US Stock Outlook | Futures of the three major stock indexes are falling sharply, Trump's tariff statement is about to be announced, Tesla (TSLA.US) Q1 delivery volume is about to be announced

Pre-market market trends

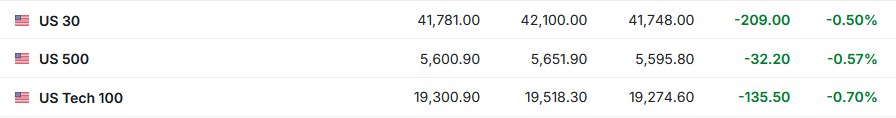

1. On April 2 (Wednesday), the futures of the three major US stock indexes fell sharply before the US stock market. As of press release, Dow futures were down 0.50%, S&P 500 futures were down 0.57%, and NASDAQ futures were down 0.70%.

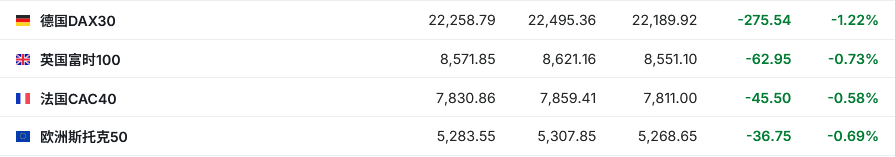

2. As of press release, the German DAX index fell 1.22%, the UK FTSE 100 index fell 0.73%, the French CAC40 index fell 0.58%, and the European Stoxx 50 index fell 0.69%.

3. As of press release, WTI crude oil fell 0.56% to $70.80 per barrel. Brent crude oil fell 0.64% to $74.01 per barrel.

Market news

Countdown to Trump's tariff statement. According to media quoting people familiar with the matter, Trump's review of the plan to levy equal tariffs has entered the final stage, and his team is still finalizing the size and scope of the new tariffs scheduled to be announced on Wednesday afternoon EST. According to reports, as the last minute approaches, the Trump team is still in a fierce game between the three tariff plans. The first plan: imposing 10% or 20% tariffs on countries (implementing more tailored equal tariff plans), depending on their tariffs and non-tariff barriers on US goods; the second option: imposing a 20% unified tariff on each country; the third option: imposing comprehensive tariffs on some countries (more targeted), but the tariffs may not be as high as the 20% general tariff plan.

Trump's “Liberation Day” is imminent, and the “Big Seven” are under pressure for a short time! Wedbush warns AI investment prospects are overshadowed. A Wedbush analyst, led by Daniel Ives, said: “Tariff pressures facing various industries will curb economic demand and drive up prices... In turn, this will prompt business executives to suspend spending, including AI projects. In theory, Trump's tariff policy may change the short-term growth trajectory of AI investment (with limited long-term impact), and current stock market fluctuations reflect this concern.” Ives added, “Although no signs of shrinking spending in related fields have been observed... this policy suspense has triggered risk aversion in the global market towards the US technology sector. Many investors chose to wait and see or switch to the Eurasian stock market until the rules of Trump's new policy are clarified. It should be emphasized that anyone with basic economics education knows that the cost of tariffs will eventually be borne by consumers... This will further inhibit consumer confidence and spending, leading to an overall slowdown in corporate capital expenditure, digital advertising investment, etc. — this chain reaction is what the market is most concerned about.”

The Big Three Wall Street players cut the target spot in the S&P 500 Index, but they are convinced that the “hold back first, then improve” market is coming. Stock market strategists from Goldman Sachs, Societe Generale, and Yardeni Research (Yardeni Research) lowered their year-end targets for the S&P 500 index at the beginning of the second quarter. Adney currently expects the S&P 500 to close at 6,000 points at the end of the year, but it is much lower than the previous forecast of 6,400 points; David Costin, a stock market strategist from Goldman Sachs, drastically lowered the S&P 500 year-end point forecast from 6,200 points to around 5,700 points; fellow strategists Manish Cabra and Charles de Boisseau from Societe Generale Bank lowered the target point from 6,750 points to 6,400 points. However, well-known investment institutions on Wall Street, including these three institutions, still generally believe that in the end, tariffs are only a prelude to a downward adjustment in the US stock market and will not affect the long-term bull market in US stocks. Cabra and de Boisseau from Societe Generale said: “We expect investment confidence to recover before the end of the year. Based on the experience of the 2018 tariff campaign, the S&P 500 index is expected to close up in the second quarter despite the possibility of a sharp decline during the Liberation Day week.”

Federal Reserve Goulsby warned that tariff policies could cause consumer investment to double shrink. Chicago Federal Reserve Chairman Goulsby warned that a slowdown in consumer spending or a contraction in corporate investment due to uncertainty about tariff policies could have negative consequences. Goulsby said, “It would be a bit bad if consumers stopped spending because they were uncertain or worried about the future, and companies stopped investing.” Goulsby pointed out that in theory, the impact of one-time tariffs on prices should be temporary, but he added that tariffs may have a more lasting impact. He said that this may be due to retaliatory tariffs and the fact that some taxes may affect so-called intermediate products, such as parts that end up being used in domestically produced products. The Chicago Federal Reserve chairman said he still expects interest rates to fall within the next 12 to 18 months. He also said that although consumer and business survey data showed that the economic situation was weakening, hard data still showed that the US economy was growing steadily.

Moody's warns that the US economy has a 40% chance of falling into recession! Many of the data are “disturbing.” Moody's chief economist Mark Zandy believes that due to the Trump administration's imposition of tariffs and cuts in government employees, the probability that the US economy will fall into recession this year has risen to 40%. He said that at the beginning of 2025, the probability was only 15%, but “disturbing data” such as the recent decline in consumer confidence, slowing spending, and high inflation forced the forecast to be adjusted. Zandy warned, “The intensifying trade war and tariff cuts are the reason behind all of this. Coupled with the drastic increase in automobile import tariffs announced last week and the upcoming reciprocal tariffs, the situation will definitely get worse.” Zandy added: “Currently, the probability of a recession is still less than 50% due to low layoffs and steady growth in employment income. The March non-agricultural data released this Friday will be a key indicator.” The economist pointed out, “Fewer than 100,000 new jobs would cause concern, while more than 200,000 would ease anxiety.”

Individual stock news

Tesla (TSLA.US) Q1 delivery volume is about to be announced. Will sales collapse due to Musk's “political participation”? Analysts generally predict that Tesla delivered about 377,000 vehicles in the first quarter, down 8.5% year on year and more than 20% month on month. If Tesla delivered 355,000 vehicles or less in the first quarter, this would be the worst year-on-year performance since 2017. This is a major test for the electric car manufacturer, whose CEO Elon Musk's role in the Trump administration harmed the Tesla brand and sparked protests calling for “Tesla's removal”, leading to a decline in Tesla's sales in several markets. As of press release, Tesla's US stocks fell more than 2% before the market on Wednesday.

Tesla's sales volume in China fell 11.5% year on year in March. According to the data, Tesla's wholesale passenger car sales volume in March was 78,800 units, down 11.5% year on year, but far higher than the 30,700 units in February.

Meta (META.US) AI research director leaves his job, and senior vacancies may impact AI ambitions. Vice President Pino, who heads Meta's Basic Artificial Intelligence Research Group (FAIR), announced his departure on Tuesday. Pino's team is responsible for Meta's artificial intelligence research, focusing on fields such as speech translation and image recognition technology, and Llama, an open source large-scale language model. The department also explores the development of what Meta calls “advanced machine intelligence,” the human-grade intelligence of machines. Pino's departure could make it harder for Meta to compete with competitors like OpenAI, Anthropic, and Elon Musk's XAI in terms of artificial intelligence products and talent. Meta CEO Mark Zuckerberg has made artificial intelligence a top priority for Meta and said in January this year that the company will invest up to $65 billion in related projects this year.

Is the meme stock boom making a comeback? The US conservative media Newsmax (NMAX.US) surged 22 times on the second day of its listing. The stock price of the media company Newsmax soared again by nearly 180% the day after listing. The stock price was reported at 233 US dollars/share, with a total market value of nearly 30 billion US dollars. The stock has already risen 2230% in the two days since it was listed. According to reports, the Newsmax IPO price is $10 per share. Trump has been exclusively interviewed by Newsmax several times, most recently last week. At the same time, the Trump administration has also made adjustments to the White House press corps that closely cover the president's affairs. White House reporters from the Associated Press and Reuters have all been kicked out of the press corps list, and Newsmax, who is a staunch supporter of Trump, is naturally a beneficiary. However, as of press time, Newsmax's pre-market share fell more than 28% on Wednesday.

Is the payment industry staging an “order grabbing” drama? Rumor has it that Visa (V.US) spent $100 million to grab Apple (AAPL.US) credit card cooperation. According to people familiar with the matter, the global payment giant Visa has issued an sky-high chip of about 100 million US dollars to Apple with the intention of stealing Apple Credit Card's exclusive cooperation rights from its old rival Mastercard (MA.US). This move marks a bold move by Visa to secure the Apple Card payment network and provides advance payments that are usually reserved only for the largest credit card projects. According to an analysis by industry insiders, this is equivalent to prepaying potential profits to Apple for the next few years. It can be seen that Visa's ambition for the Apple Card must be obtained. In fact, Visa isn't the only hunter eyeing this piece of cake. It was revealed that American Express (AXP.US) is taking a two-pronged approach, wanting to be both a card issuer and a payment network; established card issuers such as Barclays Bank (BCS.US) and Synchrony Financial (SYF.US) are also actively engaging; even JPM.US (JPM.US) has been in frequent contact with Apple since last year. This battle for payment entrances has become a “gladiatorial arena” for financial giants.

Key economic data and event forecasts

Changes in ADP employment numbers in the US in March at 20:15 Beijing time

Revised monthly rate for US durable goods orders in February at 22:00 Beijing time

Monthly rate of US factory orders in February at 22:00 Beijing time

At 03:00 Beijing time the next day, US President Trump announced the details of implementing equal tariffs and industry-specific tariffs

At 04:30 Beijing time the next day, Federal Reserve Governor Kugler delivered a speech on inflation expectations

Wall Street Journal

Wall Street Journal