Shopify (NasdaqGS:SHOP) Sees 20% Weekly Decline As Nasdaq Enters Bear Market

Shopify (NasdaqGS:SHOP) recently saw a 20% decline last week, amidst significant market volatility as global stock indexes suffered due to new tariffs. The addition of Shopify to the NASDAQ Composite Index highlights its market standing, yet the broader economic conditions overshadow such achievements. Moreover, partnerships with Contentful and Braze are expanding Shopify's eCommerce capabilities. However, these positive developments have been largely overshadowed by the downturn in the tech-heavy Nasdaq index, which entered bear market territory due to the tariff turmoil. Consequently, broader market sentiment seems to have driven the recent decline in Shopify’s total shareholder returns.

Find companies with promising cash flow potential yet trading below their fair value.

Shopify's recent 20% decline amid broader market volatility could impact its projected narrative by overshadowing advancements like its partnerships with Contentful and Braze. This downturn, driven by market sentiment and fears of looming tariffs, may overshadow the company's potential revenue growth stemming from expanded eCommerce capabilities. Over the long term, Shopify's total return, including share price and dividends, stands at a strong 84.06% over five years, demonstrating resilience despite recent fluctuations. In the past year, Shopify outperformed the US IT industry, which returned a 3.9% decline, highlighting its relative market strength.

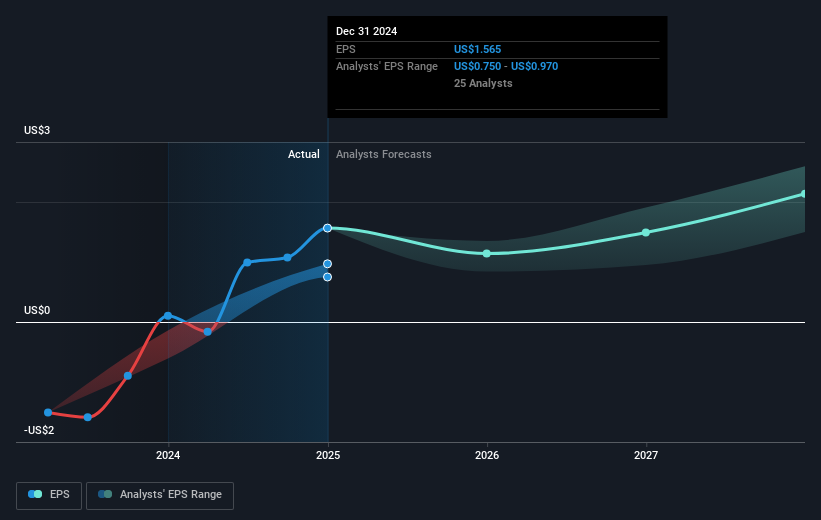

Analysts forecast revenue growth driven by international expansion and AI investments; however, the current market uncertainty might challenge these forecasts. Earnings, predicted to reach US$2.7 billion by March 2028, could face pressure if broader economic challenges affect operational margins and efficiency. Despite the 20% drop, Shopify’s current share price of US$109.82 remains below the consensus price target of US$134.54, indicating an 18.4% potential upside. Investors should assess these forecasts in light of current market conditions and their potential effects on Shopify's future performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal