ASX Penny Stocks To Watch In April 2025

The Australian market has recently experienced a significant downturn, with the ASX200 closing down 4.2% amid substantial losses in the Energy, Financials, Materials, and Discretionary sectors. In such volatile times, investors often look beyond established giants to explore opportunities in penny stocks—smaller or newer companies that can offer unique growth potential. While the term "penny stocks" might seem outdated, these investments remain relevant as they can combine value with growth prospects when backed by strong financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.535 | A$119.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.685 | A$953.71M | ✅ 4 ⚠️ 1 View Analysis > |

| Cedar Woods Properties (ASX:CWP) | A$4.98 | A$410.9M | ✅ 5 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.31 | A$61.8M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.21 | A$341.43M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.57 | A$109.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$2.85 | A$135.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.825 | A$612.1M | ✅ 5 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.59 | A$420.19M | ✅ 5 ⚠️ 1 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$2.90 | A$239.94M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 983 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aims Property Securities Fund (ASX:APW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aims Property Securities Fund, with a market cap of A$111.30 million, is a close-ended fund of funds launched by MacArthurCook Ltd.

Operations: The fund's revenue segments include contributions from AIMS Growth Investment Fund at A$86.51 million, AIMS Real Estate Opportunity Fund at A$1.70 million, and smaller inputs from AIMS APAC REIT and AIMS Total Return Fund, while Blackwall Limited and other property funds posted negative figures.

Market Cap: A$111.3M

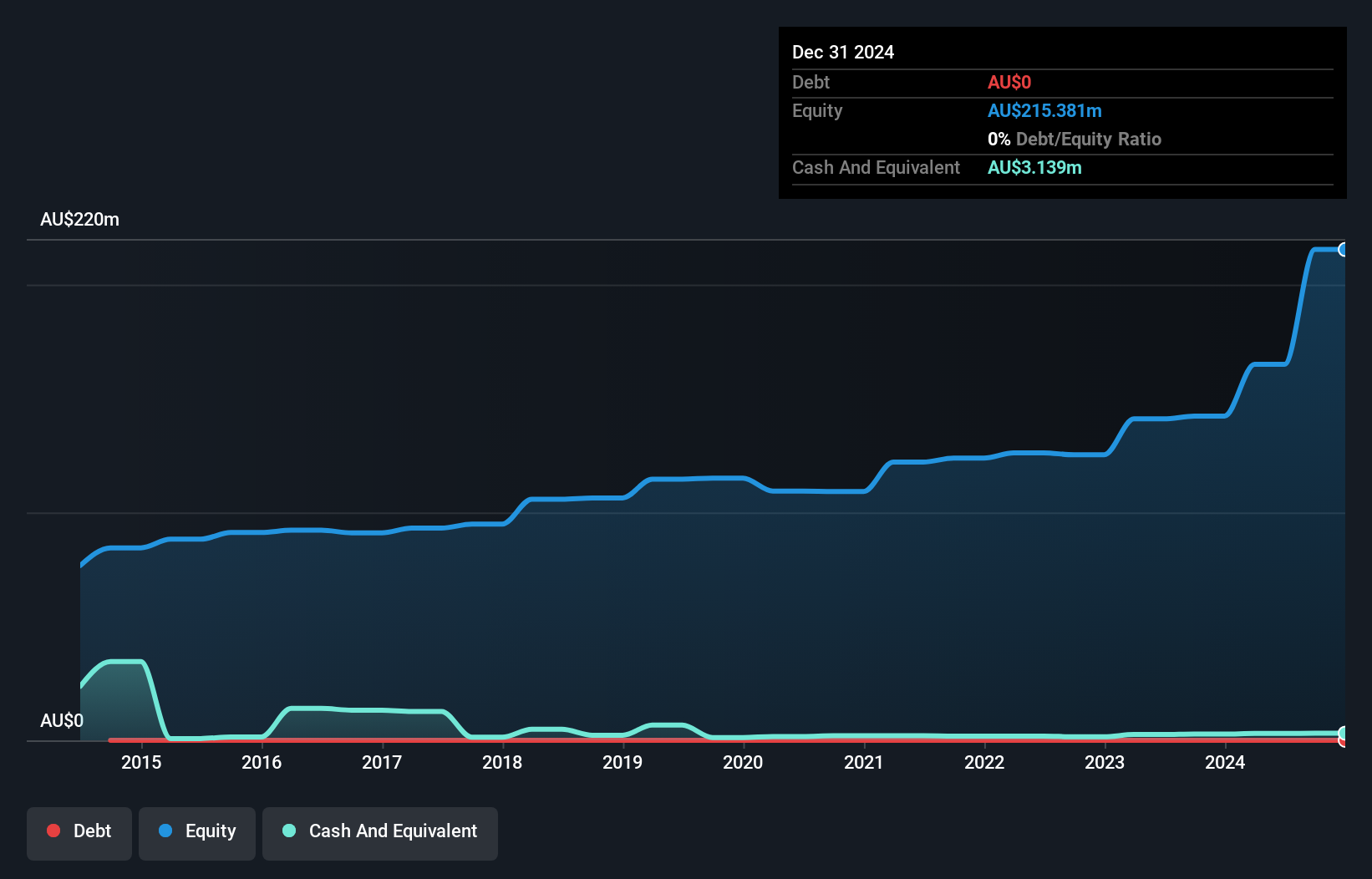

Aims Property Securities Fund, with a market cap of A$111.30 million, has demonstrated robust performance as a penny stock. The fund boasts a high Return on Equity of 33.9% and impressive earnings growth, surging by 330.6% over the past year, significantly outpacing the REITs industry average. Its Price-To-Earnings ratio of 1.5x suggests potential undervaluation compared to the broader Australian market at 16.8x. The company is debt-free with no long-term liabilities, enhancing its financial stability alongside seasoned board leadership averaging 14.7 years in tenure and strong net profit margins currently at 98.3%.

- Take a closer look at Aims Property Securities Fund's potential here in our financial health report.

- Learn about Aims Property Securities Fund's historical performance here.

Reef Casino Trust (ASX:RCT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Reef Casino Trust operates as an owner and lessor of the Reef Hotel Casino complex in Cairns, North Queensland, Australia, with a market cap of A$88.15 million.

Operations: The company's revenue is derived from its Casinos & Resorts segment, totaling A$25.52 million.

Market Cap: A$88.15M

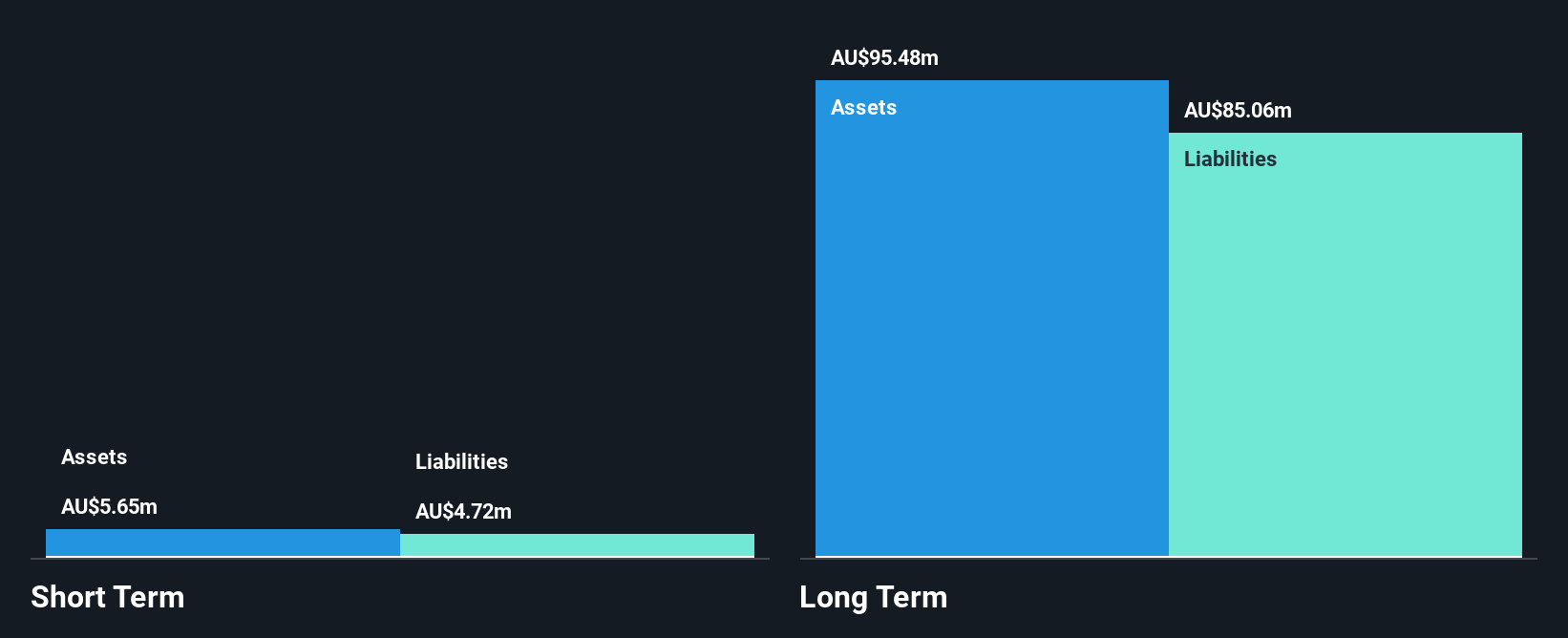

Reef Casino Trust, with a market cap of A$88.15 million, presents mixed aspects for penny stock investors. The company has an outstanding Return on Equity of 44.8% and significant profit growth over the past five years, yet recent earnings have declined slightly by 5.3%. Despite having more cash than its total debt and strong operating cash flow coverage, RCT's interest payments are not well covered by EBIT. Its short-term assets exceed liabilities; however, long-term liabilities remain uncovered by short-term assets. Recently dropped from the S&P/ASX All Ordinaries Index, it reported stable revenue but slightly lower net income for 2024 compared to the previous year.

- Get an in-depth perspective on Reef Casino Trust's performance by reading our balance sheet health report here.

- Explore historical data to track Reef Casino Trust's performance over time in our past results report.

Richmond Vanadium Technology (ASX:RVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Richmond Vanadium Technology Limited focuses on the exploration and development of mineral properties in Australia, with a market cap of A$32.17 million.

Operations: The company generates revenue from its mineral exploration and development activities, specifically focusing on vanadium resources, amounting to A$0.67 million.

Market Cap: A$32.17M

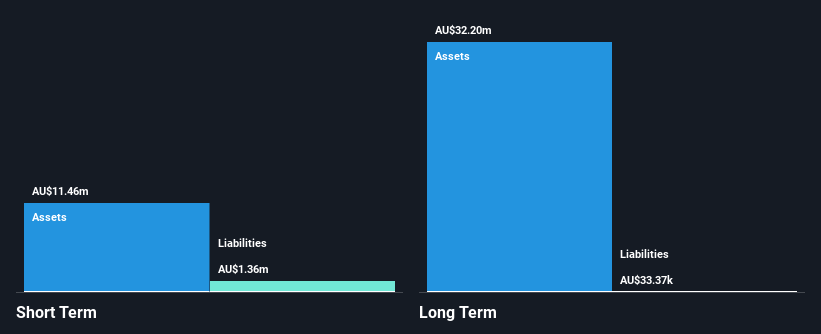

Richmond Vanadium Technology, with a market cap of A$32.17 million, is pre-revenue, generating only A$0.67 million from mineral exploration. The company remains unprofitable with a negative Return on Equity and has experienced increasing losses over the past five years. Despite this, RVT is debt-free and maintains sufficient cash runway for over two years if costs continue to decline at historical rates. Recent developments include a share buyback program aimed at reducing outstanding shares by repurchasing up to 3,350,724 shares using existing liquidity. However, volatility remains high compared to most Australian stocks.

- Jump into the full analysis health report here for a deeper understanding of Richmond Vanadium Technology.

- Gain insights into Richmond Vanadium Technology's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 980 more companies for you to explore.Click here to unveil our expertly curated list of 983 ASX Penny Stocks.

- Ready To Venture Into Other Investment Styles? Explore 21 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal