UK Value Stocks Priced Below Estimated Worth In March 2025

As the United Kingdom's FTSE 100 index experiences downward pressure due to weak trade data from China, investors are increasingly focused on identifying opportunities within the market. In such conditions, stocks that are priced below their estimated worth can offer potential value for those looking to navigate the uncertain economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| QinetiQ Group (LSE:QQ.) | £4.032 | £7.78 | 48.2% |

| On the Beach Group (LSE:OTB) | £2.435 | £4.69 | 48.1% |

| Informa (LSE:INF) | £7.928 | £15.43 | 48.6% |

| M&C Saatchi (AIM:SAA) | £1.665 | £3.10 | 46.3% |

| Duke Capital (AIM:DUKE) | £0.285 | £0.54 | 47.4% |

| TI Fluid Systems (LSE:TIFS) | £1.972 | £3.74 | 47.3% |

| Vanquis Banking Group (LSE:VANQ) | £0.611 | £1.13 | 46% |

| Xaar (LSE:XAR) | £0.73 | £1.35 | 45.8% |

| Optima Health (AIM:OPT) | £1.75 | £3.34 | 47.6% |

| Crest Nicholson Holdings (LSE:CRST) | £1.696 | £3.20 | 47.1% |

Let's explore several standout options from the results in the screener.

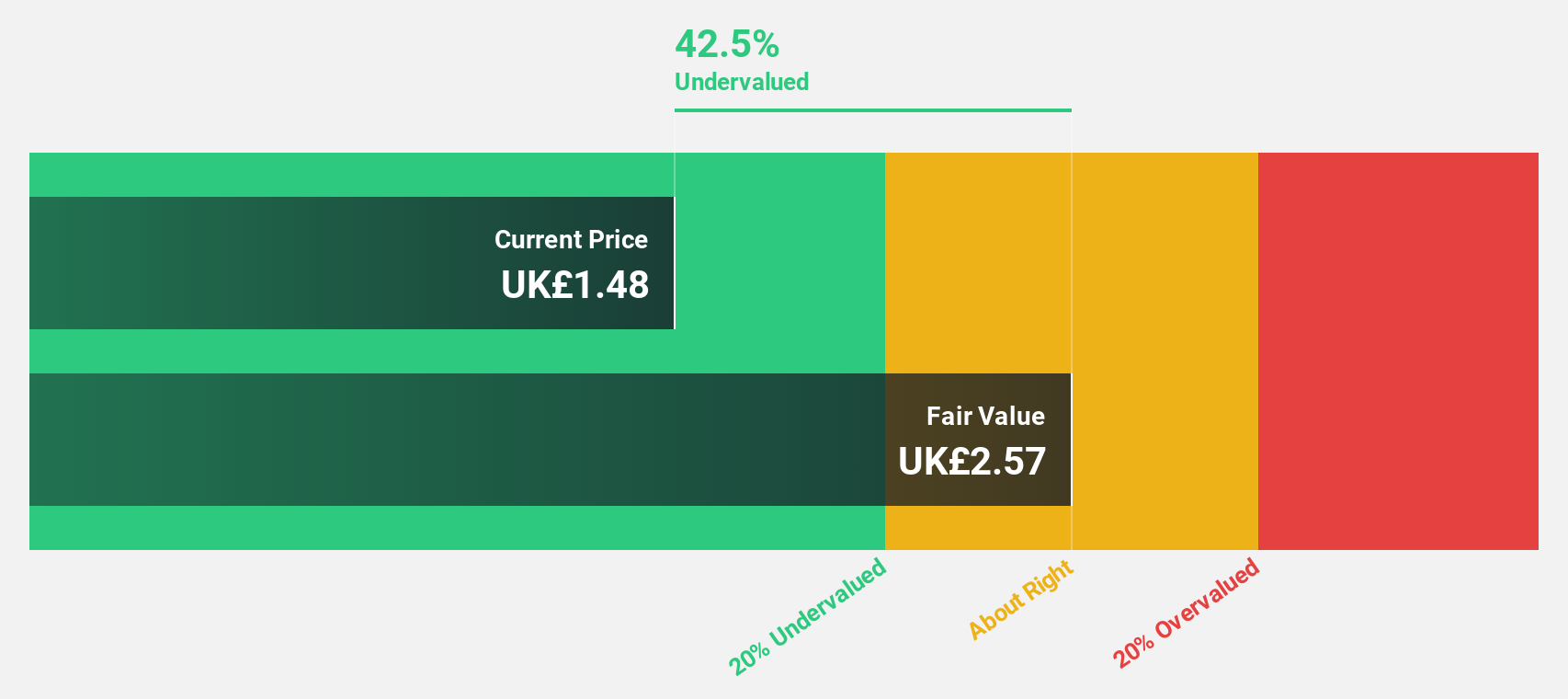

Franchise Brands (AIM:FRAN)

Overview: Franchise Brands plc operates through its subsidiaries to engage in franchising and related activities across the United Kingdom, North America, and Europe, with a market capitalization of £274.74 million.

Operations: Revenue segments for the company include franchising and related activities across the United Kingdom, North America, and Europe.

Estimated Discount To Fair Value: 37.7%

Franchise Brands is trading at £1.43, significantly below its estimated fair value of £2.29, indicating potential undervaluation based on cash flows. Recent earnings show robust growth, with net income rising from £2.99 million to £7.28 million year-over-year and sales increasing to £139.21 million from £121.02 million. The company forecasts strong earnings growth of 29.4% annually, outpacing the broader UK market's expected growth rate of 14%.

- Our growth report here indicates Franchise Brands may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Franchise Brands' balance sheet health report.

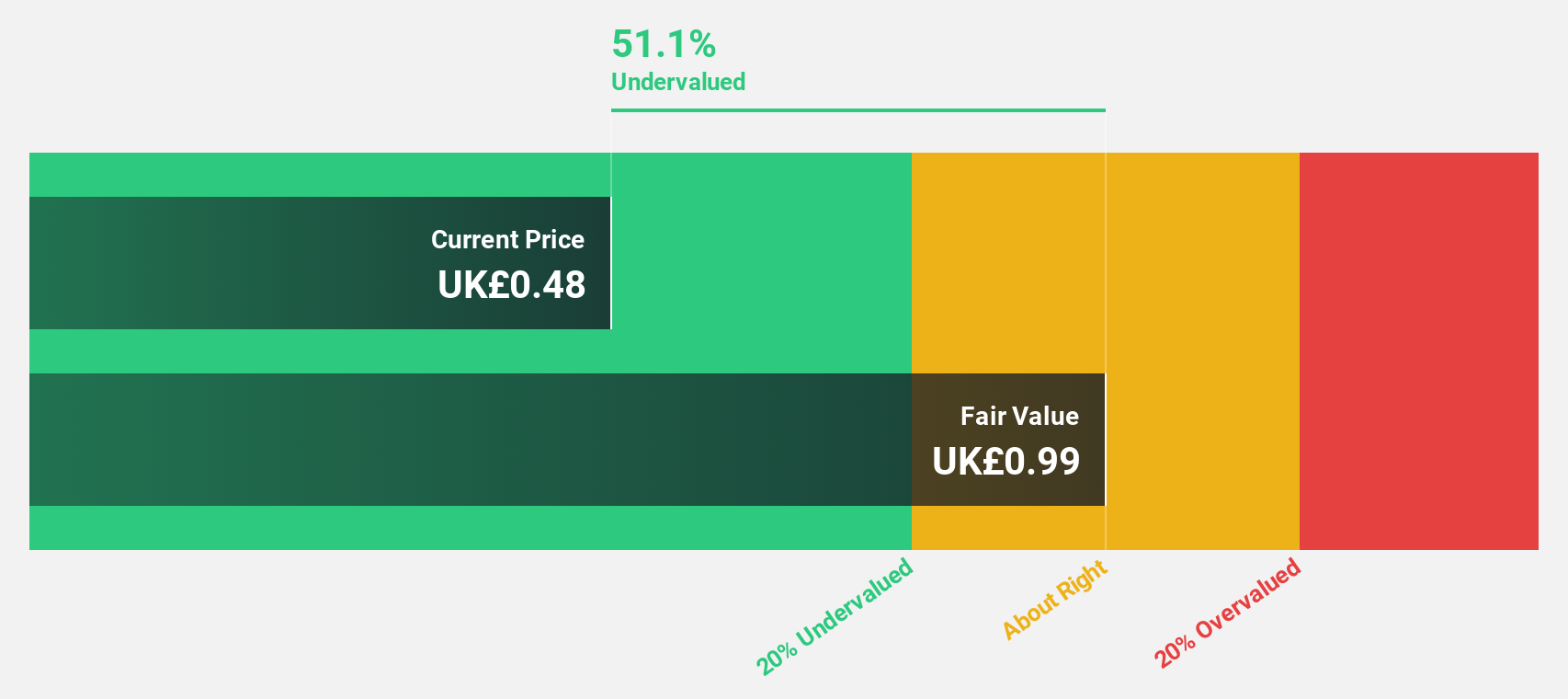

Pan African Resources (AIM:PAF)

Overview: Pan African Resources PLC is involved in the mining, extraction, production, and sale of gold in South Africa with a market cap of £866.52 million.

Operations: The company's revenue is primarily derived from its Evander Mines at $162.06 million and Barberton Mines at $190.16 million, with additional contributions from Agricultural ESG Projects totaling $0.43 million.

Estimated Discount To Fair Value: 45.3%

Pan African Resources is trading at £0.43, significantly below its estimated fair value of £0.78, suggesting it may be undervalued based on cash flows. The company reported net income of US$45.44 million for the half year ended December 31, 2024, up from US$40.9 million a year ago. Despite high debt levels and recent share price volatility, earnings are forecast to grow significantly at 34.56% annually over the next three years, surpassing UK market growth expectations.

- Insights from our recent growth report point to a promising forecast for Pan African Resources' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Pan African Resources.

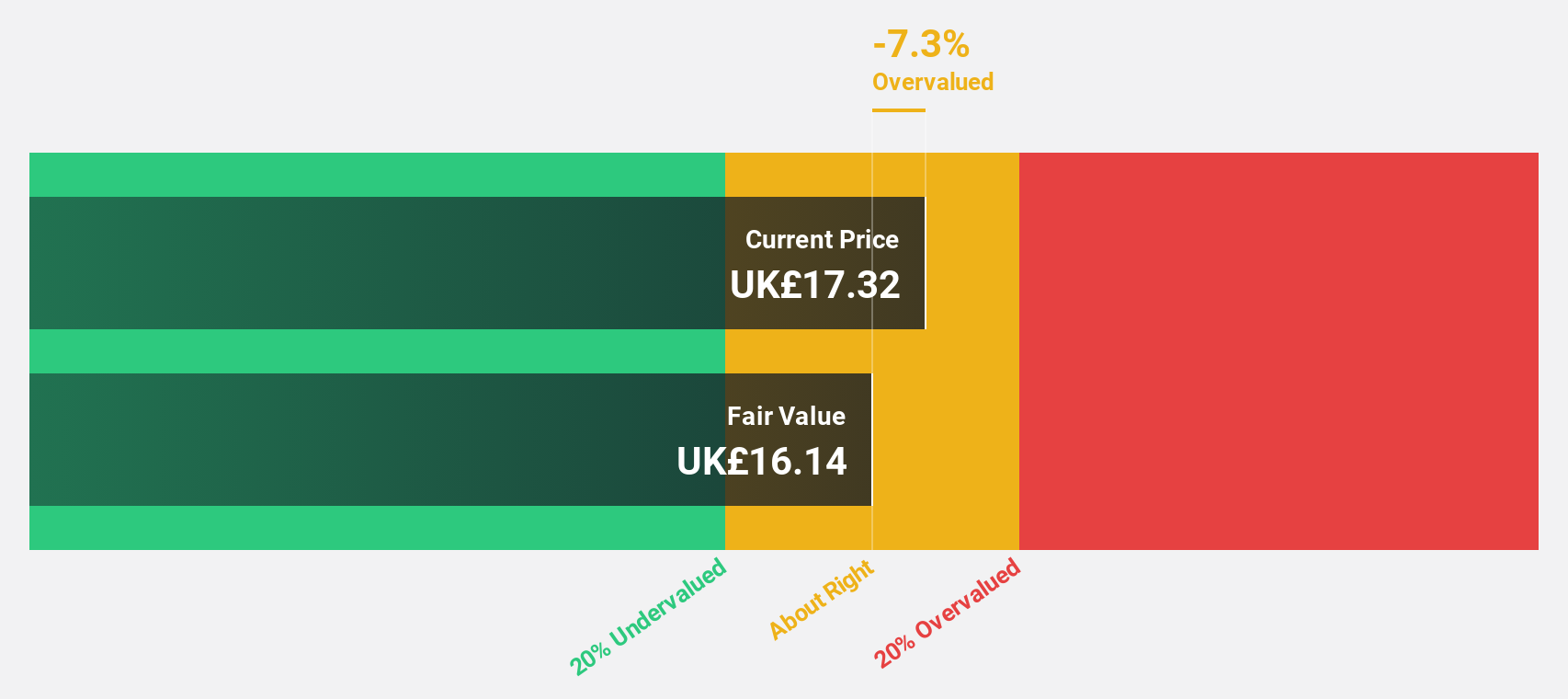

Avon Technologies (LSE:AVON)

Overview: Avon Technologies Plc, with a market cap of £441.98 million, specializes in providing respiratory and head protection products for military and first responder markets in Europe and the United States.

Operations: The company's revenue segments include $129.40 million from Team Wendy and $145.60 million from Avon Protection, focusing on respiratory and head protection products for military and first responder markets.

Estimated Discount To Fair Value: 10.3%

Avon Technologies, trading at £14.88, is below its estimated fair value of £16.59, potentially indicating undervaluation based on cash flows. The company has recently raised its revenue guidance for 2025 due to increased demand and expects improved operating profit margins. With earnings forecasted to grow significantly at 55.6% annually over the next three years—outpacing UK market growth—and recent significant defense contract wins, Avon demonstrates strong potential despite low return on equity forecasts and large one-off items impacting results.

- Our earnings growth report unveils the potential for significant increases in Avon Technologies' future results.

- Take a closer look at Avon Technologies' balance sheet health here in our report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 52 Undervalued UK Stocks Based On Cash Flows by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal