US Market Undiscovered Gems To Explore In March 2025

The United States market has been relatively stable over the past week, with a notable 7.8% increase over the last year and anticipated earnings growth of 14% annually in the coming years. In this environment, identifying stocks that offer strong fundamentals and potential for growth can be key to uncovering promising investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Nanophase Technologies | 33.45% | 23.87% | -3.75% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Mission Produce (NasdaqGS:AVO)

Simply Wall St Value Rating: ★★★★★★

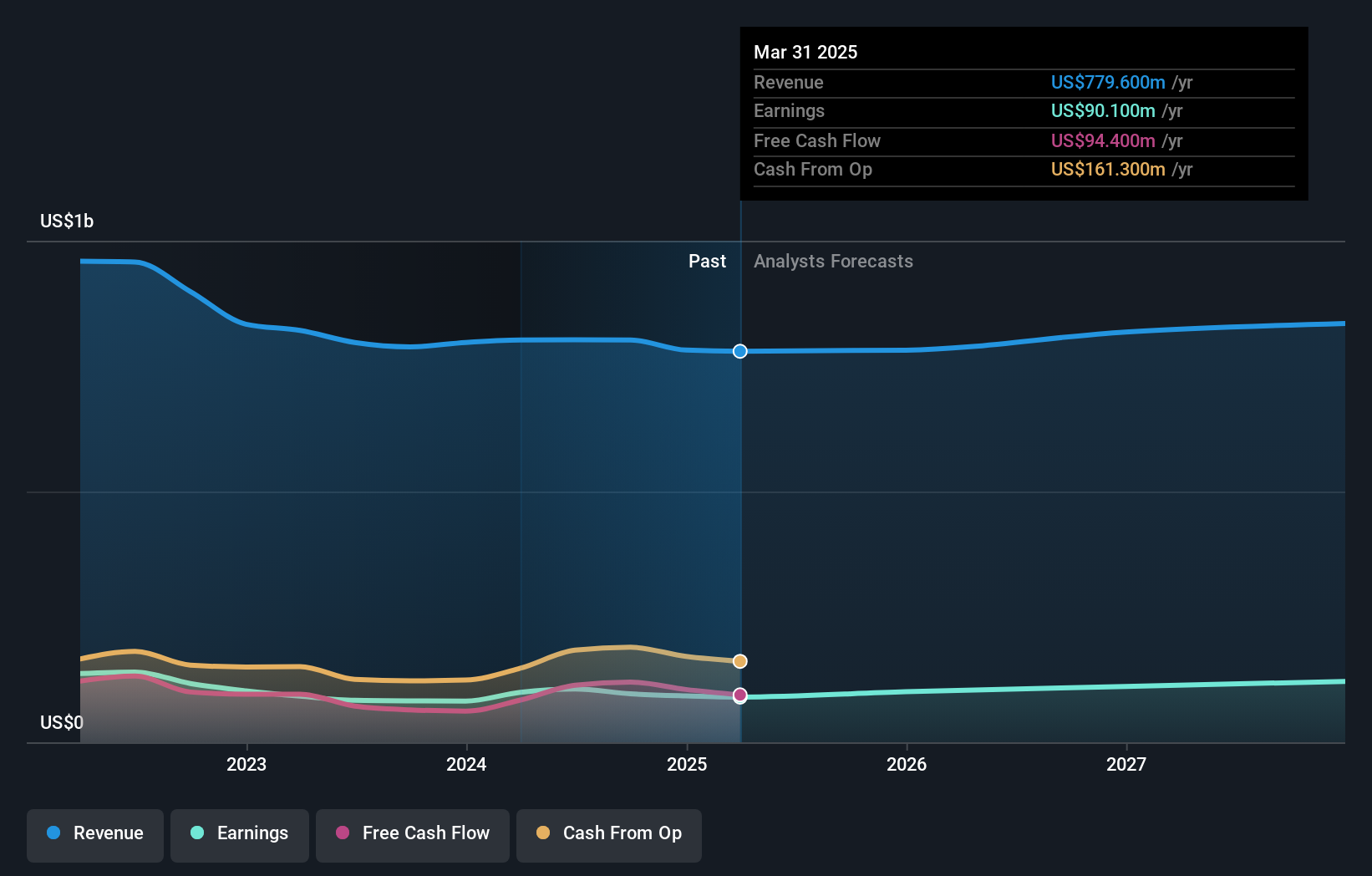

Overview: Mission Produce, Inc. specializes in the sourcing, farming, packaging, marketing, and distribution of avocados, mangoes, and blueberries to food retailers, wholesalers, and foodservice customers both domestically and internationally with a market cap of approximately $697.92 million.

Operations: Mission Produce generates revenue primarily from its Marketing & Distribution segment, which accounts for $1.22 billion, followed by Blueberries at $79.60 million and International Farming at $68.30 million. The company exhibits a net profit margin trend that warrants attention in the context of its financial performance.

Mission Produce, a nimble player in the produce industry, is making strategic moves to diversify its offerings by expanding into avocados, blueberries, and mangoes. Recent earnings showcased sales of US$334.2 million for Q1 2025, up from US$258.7 million the previous year, with net income at US$3.9 million. The company's debt management appears robust with a net debt to equity ratio of 13.6%. Despite facing margin pressures due to supply chain challenges and rising costs, analysts maintain a price target of $17 per share against its current market price of about $9.79—indicating potential undervaluation in the market's eyes.

Weyco Group (NasdaqGS:WEYS)

Simply Wall St Value Rating: ★★★★★★

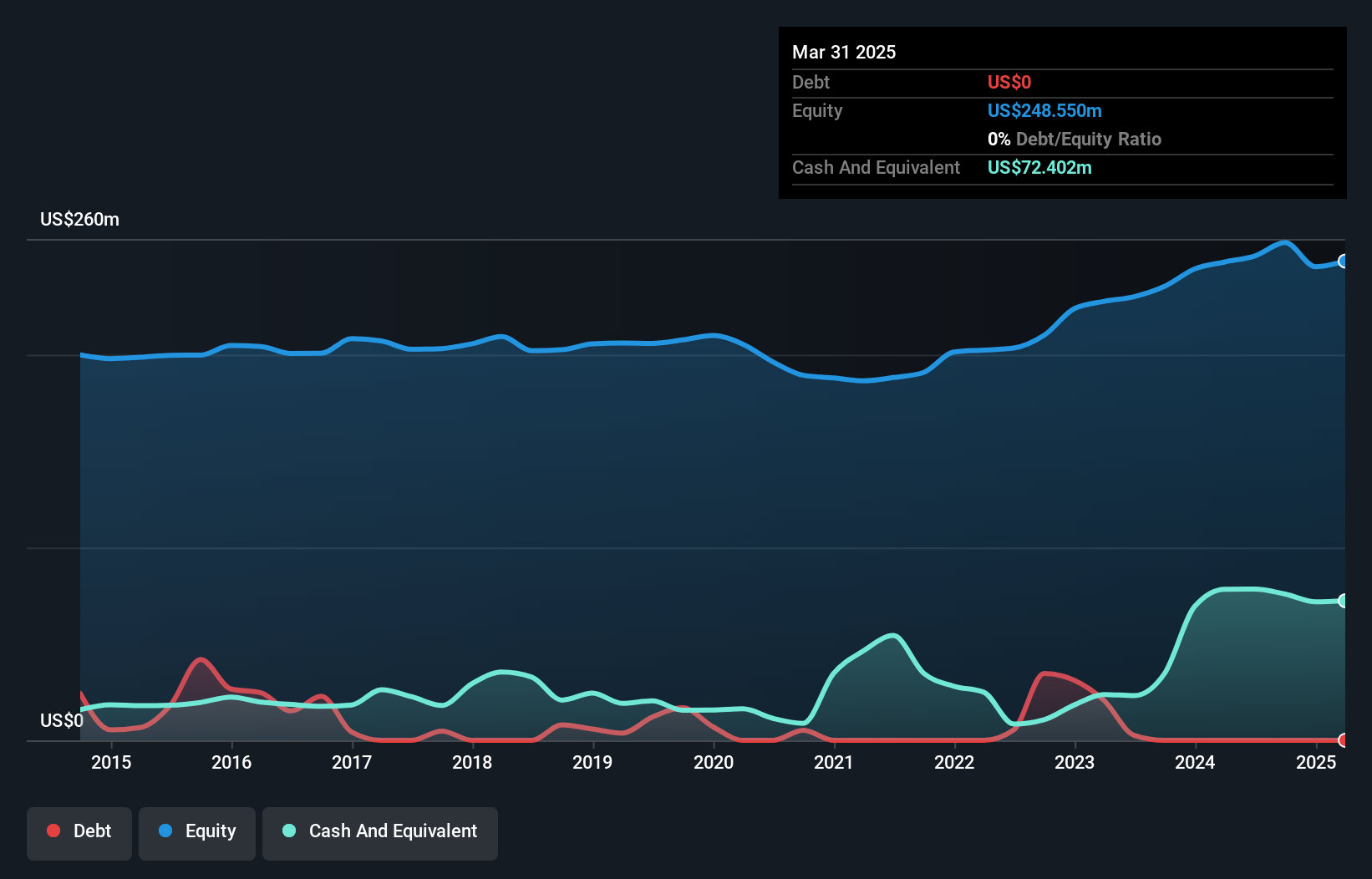

Overview: Weyco Group, Inc. is engaged in designing, marketing, and distributing footwear for men, women, and children across various international markets including the United States and Asia Pacific, with a market capitalization of approximately $286.23 million.

Operations: Weyco Group generates revenue primarily through wholesale and retail segments, with the wholesale segment contributing $227.94 million and the retail segment adding $38.70 million.

Weyco Group, a small footwear company, has shown resilience with earnings growth of 0.4% over the past year, outpacing the Retail Distributors industry which saw a -25.7% change. The firm is debt-free now compared to five years ago when it had a debt-to-equity ratio of 3.4%. Its price-to-earnings ratio stands at 9.7x, lower than the US market average of 17.7x, suggesting potential value for investors seeking bargains in smaller companies. Despite recent board changes affecting Nasdaq compliance, Weyco continues to pay dividends and reported net income growth from $8.54 million to $10 million in Q4 2024.

- Click here and access our complete health analysis report to understand the dynamics of Weyco Group.

Examine Weyco Group's past performance report to understand how it has performed in the past.

Donnelley Financial Solutions (NYSE:DFIN)

Simply Wall St Value Rating: ★★★★★★

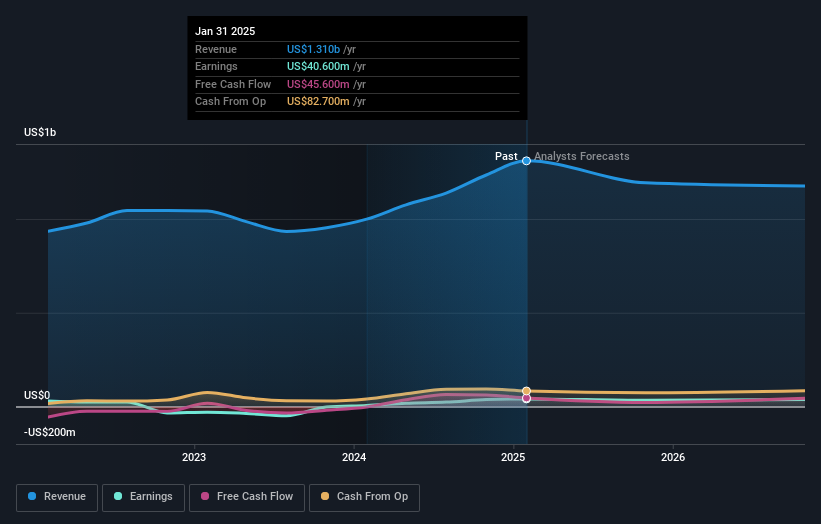

Overview: Donnelley Financial Solutions, Inc. offers software and technology-enabled financial regulatory and compliance solutions globally, with a market capitalization of approximately $1.30 billion.

Operations: Donnelley Financial Solutions generates revenue through two primary segments: Software Solutions and Compliance and Communications Management, with the Capital Markets segment contributing $535.3 million and the Investment Companies segment adding $246.6 million.

Donnelley Financial Solutions has been making strategic moves to bolster its position in the market, emphasizing high-margin software and compliance products. Its debt-to-equity ratio impressively dropped from 110.2% to 28.6% over five years, showcasing strong financial management. The company repurchased 947,288 shares for US$58.96 million, demonstrating confidence in its valuation as it trades at a notable discount of 31.7% below estimated fair value. Despite facing challenges like declining print revenues and geopolitical volatility affecting transaction volumes, DFIN's focus on software solutions positions it well for capturing demand from emerging regulations and industry shifts.

Where To Now?

- Click here to access our complete index of 283 US Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal