Meta Platforms (NasdaqGS:META) Collaborates with Cerebras to Launch Llama 4 AI Models

Meta Platforms (NasdaqGS:META) recently launched its advanced large language models, Llama 4 Scout and Maverick, highlighting significant advancements in AI capabilities. Simultaneously, the company announced a substantial investment in a data center project aimed at bolstering AI and cloud infrastructure. Despite these developments, the company’s stock experienced flat movement over the past week. This is consistent with broader market declines, as major indices, including the Dow and Nasdaq, grappled with sell-offs and volatility, highlighting the challenging market conditions impacting technology stocks amid economic pressures and investor sentiment shifts.

Be aware that Meta Platforms is showing 1 weakness in our investment analysis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments at Meta Platforms, including the launch of advanced AI models and a major data center investment, have the potential to significantly influence the company's future strategies and financial performance. These initiatives are expected to enhance personalization, drive user engagement, and solidify Meta's position in AI, potentially leading to increased advertising revenue. However, such investments might also strain finances in the short term due to high capital expenditures before realizing revenue gains.

Despite the recent flat share price movement, Meta Platforms has delivered impressive total shareholder returns of 232.56% over the past five years. Over a shorter period of one year, the company's stock performance has outpaced both the broader market and the US Interactive Media and Services industry. The share price, currently at US$510.45, reflects a discount of around 28.4% to the consensus analyst price target of approximately US$752.36, suggesting a potential upside if analyst forecasts are realized.

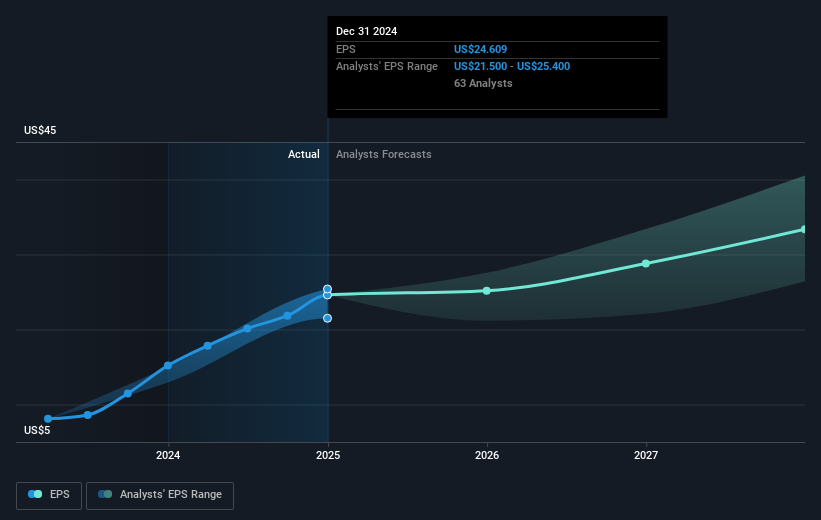

The positive impact on revenue and earnings forecasts stems from the company's focus on AI initiatives and enhanced ad monetization strategies. Analysts anticipate revenue growth to continue, albeit at a slower pace than the company's past high growth rates. Earnings forecasts also project moderate annual growth. These factors, combined with the company's strong return on equity and good valuation compared to industry peers, might reassure investors about long-term prospects, aligning market expectations with analyst price targets.

Take a closer look at Meta Platforms' potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal