“Product power” led to a 28.6% increase in revenue, and the re-entry of Weilong Mei (09985) will open up new space for valuation

Against the macro backdrop of slowing economic growth and weak consumer demand, the overall performance of the food and beverage industry in 2024 is under pressure. However, in the midst of the “cold wind,” there is still no shortage of leading companies that have achieved strong headwinds. For example, Weilong Mei (09985), a leader in spicy snack food, achieved steady growth in performance last year, and its revenue structure was further diversified, and it handed over an excellent report card.

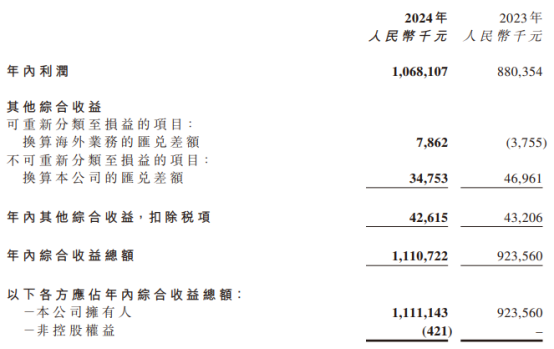

In 2024, Weilong's overall performance improved, and profit indicators were strong, showing steady strength through the cycle. On March 27, Weilong released its 2024 financial report, showing that the company's annual revenue was about 6.266 billion yuan (RMB, same below), up 28.6% year on year; net profit reached about 1,068 billion yuan, up 21.3% year on year; overall gross margin level also increased by 0.4 percentage points to 48.1%.

From spicy strips to konjac refreshment, Weilong continues to create “a variety of explosions”

The reason why Weilong is still growing against the wind in the industry is inseparable from the contribution of the spicy strip category. Financial reports show that Weilong's annual revenue for spicy strips (flavored noodle products) products increased 4.6% to 2,667 billion yuan, and its basic market position is stable. This data definitely strongly refutes the spicy strip skepticism that once appeared on the internet, such as “spicy bars can't be sold” and “spicy bars don't work anymore.”

According to analysis by industry insiders, Weilong pioneered a new snack food category called spicy strips. It has remained popular since its launch for more than 20 years, and has continued to launch new products with various flavors such as spicy, spicy, hot and sour, and spicy. It continues to explore the multi-level experience of “spiciness”, showing strong brand vitality, which is indeed rare.

In addition to spicy strips, Weilong also pioneered a second growth curve, namely vegetable products represented by konjac flavor. According to financial data, the annual revenue of vegetable products increased by 59.1% to 33.71 yuan, accounting for 53.8% of total revenue, showing a rapid growth trend.

Also a product pioneered by Weilong, konjac is healthy and low in calories, and was warmly welcomed by consumers as soon as it was launched. According to the Zhitong Finance App, since the end of 2023, Weilong has successively launched various konjac products such as “Little Witch” konjac tripe, spicy barbecue konjac noodles, sesame sauce konjac soup, chili stir-fried meat, and spicy crayfish limited-flavor konjac crisp, which has led to a rapid increase in the popularity of the konjac category.

In just a few years, Weilong's konjac soup series became popular and quickly occupied a leading position in the segmented circuit. This not only brought continuous growth to the company's performance, but also verified Weilong's excellent “product strength”. According to Nielsen data, Weilong Konjac has maintained the number one sales volume in the country for 3 consecutive years, with a market share of 70%, while the 2nd to 10th places together account for 20% of the market share, which has widened a clear gap with latecomers.

From spicy bars to konjac snacks, Weilong's ability to continue to create hits has been proven. By continuously expanding the boundaries of the spicy casual snack circuit, the risk of Weilong's revenue being dependent on a single category has now been greatly reduced, the business structure is healthier and more balanced, and the long-term value of industry leaders is becoming more prominent.

Product superposition channel innovation, brand continues to rejuvenate

The reason why Weilong can continue to create popular models in multiple categories is inseparable from its efforts to focus on product innovation over the years. The company puts forward a new brand proposition of “Weilong is not just a spicy”. It is not limited to the traditional spicy strip called big gluten, but is actively breaking out of the comfort zone and continuously launching more segmented products to meet the increasingly diverse spicy needs of consumers.

Recently, Weilong's Spicy Spicy Hot Strip released a new spicy flavor. Using Devil's Chili Pepper as a base, it selects a new generation of Chaotian pepper. Combining the mellow peppery aroma of Wudu peppercorns with a special Sichuan-style spicy red oil, it not only made a bold breakthrough in spiciness, but also created a multi-level unique taste experience through special recipes.

In addition to continuously introducing new flavors, Weilong strives to maintain a “tasty and not expensive” brand image, and has taken a number of measures to continuously optimize the product experience. In 2024, Weilong announced that there will be no price increase for all products, and that influencer items such as konjac soup will be upgraded to further benefit consumers; Weilong invested in the supply chain to build a transparent factory with 100,000-grade clean standards, and actively publicize product sampling reports.

On the other hand, Weilong's headwinds and steady growth in performance are also inseparable from the continuous consolidation of channel operation capabilities. During the reporting period, Weilong actively promoted omni-channel construction, comprehensively improved online and offline operation capabilities, and explored more growth opportunities by seizing emerging channels.

Among them, revenue generated by online channels increased by 38.1% to 705 million yuan from 510 million yuan in the same period last year, mainly due to the increase in performance brought about by the continued layout of social e-commerce such as Douyin and Kuaishou; offline channel revenue increased 27.5% to 5.562 billion yuan from 4.361 billion yuan in the same period last year. Not only did cooperation with offline dealers continue to deepen, but they also explored and expanded emerging channels such as snacks and member supermarkets to successfully explore more potential markets.

In addition, Weilong focuses on building a younger brand and continuously deepens its brand awareness among young consumers through creative marketing. During the reporting period, the company launched the durian spicy strip, using the unique taste experience of durian, which is both smelly and fragrant; used harmonic notes such as “Jiang Lang Dishes” and “No energy cooking” to create the “Weilong konjac is fresh” hot topic, bringing an immersive “serving” experience through offline pop-up stores; and held a month-long “Weilong Spicy Bar Festival” national spicy pop-up event. Through innovative experiences of hunting strange flavors, it closely followed the hot spots and had fun offline interactions to catch the attention of young consumers.

Weilong has a deep insight into the needs of young consumers from the marketing side and successfully establishes emotional links with young consumers, which is expected to lay a solid customer foundation for the company's future performance growth and market expansion.

High growth potential is being formed, and access is expected to catalyze the market

Steady growth performance, active product innovation strategies, and excellent channel operation have all enabled Weilong to win the “vote” of investors for real money in the capital market.

Since the beginning of 2025, Weilong's stock price has been rising in the secondary market, reaching a maximum of HK$14, and has doubled in more than 3 months.

On March 10, Weilong was transferred to Hong Kong Stock Connect again, reflecting the market's continued optimism about the company's value. In response, the Fangzheng Securities Research Report pointed out that with the company's re-entry into operation, liquidity is expected to improve markedly, leading to an increase in the company's valuation. The Guotai Junan Research Report also said that considering the obvious volume of konjac and other products in the company's vegetable products, it will drive a relatively rapid increase in revenue and profit, raise the company's profit forecast, and maintain the “increase in wealth” rating.

Entering 2025, the food industry is expected to usher in recovery opportunities as the policy side continues to increase consumption and expectations for a recovery in domestic demand heat up. At the same time, judging from the segmented circuit, food and drink tracks such as casual snacks and soft drinks have maintained a high level of prosperity thanks to the decline in offline channels and the support of online e-commerce traffic.

According to the Guoxin Securities Research Report, Weilong has formed a scale advantage and built a comprehensive channel coverage system in categories such as spicy strips and konjac soup, and the rich konjac product matrix is expected to form high growth potential and add impetus to the company's long-term development; Damo's channel research shows that in the first two months of 2025, Weilong's sales will increase by about 30%, far higher than the overall growth rate of staple foods and snacks. If this trend continues, Weilong's sales volume of konjac is expected to exceed expectations. The bank expects the company's net profit compound annual growth rate (CAGR) of over 10%.

According to information, Weilong recently issued an announcement stating that the company's management has changed, and the founder of the company, Mr. Liu Fuping, has been appointed as the company's CEO, which will take effect from April 30, 2025.

In recent years, the model of a Chinese listed company founder and CEO is quietly emerging. Through the founder's deep participation in the operation of the company, it is possible to break the constraints of the traditional professional manager management model, ensure that the company can quickly make decisions, respond to market changes, and give full play to the founder's deep perception of the industry and innovative thinking. Examples such as Xiaomi, Youzan Technology, 360 Group, and Lixun Precision are typical examples of founders always active on the front line of enterprise management.

Currently, the Hong Kong stock food and beverage sector is in the undervaluation range. Weilong, which has re-entered the market, is also expected to return strongly to its market valuation as liquidity improves markedly.

Wall Street Journal

Wall Street Journal