Angling Direct And 2 Other UK Penny Stocks To Consider

The UK stock market has faced challenges recently, with the FTSE 100 and FTSE 250 indices experiencing declines, partly due to weak trade data from China affecting global economic sentiment. Despite these broader market pressures, investors can still find opportunities by focusing on stocks that demonstrate strong financial health and potential for growth. Penny stocks, though an older term, continue to represent smaller or less-established companies that might offer value and growth potential when selected carefully.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.682 | £57.81M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.67 | £276.03M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.62 | £260.57M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.568 | £272.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.825 | £309.01M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.365 | £381.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.03 | £388.48M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.015 | £161.88M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.926 | £2.17B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.335 | £36.25M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 392 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Angling Direct (AIM:ANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angling Direct PLC, with a market cap of £28.47 million, operates in the sale of fishing tackle products and equipment across the United Kingdom, Europe, and internationally.

Operations: The company's revenue is derived from its operations in Europe (£4.29 million), physical stores (£46.48 million), and online sales within the UK (£33.39 million).

Market Cap: £28.47M

Angling Direct PLC, with a market cap of £28.47 million, has shown promising financial stability and growth potential as a penny stock. The company’s revenue streams are robust, with significant contributions from physical stores (£46.48 million) and online sales within the UK (£33.39 million). Earnings have grown by 66.1% over the past year, outpacing industry averages, while maintaining high-quality earnings without debt concerns. Recent leadership changes include appointing Neil Williams as an Independent Non-Executive Director to strengthen governance further. The board anticipates fiscal year 2025 revenue to slightly exceed market expectations, indicating positive momentum ahead.

- Get an in-depth perspective on Angling Direct's performance by reading our balance sheet health report here.

- Evaluate Angling Direct's prospects by accessing our earnings growth report.

Induction Healthcare Group (AIM:INHC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Induction Healthcare Group PLC offers software solutions to healthcare professionals in the United Kingdom and has a market cap of £6.10 million.

Operations: The company generates £12.78 million in revenue from its healthcare software segment.

Market Cap: £6.1M

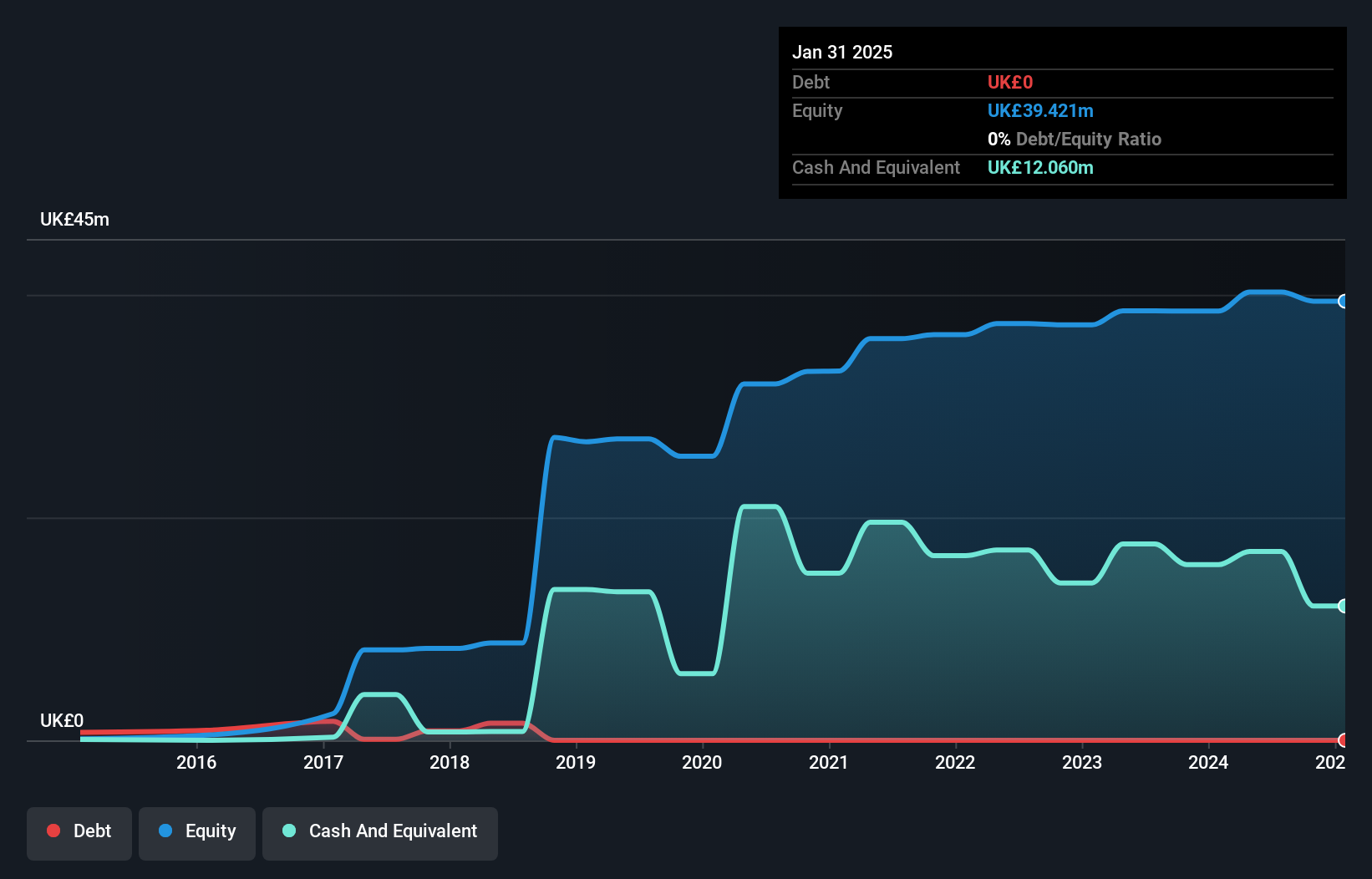

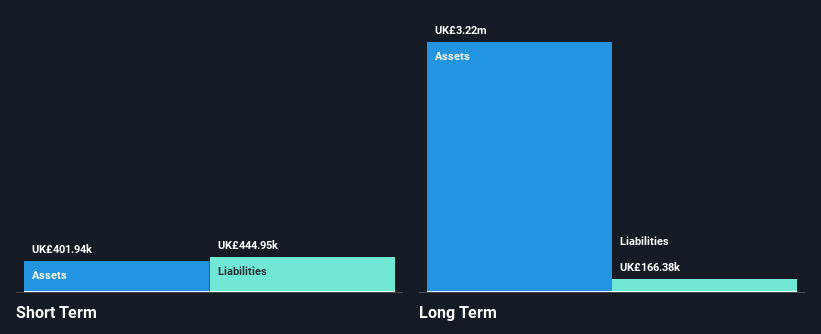

Induction Healthcare Group PLC, with a market cap of £6.10 million, offers healthcare software solutions and generates £12.78 million in revenue. Despite being unprofitable with a negative return on equity of -18.99%, the company is debt-free and maintains a cash runway exceeding three years based on current free cash flow. Revenue is forecast to grow at 13% annually, indicating potential future growth prospects. The board's average tenure of 2.6 years suggests recent changes in leadership, which may impact strategic direction. Short-term assets cover both short-term (£5M) and long-term liabilities (£3.9M), providing some financial stability.

- Dive into the specifics of Induction Healthcare Group here with our thorough balance sheet health report.

- Gain insights into Induction Healthcare Group's outlook and expected performance with our report on the company's earnings estimates.

Tectonic Gold (OFEX:TTAU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tectonic Gold Plc focuses on the exploration, research, and development of mineral assets in Australia and has a market cap of £1.91 million.

Operations: Currently, there are no reported revenue segments for Tectonic Gold Plc.

Market Cap: £1.91M

Tectonic Gold Plc, with a market cap of £1.91 million, is currently pre-revenue and unprofitable, having reported a net loss for the recent half-year. Despite this, the company has strategically partnered with White Energy on its Specimen Hill project, which could potentially provide future revenue through a 3% net smelter royalty. Tectonic's financial position shows short-term assets exceeding liabilities and reduced debt levels over time. The company's management and board are experienced with average tenures of 6.4 and 9 years respectively. An impending reverse merger with Godolphin Exploration Limited may further influence its strategic direction.

- Jump into the full analysis health report here for a deeper understanding of Tectonic Gold.

- Examine Tectonic Gold's past performance report to understand how it has performed in prior years.

Where To Now?

- Take a closer look at our UK Penny Stocks list of 392 companies by clicking here.

- Ready For A Different Approach? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal