America's core CPI fell to its lowest level in 4 years! However, under the tariff storm, the “monster of inflation” is preparing to make a comeback

The Zhitong Finance App learned that the US core CPI inflation slowed more than expected in March. For the financial market, the good news is that the March inflation data, which cooled beyond expectations, gave consumers some respite before Trump's aggressive global tariff policy, which could drastically increase prices, and may also greatly ease the trend of stock debt sell-off.

Needless to say, the bad news for the market is that the latest segmented data shows that the core drivers of US inflation in recent years — housing and other services, and food price inflation is very sticky. More importantly, as Trump opened a universal tariff of at least 10% globally in April, and tariffs of up to 25% on global automobiles, steel, and aluminum products — especially steel and aluminum, which are critical to the production of various core commodities in the US. The CPI data in March may be the last happy day before the “monster of inflation” makes a comeback Relaxing time.

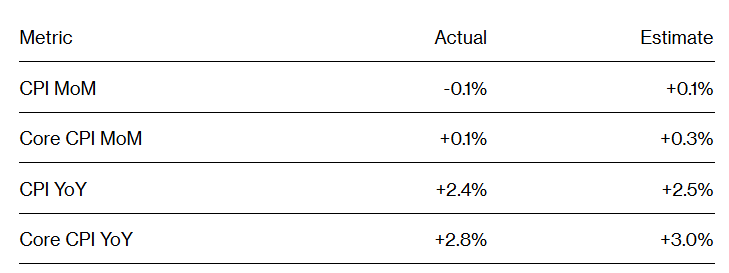

According to CPI inflation data released by the US Bureau of Labor Statistics on Thursday, after excluding fluctuating food and energy costs, the US core consumer price index (i.e. core CPI) rose only 0.1% month-on-month in March, the smallest increase in nine months; the core CPI rose 2.8% year on year, the lowest year-on-year increase in four years.

The core CPI is the US inflation data that the market is most concerned about. It is an important reference for the market to set the Fed's interest rate cut expectations. The overall CPI fell 0.1% month-on-month, the first month-on-month decline in nearly five years. The overall CPI rose 2.4% year on year, which is lower than the 2.5% increase generally expected by the market.

After the release of the latest CPI data, which is better than market expectations, the interest rate futures market's bets on the Fed's interest rate cut have not clearly heated up or cooled down. Most traders are still betting that the Fed will cut interest rates three times this year, by 25 basis points each time. It highlights that the interest rate futures market and bond market traders have completely turned their attention to inflation data for April and beyond, fearing that the tariff policy may once again sweep the monster of inflation across the US.

Samuel Tombs (Samuel Tombs), chief US market economist from Pantheon Macroeconomics, said in a report: “The experience with the 2018 laundry agency tax shows that consumer prices will take three months to respond to the new tariffs, and then they will be transmitted very quickly.” He added that the May CPI report should reflect this impact.

The good news is that CPI inflation cooled more than expected in March

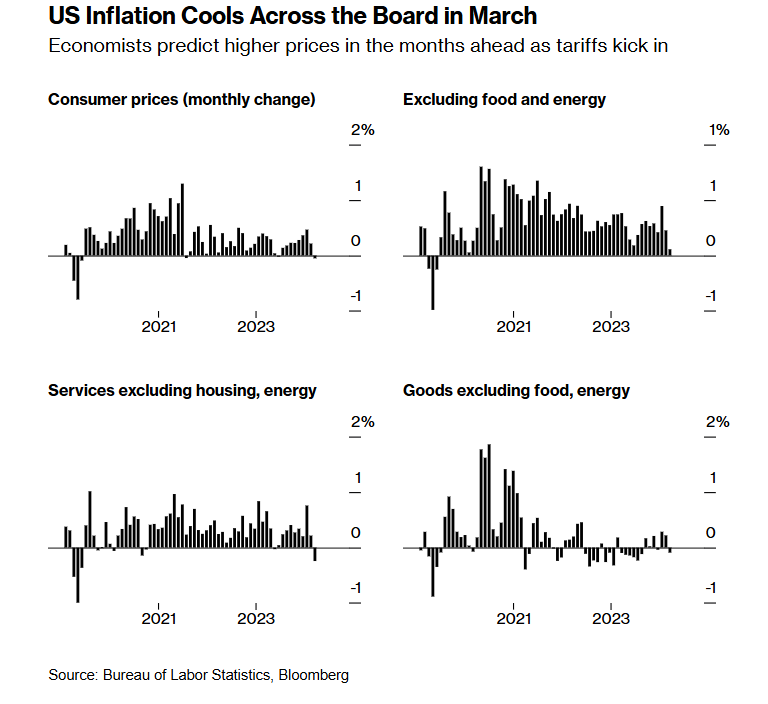

Inflation breakdown data shows that energy costs, used cars, and air ticket prices have dropped sharply, combined with a marked slowdown in the growth rate of clothing prices, which together drove down the overall CPI. After the data was released, treasury bond yields declined, S&P 500 futures maintained a downward trend, and the US dollar continued to depreciate during the day, which meant that the CPI, which cooled in March, did not ease market concerns that the US economy might fall into “stagflation.”

Although these data provide a temporary dawn for consumers who have been under high price pressure for a long time, the large-scale tariffs implemented by the US administration led by Trump, who has returned to the White House, may make the benefits fleeting.

Although Trump announced on Wednesday local time that the process of imposing so-called “equal tariffs” on most countries will be suspended for 90 days (less than 24 hours before the announcement was suspended), most countries in the world are currently facing at least 10% tariffs on imported goods. The US already levied a 25% tax on imported steel and aluminum last month, and began imposing tariffs of up to 25% on global automobiles this month, while tariffs on imported goods from China have risen sharply to 125% this week due to Beijing's countermeasures.

Although US President Trump said he has authorized the implementation of a 90-day “equal tariff suspension” concession measure for most countries around the world, tariffs were still imposed on these countries to 10% during this period.

As for CPI in April and beyond, it can be said that upward expectations will continue to heat up sharply, and some of the rising import costs will eventually be passed on to consumers in the US. Auto giants from Target to Volkswagen have warned the American public that prices will rise soon. This uncertainty has kept Federal Reserve officials on the sidelines, waiting for further clarification on the impact of tariffs on inflation and the US economy as a whole.

Even though some tariffs were implemented in March, prices for categories that are highly dependent on China, such as toys, home appliances, and tools, have fallen. The CPI report shows that core commodity prices fell 0.1% month-on-month in March, the first decline since August last year.

However, while the market focuses on the impact of tariffs on commodity prices, the key driver of inflation in recent years, the cost of housing (the largest segment of service inflation), has shown a moderate rise, showing that inflation is sticky, compounded by the extreme negative effects of tariff expectations. It can be described as very logical that the market's expectations for US inflation are heating up.

In terms of sticky inflation in the service sector, hotel accommodation prices in the US recorded the biggest drop in more than three years in March, while the equivalent rent for landlords (an important subcategory of housing) unexpectedly accelerated to 0.4% month-on-month.

Among other service sector indicators, the cost of motor vehicles, family insurance, and car rental all declined last month. According to Bloomberg Calculations estimates, the price of core services excluding housing and energy recorded the biggest drop in the past five years. Although the Federal Reserve emphasizes the importance of this indicator in judging the trajectory of inflation, its calculation is based on a different index system.

Furthermore, the cost of groceries in the US unexpectedly rose 0.5% month-on-month in March, the biggest increase since October 2022.

Another set of inflation indicators called the Personal Consumer Expense Price Index (PCE) does not give housing too much weight as the CPI. This explains why PCE data, particularly the core PCE, which suggests energy and food costs, is closer to the Federal Reserve's 2% inflation target. The PPI report to be released this Friday will provide some key segment clues that directly affect the March core PCE data. Core PCE is also the most popular measure of inflation for a long time by Federal Reserve officials such as Federal Reserve Chairman Powell.

According to CPI breakdown data, the price of eating out, which has a large weight in the basket of core PCE inflation indicators, showed an unexpected increase of 0.4% for two consecutive months, which may push the core PCE upward beyond expectations. Another report on Thursday showed that the number of jobless claims rose to 223,000 at the beginning of last week and is still hovering near historic lows.

The bad news is that the cooling of inflation may be temporarily halted! Wall Street and the Federal Reserve make a tacit bet: inflation is about to heat up

David Kelly, chief global strategist in the asset management department of J.P. Morgan Chase, said after the inflation announcement: “This (the cooling of inflation in March) was the calm before the inflation storm. Tariffs will cause inflation to rise slightly, and I think the actual state of the US economy will worsen further this year.”

According to information, Wall Street bank Goldman Sachs recently raised the core PCE inflation index by 0.5% percentage points to 3.5% by the end of 2025, and is expected to rise to 4%, stressing that even the core PCE will be difficult to return to the 2% target anchored by the Federal Reserve. In February of this year, the core PCE index increased 2.8% year over year.

Furthermore, Goldman Sachs's latest forecast shows that the US economic growth rate will be only 0.5% in 2025, and the possibility of falling into recession in the next 12 months is as high as 45%. Since Trump first announced tariffs on April 2, other major Wall Street economists have also drastically lowered US economic growth expectations and drastically raised core PCE inflation expectations. Among them, Citigroup expects the US GDP to grow by only 0.1% in 2025, mainly due to a resurgence in inflation driving a sharp drop in consumer spending.

Goldman Sachs anticipates that the Fed may cut interest rates three times this year, but another Wall Street bank, Morgan Stanley's expectations seem very hawkish — the Fed is not expected to cut interest rates this year. Morgan Stanley warns that the market is not currently pricing the impending recession. Although the global economic downturn triggered by the US recession is not a benchmark scenario, it is becoming an increasingly realistic and pessimistic scenario. Therefore, the team of economists at Morgan Stanley currently anticipates that the return of inflation caused by Trump's tariff policy will keep the Federal Reserve on the sidelines and may not cut interest rates to any extent in 2025.

American economists at Morgan Stanley emphasized that if announced tariffs persist for a long time, the downside risks facing growth will increase significantly, and the upward risk facing inflation will also increase, and it is expected that the upward driving force of inflation and the drag on economic growth from trade and immigration policies is unlikely to be offset by US fiscal policy measures and deregulation.

At present, many Federal Reserve officials have sent a clear signal through public comments and interviews, ruling out adopting “preventive interest rate cuts” as an insurance policy against the US economic slowdown. In order to minimize the risk of rising inflation caused by the tariff policy, they may be prepared to keep policy interest rates unchanged for a long time.

St. Louis Federal Reserve Chairman Alberto Musalem (Alberto Musalem), who has the right to vote on monetary policy at the Federal Open Market Committee (FOMC) of the Federal Reserve in 2025, said on Wednesday that as companies and households have to accept the rise in prices brought about by the new tariffs, the US economic growth may “significantly” fall below the trend level, and the unemployment rate will rise in the next year. He also said that the higher-than-expected tariff policy will put severe upward pressure on prices; at the same time, the decline in business/consumer confidence and the sharp decline in the stock market have hit household wealth, thereby curbing spending. Combined, all of these factors are expected to slow down the growth rate of the US economy.

Minneapolis Federal Reserve Chairman Neel Kashkari (Neel Kashkari) wrote in an article published on Wednesday morning local time: “Given the importance of keeping long-term inflation expectations stable, and the potential for tariffs to boost recent inflation, the threshold for cutting interest rates is higher even when the economy is weak and unemployment is likely to rise. The barriers to somehow changing the federal funds rate have increased because of tariffs.”

Jeremy Schwartz, an American economist at Nomura Securities, said that the Federal Reserve may only take more aggressive action when large-scale layoffs, a sharp rise in the number of jobless claims, and a sharp rise in the unemployment rate. He expects to cut interest rates once in December this year. He said, “Not only is inflation too high, it has been above the target for many years, and it will also be bad for the target. Lowering interest rates in this context will indeed jeopardize the credibility of the Federal Reserve to return inflation to target levels.”

Wall Street Journal

Wall Street Journal