What 13 Analyst Ratings Have To Say About Johnson & Johnson

13 analysts have expressed a variety of opinions on Johnson & Johnson (NYSE:JNJ) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 8 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 3 | 6 | 0 | 0 |

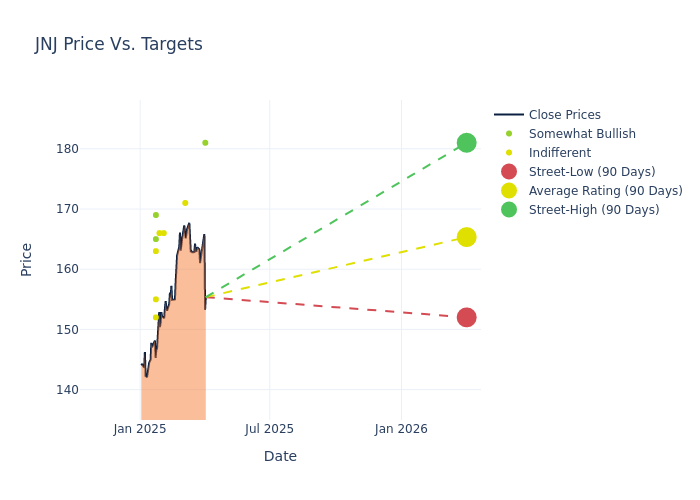

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $166.85, along with a high estimate of $181.00 and a low estimate of $152.00. Observing a downward trend, the current average is 1.94% lower than the prior average price target of $170.15.

Deciphering Analyst Ratings: An In-Depth Analysis

The analysis of recent analyst actions sheds light on the perception of Johnson & Johnson by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Shagun Singh | RBC Capital | Maintains | Outperform | $181.00 | $181.00 |

| Tim Anderson | B of A Securities | Raises | Neutral | $171.00 | $159.00 |

| Shagun Singh | RBC Capital | Maintains | Outperform | $181.00 | $181.00 |

| Vamil Divan | Guggenheim | Raises | Neutral | $166.00 | $162.00 |

| Matt Miksic | Barclays | Raises | Equal-Weight | $166.00 | $159.00 |

| Shagun Singh | RBC Capital | Maintains | Outperform | $181.00 | $181.00 |

| Terence Flynn | Morgan Stanley | Lowers | Equal-Weight | $163.00 | $175.00 |

| Rick Wise | Stifel | Lowers | Hold | $155.00 | $170.00 |

| David Risinger | Leerink Partners | Lowers | Outperform | $169.00 | $182.00 |

| Larry Biegelsen | Wells Fargo | Lowers | Equal-Weight | $152.00 | $166.00 |

| Jayson Bedford | Raymond James | Lowers | Outperform | $165.00 | $170.00 |

| Tim Anderson | B of A Securities | Lowers | Neutral | $159.00 | $160.00 |

| Tim Anderson | B of A Securities | Lowers | Neutral | $160.00 | $166.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Johnson & Johnson. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Johnson & Johnson compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Johnson & Johnson's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Johnson & Johnson's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Johnson & Johnson analyst ratings.

Discovering Johnson & Johnson: A Closer Look

Johnson & Johnson is the world's largest and most diverse healthcare firm. It has two divisions: pharmaceutical and medical devices. These now represent all of the company's sales following the divestment of the consumer business, Kenvue, in 2023. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. Geographically, just over half of total revenue is generated in the United States.

Johnson & Johnson's Financial Performance

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Johnson & Johnson's remarkable performance in 3 months is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 5.26%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Johnson & Johnson's net margin excels beyond industry benchmarks, reaching 15.24%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Johnson & Johnson's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.84% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.91%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.51, Johnson & Johnson adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal