After Leaping 32% RHI Magnesita India Limited (NSE:RHIM) Shares Are Not Flying Under The Radar

RHI Magnesita India Limited (NSE:RHIM) shares have had a really impressive month, gaining 32% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.9% over the last year.

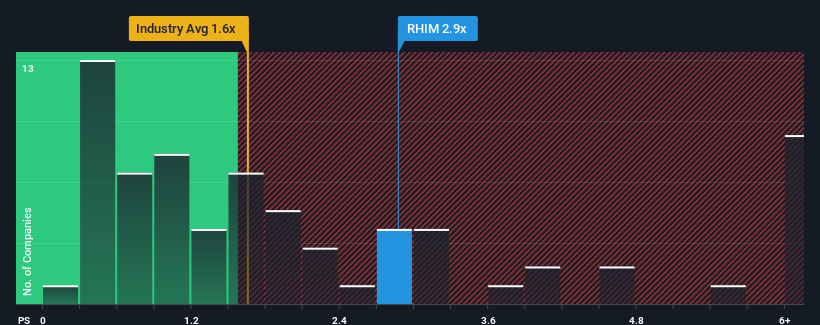

Following the firm bounce in price, when almost half of the companies in India's Basic Materials industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider RHI Magnesita India as a stock probably not worth researching with its 2.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for RHI Magnesita India

What Does RHI Magnesita India's P/S Mean For Shareholders?

RHI Magnesita India could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think RHI Magnesita India's future stacks up against the industry? In that case, our free report is a great place to start.How Is RHI Magnesita India's Revenue Growth Trending?

RHI Magnesita India's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 104% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 6.6%. That would be an excellent outcome when the industry is expected to decline by 1.1%.

In light of this, it's understandable that RHI Magnesita India's P/S sits above the majority of other companies. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Bottom Line On RHI Magnesita India's P/S

RHI Magnesita India's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We can see that RHI Magnesita India maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. Outperforming the industry in this manner looks to have provided investors with a bit of confidence that the future will be bright, bolstering the P/S. Questions could still raised over whether this level of outperformance can continue in the context of a a tumultuous industry climate. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for RHI Magnesita India that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal