ADTRAN Holdings, Inc. (NASDAQ:ADTN) Stock's 27% Dive Might Signal An Opportunity But It Requires Some Scrutiny

ADTRAN Holdings, Inc. (NASDAQ:ADTN) shares have had a horrible month, losing 27% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 52% in the last year.

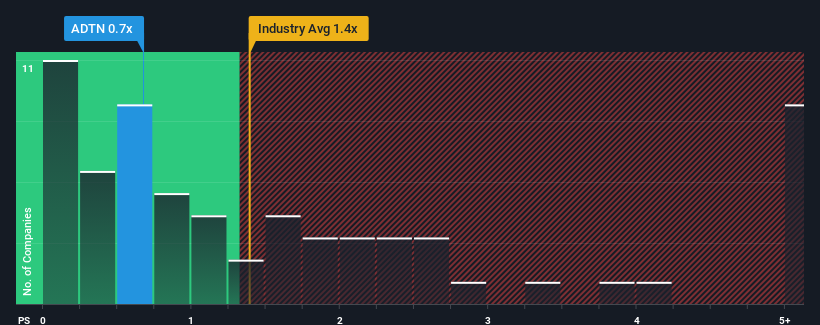

Since its price has dipped substantially, when close to half the companies operating in the United States' Communications industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider ADTRAN Holdings as an enticing stock to check out with its 0.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for ADTRAN Holdings

How Has ADTRAN Holdings Performed Recently?

While the industry has experienced revenue growth lately, ADTRAN Holdings' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think ADTRAN Holdings' future stacks up against the industry? In that case, our free report is a great place to start .How Is ADTRAN Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like ADTRAN Holdings' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 64% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 11% per year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 8.8% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that ADTRAN Holdings' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

ADTRAN Holdings' P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at ADTRAN Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 1 warning sign for ADTRAN Holdings that we have uncovered.

If these risks are making you reconsider your opinion on ADTRAN Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal