Alibaba Group Holding (NYSE:BABA) Soars 36% Over Last Quarter With Net Income Surging to CNY 49,127 Million

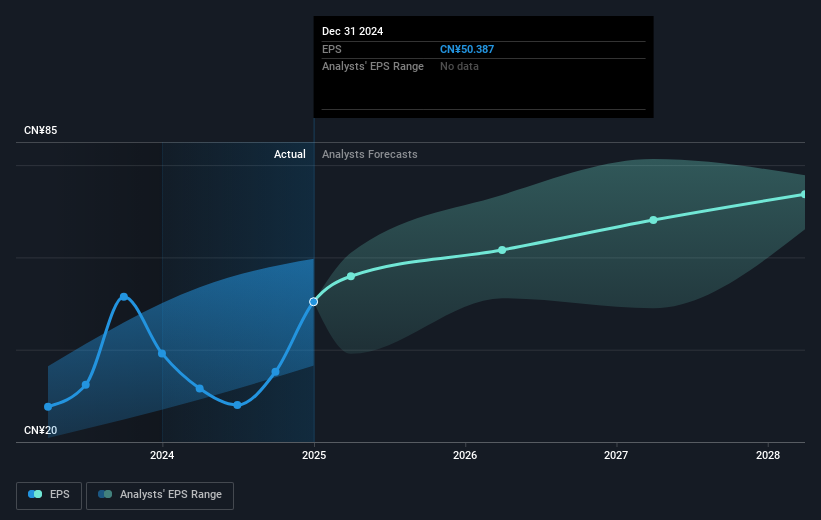

Alibaba Group Holding (NYSE:BABA) saw its stock price rise by 36% over the last quarter, against a backdrop where the broader market faced downturns with major indexes like the Nasdaq entering a bear market. This significant gain can be attributed to several key company events, notably its aggressive buyback strategy which saw 51 million shares repurchased for $600 million, enhancing shareholder value. Furthermore, the company's impressive earnings performance, with net income surging from CNY 14,555 million to CNY 49,127 million year-over-year, underscores robust operational growth that appealed to investors. While broader market indices declined, affected by tariff turmoil, Alibaba's strategic business expansions and substantial earnings uplift helped buffer and drive its share price upward during the otherwise tumultuous quarter.

Over the past year, Alibaba Group Holding experienced a substantial total shareholder return of 66.12%, outpacing the broader market and exceeding the US Multiline Retail industry, which saw a 1% decline. Key factors contributing to this performance include significant business expansions and share repurchases. Notably, from October 2024 to September 2025, Alibaba invested heavily in boosting its cloud computing and AI infrastructure with a planned expenditure of RMB 380 billion (US$53 billion). This strategic move is expected to fortify its long-term market position.

Additionally, Alibaba engaged in aggressive share repurchase activities with repurchases totaling around US$44.85 billion by the end of March 2025. This initiative has enhanced shareholder value by reducing the number of shares outstanding. The company's approach to integrating various business units under the Alibaba E-commerce Business Group marks an expansion strategy aimed at increasing operational efficiency. The declaration of both ordinary and special dividends further underscored Alibaba's commitment to delivering shareholder returns over this period.

Our valuation report here indicates Alibaba Group Holding may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal