Ibstock (LON:IBST) Is Due To Pay A Dividend Of £0.025

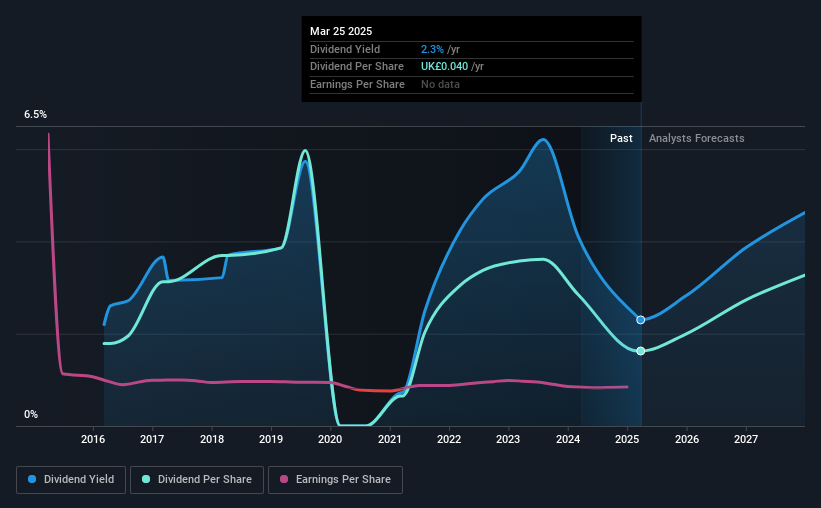

Ibstock plc (LON:IBST) has announced that it will pay a dividend of £0.025 per share on the 30th of May. This means that the dividend yield is 2.3%, which is a bit low when comparing to other companies in the industry.

Ibstock's Future Dividend Projections Appear Well Covered By Earnings

Even a low dividend yield can be attractive if it is sustained for years on end. Based on the last payment, the company wasn't making enough to cover what it was paying to shareholders. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

Analysts expect a massive rise in earnings per share in the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 28% which is fairly sustainable.

See our latest analysis for Ibstock

Ibstock's Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The annual payment during the last 9 years was £0.044 in 2016, and the most recent fiscal year payment was £0.04. This works out to be a decline of approximately 1.1% per year over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Has Limited Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Over the past five years, it looks as though Ibstock's EPS has declined at around 25% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

We're Not Big Fans Of Ibstock's Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. The dividend doesn't inspire confidence that it will provide solid income in the future.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 2 warning signs for Ibstock (of which 1 is a bit concerning!) you should know about. Is Ibstock not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal