AvalonBay Communities (NYSE:AVB) Faces 10% Weekly Decline Amid US-China Tariff Tensions

Amid a tumultuous week marked by widespread tariff-related sell-offs, AvalonBay Communities (NYSE:AVB) saw its share price fall by 10.24%. This movement parallels the broader market downturn, with major indexes like the S&P 500 dropping 9.1% due to escalating global trade tensions fueled by newly imposed tariffs from the U.S. and retaliatory actions from China. While the challenging economic environment impacted stocks across various sectors, AvalonBay's performance was significantly influenced by these macroeconomic pressures, reflecting a general investor sentiment shift towards caution in the real estate investment trust sector amidst growing uncertainty.

The last five years have seen AvalonBay Communities deliver a total return of 36.09%, including share price appreciation and dividends. During this time, AvalonBay has focused on expanding into Sunbelt and suburban markets, aiming to diversify its portfolio. This move is part of a broader strategy to capture growth opportunities, despite potential financial strains from increased competition and fluctuating demand. The company's recent earnings announcements reflect consistent revenue and net income growth, with full-year 2024 earnings reaching US$1.08 billion. This ongoing growth and investment have solidified AvalonBay's market position, even as the company navigated transitional financial challenges associated with its expansion efforts.

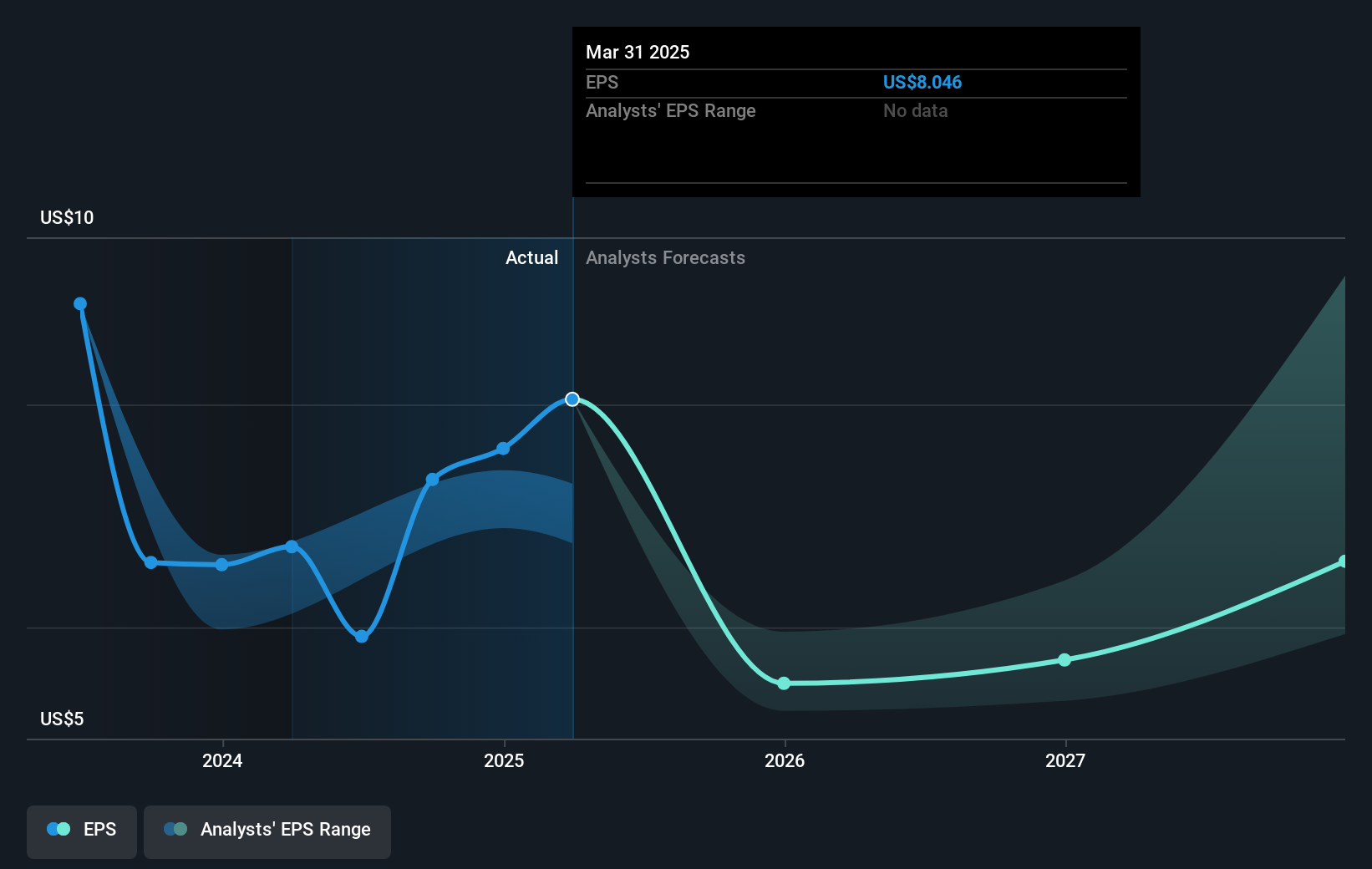

In the past year, AvalonBay's earnings growth outpaced the Residential REITs industry average. Despite this, the company underperformed its industry in terms of one-year total returns. Earnings growth remains robust, driven by an operational transformation that includes centralized services and AI utilization, enhancing profit margins. AvalonBay's proactive capital raising supports new development and investment, potentially facilitating future earnings growth. With an increase in dividends and projected revenue growth, the company remains a competitive player in the Residential REITs space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal