on exploring and developing natural resource properties in the United States, with a market cap of CA$21.33 million.

Operations: Grande Portage Resources Ltd. has not reported any specific revenue segments.

Market Cap: CA$21.33M

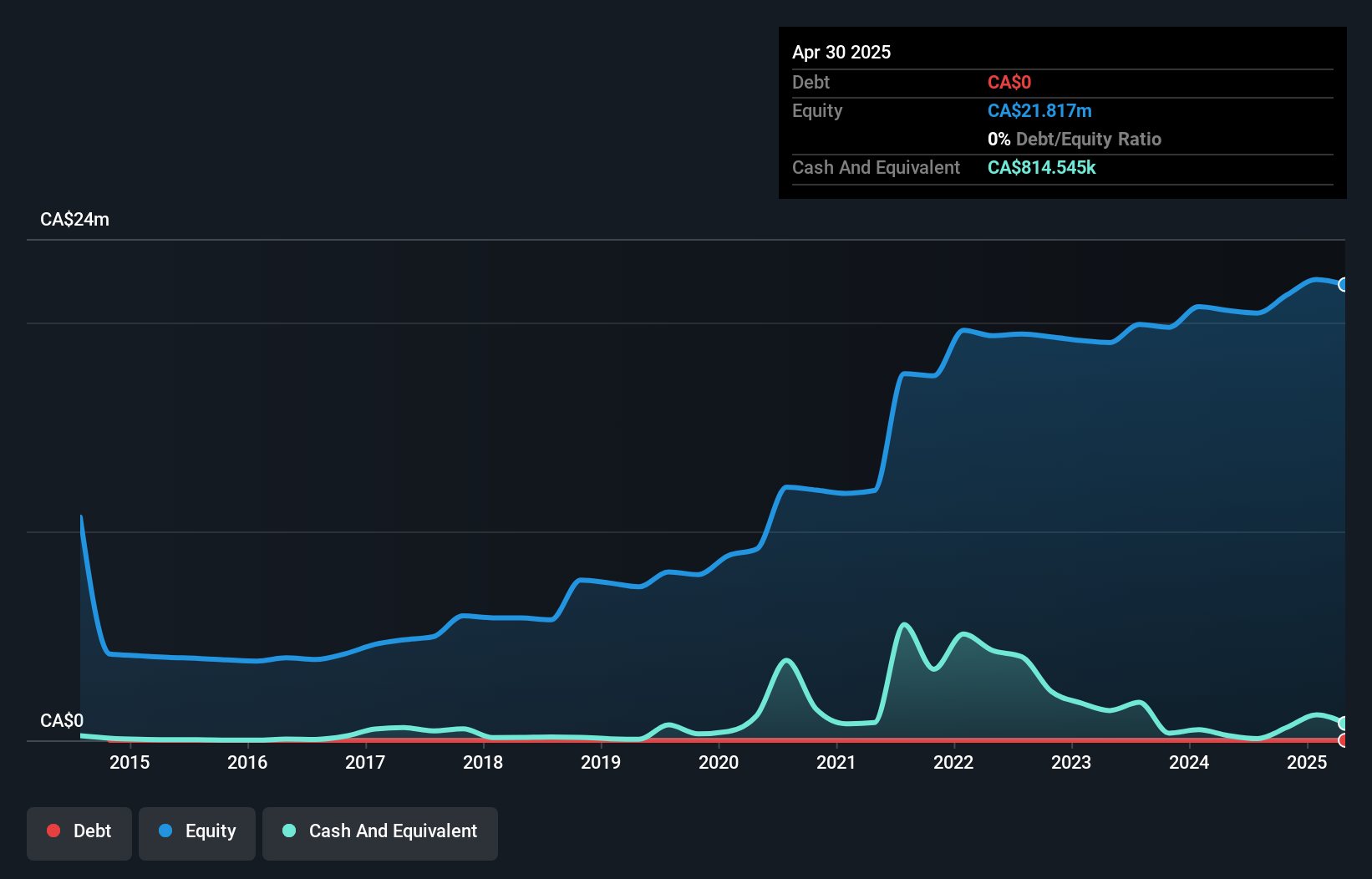

Grande Portage Resources Ltd., with a market cap of CA$21.33 million, is pre-revenue and focused on developing its New Amalga Mine Project in the U.S. The company recently announced promising test results from a sensor-based ore sorting system, which could reduce costs by minimizing waste and enhancing gold yield without chemical processing. Despite being debt-free and having seasoned management, Grande Portage faces financial challenges with less than a year of cash runway and ongoing losses. Auditor concerns about its ability to continue as a going concern highlight the risks involved for potential investors in this exploration-stage company.

- Click here and access our complete financial health analysis report to understand the dynamics of Grande Portage Resources.

- Learn about Grande Portage Resources' historical performance here.

Unigold (TSXV:UGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Unigold Inc. is a junior natural resource company dedicated to exploring and developing gold projects in the Dominican Republic, with a market cap of CA$25.01 million.

Operations: Unigold Inc. has not reported any revenue segments.

Market Cap: CA$25.01M

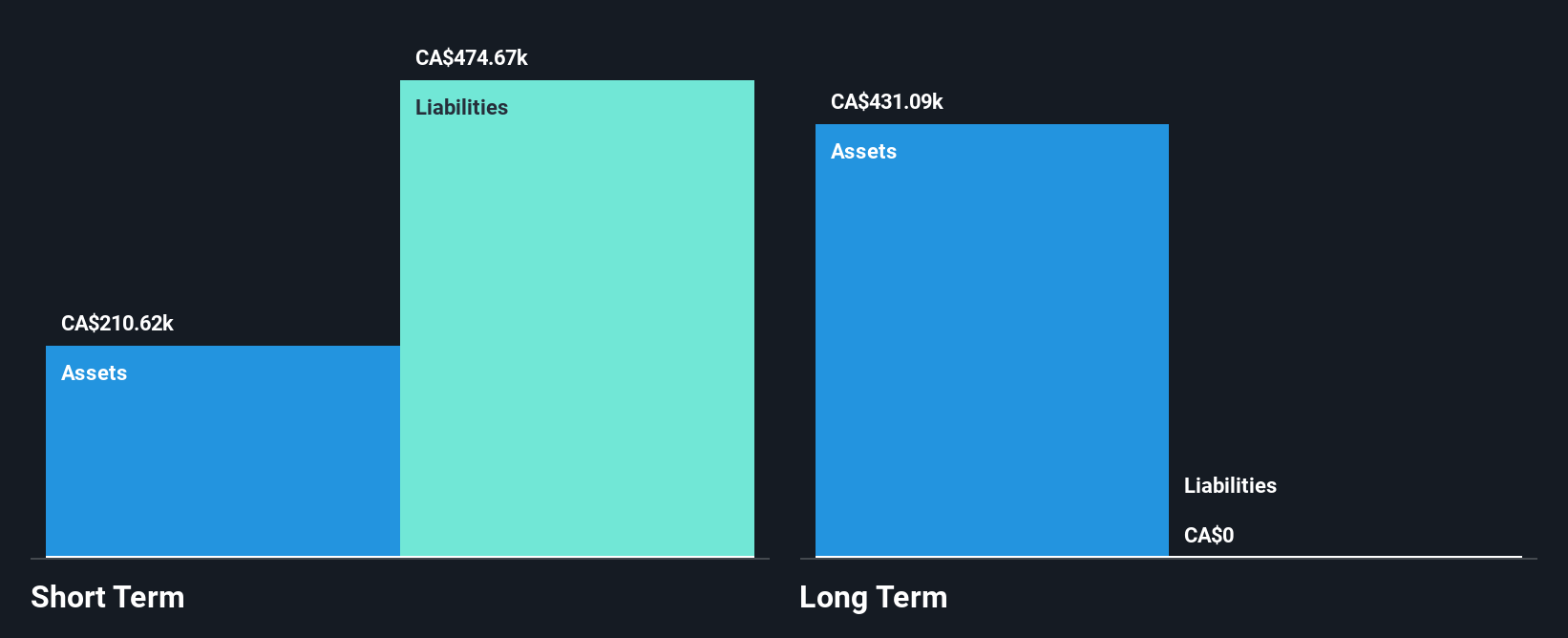

Unigold Inc., with a market cap of CA$25.01 million, is a pre-revenue junior resource company focused on gold exploration in the Dominican Republic. The company recently completed a non-brokered private placement, raising CA$293,150 to support ongoing operations. Unigold remains debt-free and its short-term assets exceed liabilities, but it faces financial constraints with only three months of cash runway based on recent free cash flow estimates. Despite unprofitability and high share price volatility, the experienced management team continues to pursue development opportunities while addressing capital needs through strategic financing initiatives such as private placements.

- Jump into the full analysis health report here for a deeper understanding of Unigold.

- Gain insights into Unigold's historical outcomes by reviewing our past performance report.

Summing It All Up

- Take a closer look at our TSX Penny Stocks list of 934 companies by clicking here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 20 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal