Ten Square Games S.A. (WSE:TEN) Could Be Riskier Than It Looks

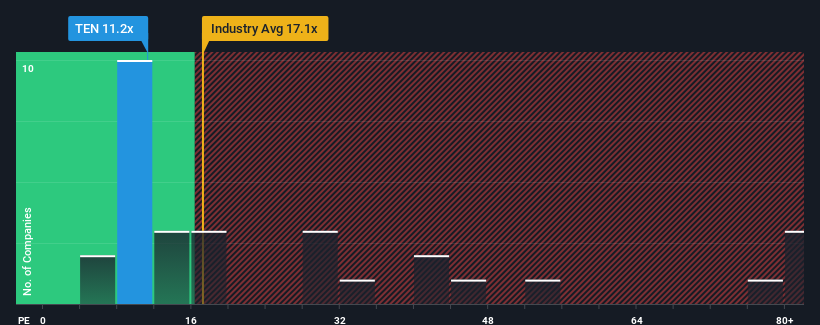

With a median price-to-earnings (or "P/E") ratio of close to 13x in Poland, you could be forgiven for feeling indifferent about Ten Square Games S.A.'s (WSE:TEN) P/E ratio of 11.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Ten Square Games as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Ten Square Games

Is There Some Growth For Ten Square Games?

The only time you'd be comfortable seeing a P/E like Ten Square Games' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 490% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 59% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 13% per annum as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 5.5% per annum, which is noticeably less attractive.

In light of this, it's curious that Ten Square Games' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Ten Square Games' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ten Square Games' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Ten Square Games that you should be aware of.

Of course, you might also be able to find a better stock than Ten Square Games. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal