What MPS Limited's (NSE:MPSLTD) 28% Share Price Gain Is Not Telling You

MPS Limited (NSE:MPSLTD) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 82%.

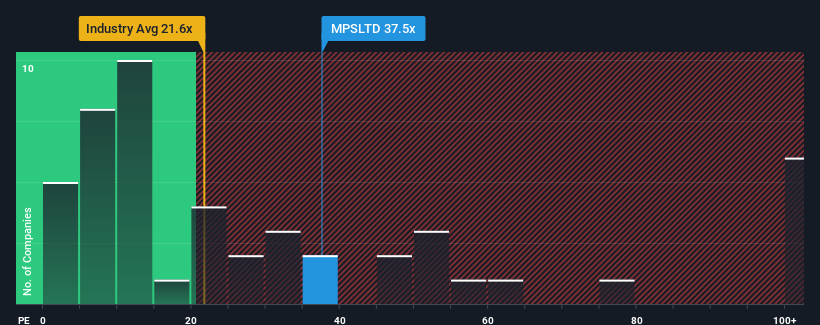

After such a large jump in price, MPS' price-to-earnings (or "P/E") ratio of 37.5x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 25x and even P/E's below 14x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

MPS could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for MPS

Is There Enough Growth For MPS?

There's an inherent assumption that a company should outperform the market for P/E ratios like MPS' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 7.0%. Pleasingly, EPS has also lifted 78% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 24% during the coming year according to the one analyst following the company. That's shaping up to be similar to the 25% growth forecast for the broader market.

With this information, we find it interesting that MPS is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

MPS shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of MPS' analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for MPS that we have uncovered.

If these risks are making you reconsider your opinion on MPS, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal