Ser Educacional S.A. (BVMF:SEER3) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

The Ser Educacional S.A. (BVMF:SEER3) share price has done very well over the last month, posting an excellent gain of 28%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

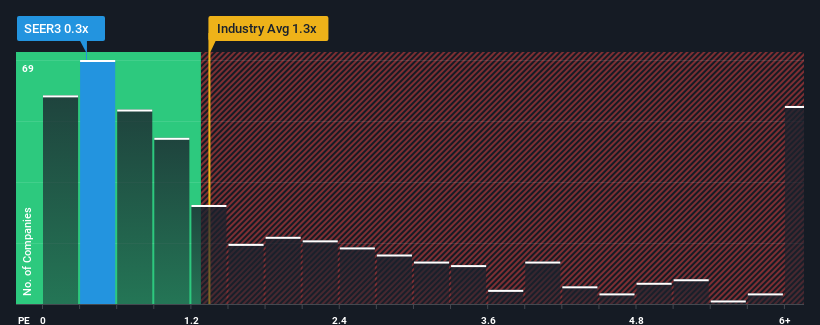

Although its price has surged higher, you could still be forgiven for feeling indifferent about Ser Educacional's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Consumer Services industry in Brazil is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Ser Educacional

How Ser Educacional Has Been Performing

Ser Educacional's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Ser Educacional will help you uncover what's on the horizon.How Is Ser Educacional's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ser Educacional's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.3% last year. This was backed up an excellent period prior to see revenue up by 44% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 6.4% per annum over the next three years. That's shaping up to be similar to the 6.1% per annum growth forecast for the broader industry.

In light of this, it's understandable that Ser Educacional's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Ser Educacional's P/S?

Its shares have lifted substantially and now Ser Educacional's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Ser Educacional's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Ser Educacional (of which 1 can't be ignored!) you should know about.

If these risks are making you reconsider your opinion on Ser Educacional, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal