TTS (Transport Trade Services)'s (BVB:TTS) Dividend Is Being Reduced To RON0.155

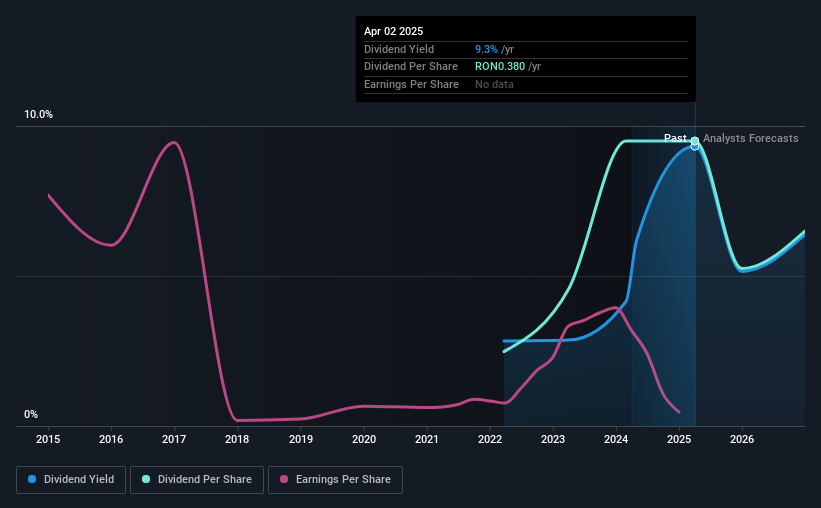

TTS (Transport Trade Services) S.A. (BVB:TTS) is reducing its dividend from last year's comparable payment to RON0.155 on the 16th of June. This payment takes the dividend yield to 9.3%, which only provides a modest boost to overall returns.

TTS (Transport Trade Services)'s Payment Could Potentially Have Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. The last dividend made up quite a large portion of free cash flows, and this was made worse by the lack of free cash flows. We think that this practice can make the dividend quite risky in the future.

Analysts expect a massive rise in earnings per share in the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 50% which is fairly sustainable.

See our latest analysis for TTS (Transport Trade Services)

TTS (Transport Trade Services) Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. Since 2022, the annual payment back then was RON0.0992, compared to the most recent full-year payment of RON0.38. This works out to be a compound annual growth rate (CAGR) of approximately 56% a year over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. TTS (Transport Trade Services)'s earnings per share has shrunk at 17% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The track record isn't great, and the payments are a bit high to be considered sustainable. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 2 warning signs for TTS (Transport Trade Services) that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal