“DOGE cuts costs” are high, and I'm afraid US technology stocks will lose major customers

The Zhitong Finance App learned that Elon Musk's efforts to cut $1 trillion in federal spending have added another risk to hard-hit tech investors and could cause this already precarious industry to lose billions of dollars in revenue. Large companies such as Microsoft (MSFT.US), Automated Data Processing (ADP.US), Autodesk (ADSK.US), SAP SE (SAP.US), and Oracle (ORCL.US) may all be affected by US federal government spending cuts because they have historically benefited from federal contracts. Last month, the US Department of Defense said it would end plans to use Oracle software to manage civilian personnel.

For investors already dealing with the impact of President Trump's announcement of high trade tariffs, this cut in federal spending has made the situation more complicated. Trump's announcement of high trade tariffs has had a shock wave on the global economy.

It's hard to estimate how much revenue might be at risk in the end, but the US government is a notable customer, and investors are watching closely. According to Bloomberg analyst Niraj Patel's analysis of IDC data, the federal government is expected to consume or purchase nearly $40 billion worth of software and public cloud services by 2025.

Commenting on Musk's cost-cutting initiatives, Federated Hermes portfolio manager and senior quantitative analyst Damian McIntyre said, “If you're a company with government exposure, investors don't know what kind of growth to expect, and they're less willing to pay for it.”

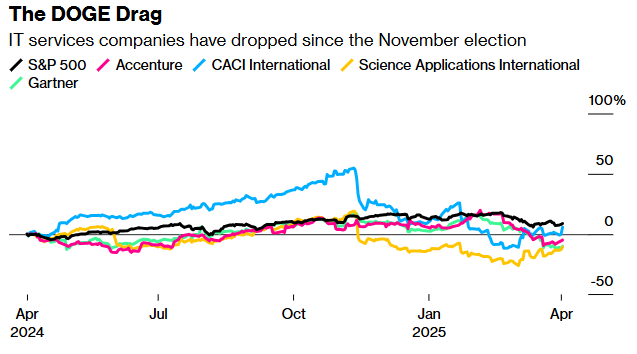

For example, IT services company CACI International (CACI.US) derives almost all of its revenue from the government, and Science Applications International (SAIC.US) said 98% of its revenue for fiscal year 2025 “can be attributed to master contracts with the US government or subcontracts with other contractors working for the US government.” Both indices have fallen by more than 20% since the election.

Meanwhile, according to supply chain data, nearly 8% of Accenture's (ACN.US) revenue comes from the US government. The IT consulting firm indicated that Musk's Department of Government Efficiency (DOGE) was a factor in the weak results last month. Its counterpart Gartner Inc. has said that approximately $1.2 billion of the company's outstanding revenue contracts belongs to government entities, and UBS also recently listed the company's government exposure as one of its concerns. International Business Machines Corp. performed better, J.P. Morgan wrote that the company “may be more resilient than Accenture”; it is also seen as a winner in the spending boom surrounding artificial intelligence.

DOGE falls far short of Musk's initial goal of cutting federal spending by $2 trillion. On Wednesday, media reported that Musk may step down from his quasi-government role and re-manage his own business. Although Musk denied the report, several of the most affected companies were affected by the news and their shares rose.

Despite this, many agencies other than the US Department of Defense are actively cutting costs, and Musk claims he will cut spending by $1 trillion by the end of next month. Software stocks are likely to be affected broadly as government spending cuts could affect education, healthcare, business services, tourism, and other sectors. According to BI data, ServiceNow (NOW.US) is considered particularly vulnerable to the slowdown in new contract growth because 11% of the company's sales come from the public sector, which is a high percentage among peers.

According to the data, software and service companies' earnings are expected to grow 11.6% in 2025, down from the 12.3% forecast in early February. Revenue expectations also tend to decline. Sean Brehm, Chairman of Spectral Capital, said, “People who want to invest in this type of company may have certain concerns. Some contracts will continue, but we don't have a full picture of the situation, which means we're in a state of uncertainty.”

Wall Street Journal

Wall Street Journal