Qunzhi Consulting: It is expected that the price of small to medium size panels will stop rising and stabilize in March, and the increase in large sizes will narrow

The Zhitong Finance App learned that on March 26, Qunzhi Consulting released the March 2025 TV panel price trend vane (late version). According to data from Qunzhi Consulting, it is expected that the price increase of small to medium size panels will stabilize in March, and the increase in large size will narrow. Qunzhi Consulting pointed out that after LCD TV panel prices experience a quarterly upward range, the upstream and downstream global TV panel market will enter a warm-up period surrounding the cost game.

On the demand side, after the tariff policy is increased, the brand procurement strategy will shift from risky stocking to cost control. In anticipation of an increase in US tariffs, the shift in TV production capacity will affect the increase in brand operating costs, driving a shift from positive to wait-and-see among manufacturers. Furthermore, the marginal effect of the “trade-in” policy on demand in the Chinese market has weakened, gradually affecting brand stocking. On the supply side, under the principle of on-demand production, panel supply increased markedly in the first quarter. It is expected that panel factories will adjust flexibly based on demand in the second quarter, and the panel utilization rate will shrink slightly from month to month.

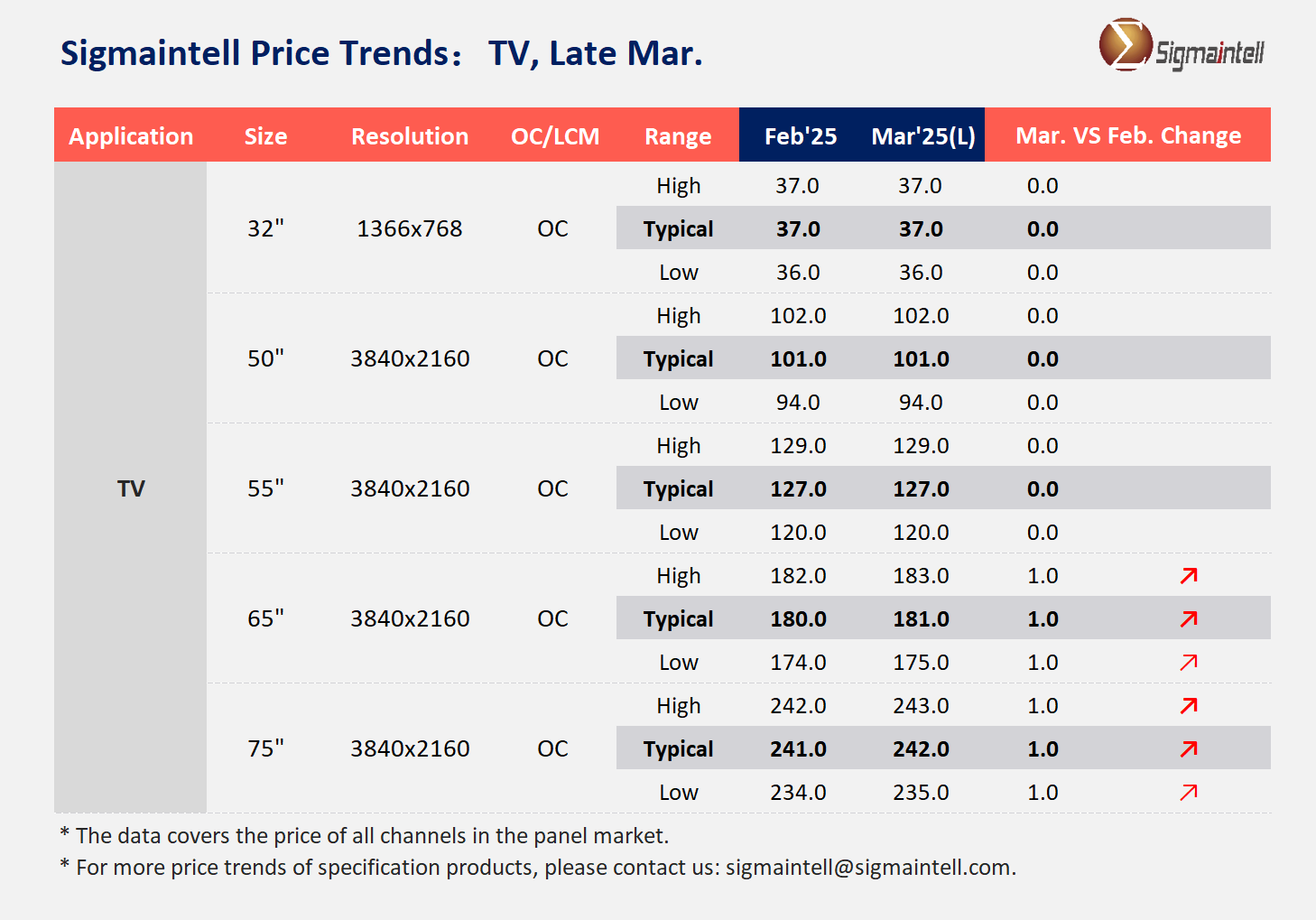

Each size is shown as follows:

32". After the price increase, demand momentum for bottom-up preparation weakened, and the price is expected to remain flat in March.

50". The brand's stocking demand is relatively stable, and the price is expected to be maintained in March.

55". Demand is relatively stable, and prices are expected to remain stable in March.

In terms of large sizes, short-term demand for large-size panels remains strong, but terminal removal capacity is weakening, and it is expected to rise slightly by 1 US dollar in March.

Wall Street Journal

Wall Street Journal