European Dividend Stocks To Watch Now

As European markets navigate the challenges of new U.S. trade tariffs and fluctuating economic indicators, investors are keenly observing opportunities that may arise in the dividend stock segment. In this environment, a good dividend stock is often characterized by its ability to provide consistent payouts and demonstrate resilience amidst market volatility, making it an attractive option for those seeking stability and income.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 5.07% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.40% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.30% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.54% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.72% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.25% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.84% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.65% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.53% | ★★★★★★ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.52% | ★★★★★☆ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

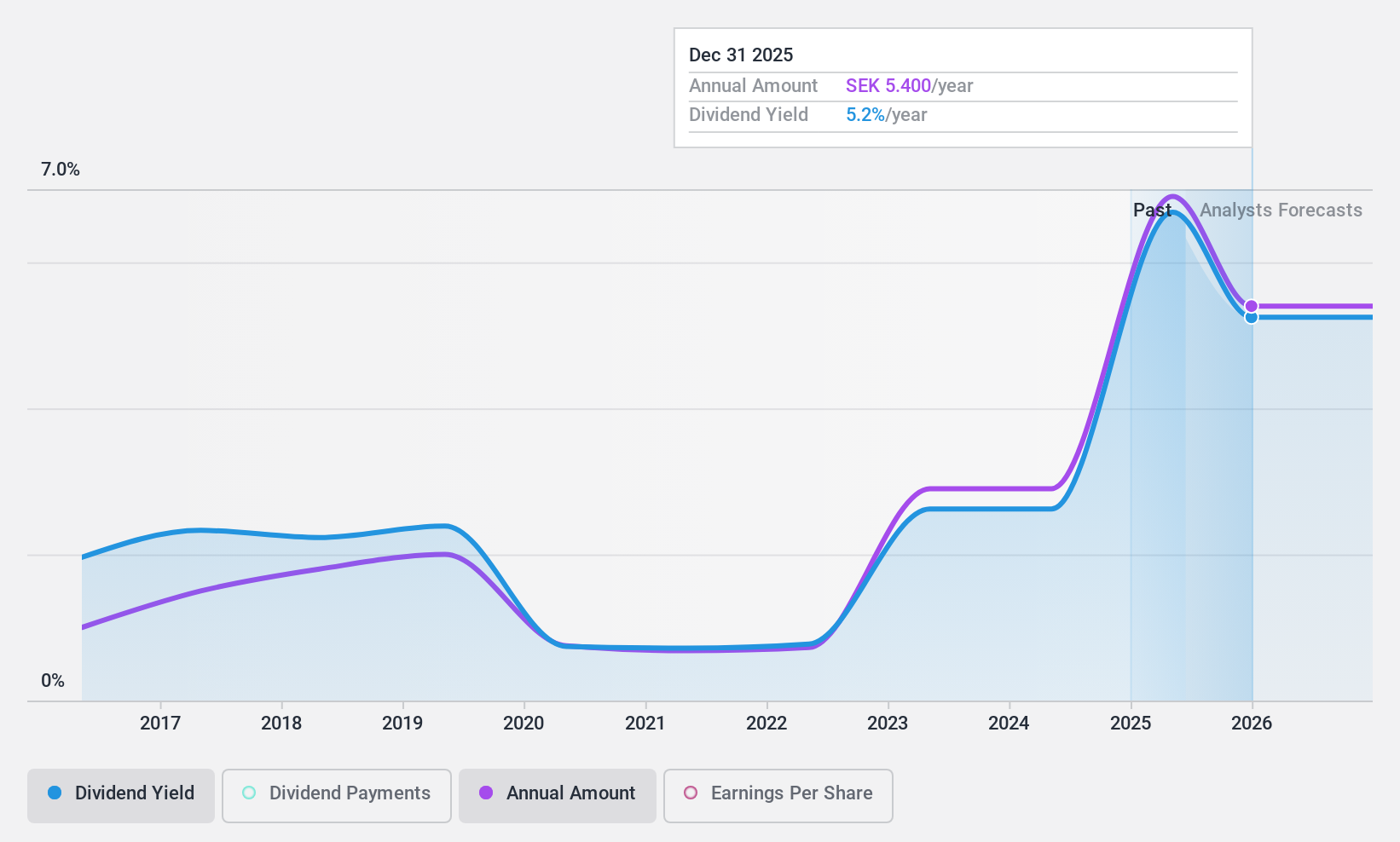

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that offers probiotic products globally, with a market cap of SEK11.60 billion.

Operations: BioGaia AB (publ) generates its revenue primarily from two segments: Pediatrics, contributing SEK1.09 billion, and Adult Health, which accounts for SEK321.29 million.

Dividend Yield: 6%

BioGaia's dividend yield of 6.02% ranks in the top 25% of Swedish dividend payers, but its dividends are not well covered by free cash flow, with a high cash payout ratio of 194.4%. Despite a reasonable earnings payout ratio of 56.1%, dividends have been volatile over the past decade. Recent announcements include an increased ordinary and special dividend totaling SEK 6.90 per share for approval at the May AGM, alongside M&A activity involving significant share acquisitions by Annwall & Rothschild Investments Ab and others for SEK 756 million.

- Dive into the specifics of BioGaia here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of BioGaia shares in the market.

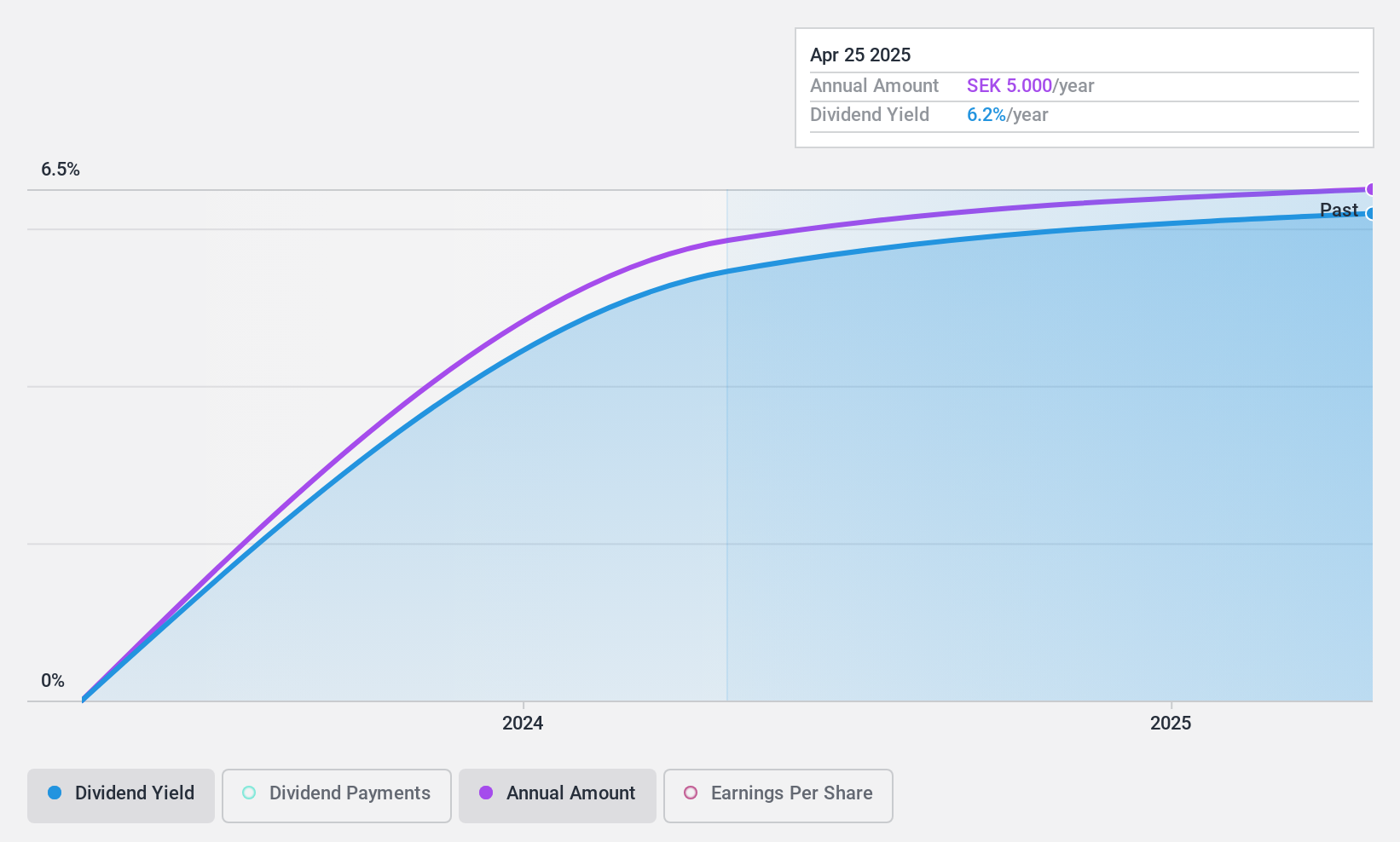

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (publ) offers non-life insurance services to both private and business clients across Sweden, Denmark, Norway, Finland, Germany, Switzerland, and other international markets with a market capitalization of SEK1.55 billion.

Operations: Solid Försäkringsaktiebolag generates revenue from various segments, including Product (SEK301.90 million), Assistance (SEK379.79 million), and Personal Safety (SEK446.90 million).

Dividend Yield: 5.8%

Solid Försäkringsaktiebolag's dividend yield of 5.81% places it in the top quartile among Swedish dividend stocks. Recent announcements highlight a proposed annual dividend increase to SEK 5.00 per share, up from SEK 4.50, reflecting an 11% growth aligned with its policy. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 55.6% and 79.8%, respectively, although dividends have been paid for only two years, indicating limited historical stability.

- Navigate through the intricacies of Solid Försäkringsaktiebolag with our comprehensive dividend report here.

- Our valuation report here indicates Solid Försäkringsaktiebolag may be undervalued.

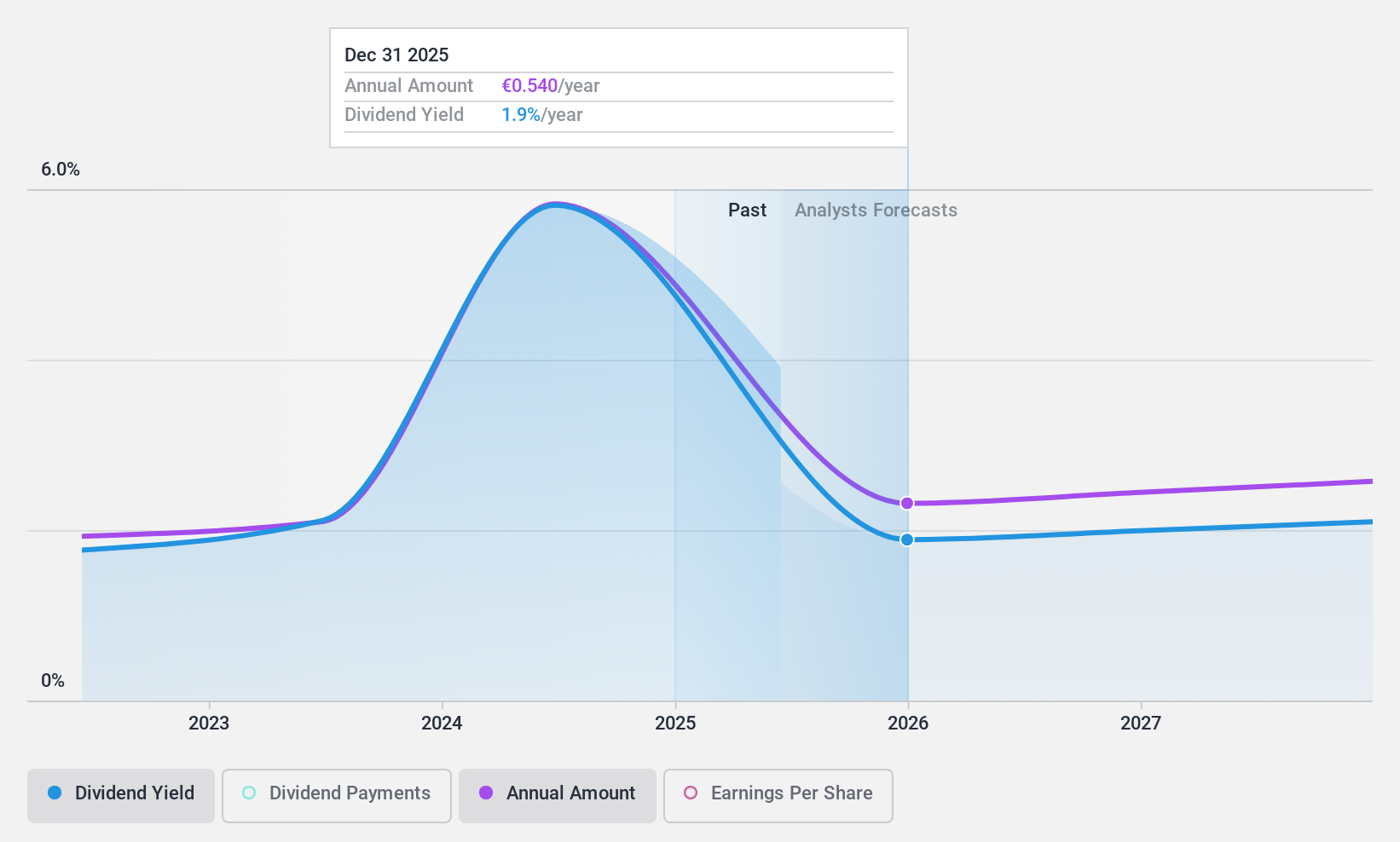

PharmaSGP Holding (XTRA:PSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PharmaSGP Holding SE manufactures and sells over-the-counter drugs and healthcare products in Germany, with a market cap of €292.56 million.

Operations: PharmaSGP Holding SE generates revenue primarily from its Pharmaceuticals segment, amounting to €114 million.

Dividend Yield: 5.5%

PharmaSGP Holding's dividend yield of 5.48% ranks it among the top 25% of German dividend stocks. Despite a high payout ratio of 86.8%, dividends are supported by both earnings and cash flows, with a cash payout ratio at 57%. While payments have been stable and growing, the company has only distributed dividends for three years, suggesting limited historical reliability. The stock trades significantly below its estimated fair value but carries a high debt level.

- Get an in-depth perspective on PharmaSGP Holding's performance by reading our dividend report here.

- The valuation report we've compiled suggests that PharmaSGP Holding's current price could be quite moderate.

Turning Ideas Into Actions

- Take a closer look at our Top European Dividend Stocks list of 229 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal