São Martinho S.A. (BVMF:SMTO3) Investors Are Less Pessimistic Than Expected

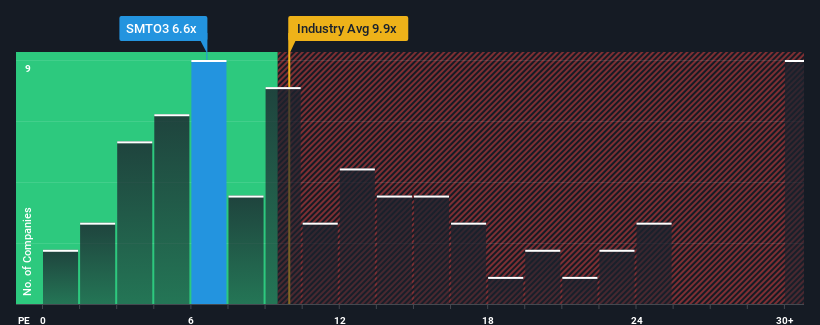

There wouldn't be many who think São Martinho S.A.'s (BVMF:SMTO3) price-to-earnings (or "P/E") ratio of 6.6x is worth a mention when the median P/E in Brazil is similar at about 8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent earnings growth for São Martinho has been in line with the market. The P/E is probably moderate because investors think this modest earnings performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

See our latest analysis for São Martinho

How Is São Martinho's Growth Trending?

The only time you'd be comfortable seeing a P/E like São Martinho's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a worthy increase of 11%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 23% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 16% as estimated by the nine analysts watching the company. Meanwhile, the broader market is forecast to expand by 14%, which paints a poor picture.

In light of this, it's somewhat alarming that São Martinho's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of São Martinho's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for São Martinho that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal