3 Reliable Dividend Stocks Yielding Up To 7.5%

As the U.S. stock market surges with optimism following potential tariff reductions, investors are increasingly looking for stability amidst economic uncertainty. In such a climate, dividend stocks can offer reliable income streams and potential growth, making them an attractive option for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 4.87% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.61% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.09% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.95% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.85% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.40% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.40% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.79% | ★★★★★★ |

Click here to see the full list of 154 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Weyco Group (NasdaqGS:WEYS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Weyco Group, Inc. designs, markets, and distributes footwear for men, women, and children across the United States, Canada, Australia, South Africa, and Asia Pacific with a market cap of $275.82 million.

Operations: Weyco Group, Inc.'s revenue is primarily derived from its Wholesale segment at $227.94 million and its Retail segment at $38.70 million.

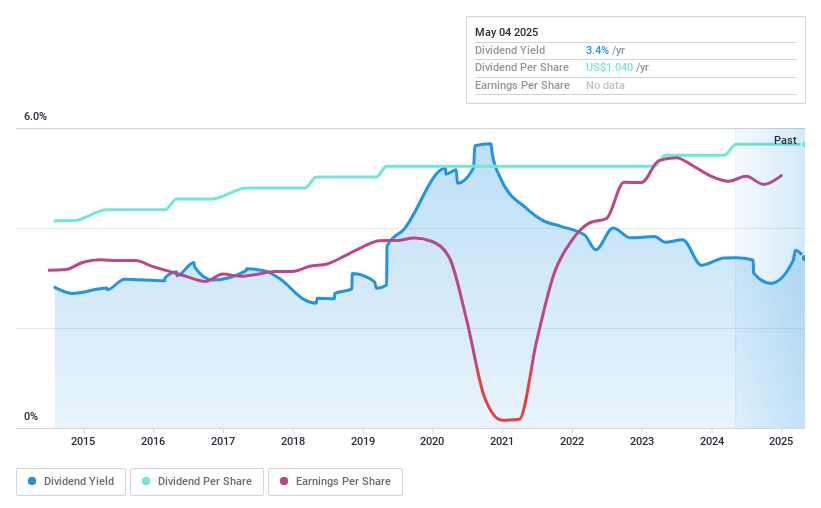

Dividend Yield: 3.4%

Weyco Group's dividend yield of 3.42% is below the top quartile of US dividend payers but remains reliable, with stable growth over the past decade. The payout ratio is modest at 32.4%, indicating dividends are well-covered by earnings and cash flows, with a cash payout ratio of 27.3%. Recent earnings showed slight growth in net income despite a decline in annual sales to US$290.29 million, and the company declared a quarterly dividend of $0.26 per share payable March 31, 2025. However, recent board changes may impact compliance with Nasdaq listing requirements if unresolved by August 27, 2025.

- Click here to discover the nuances of Weyco Group with our detailed analytical dividend report.

- Our valuation report here indicates Weyco Group may be overvalued.

Carter's (NYSE:CRI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carter's, Inc. operates as a designer, sourcer, and marketer of branded childrenswear and related products under various brands both in the United States and internationally, with a market cap of approximately $1.47 billion.

Operations: Carter's, Inc. generates its revenue through three main segments: U.S. Retail at $1.42 billion, U.S. Wholesale at $1.02 billion, and International operations at $405.60 million.

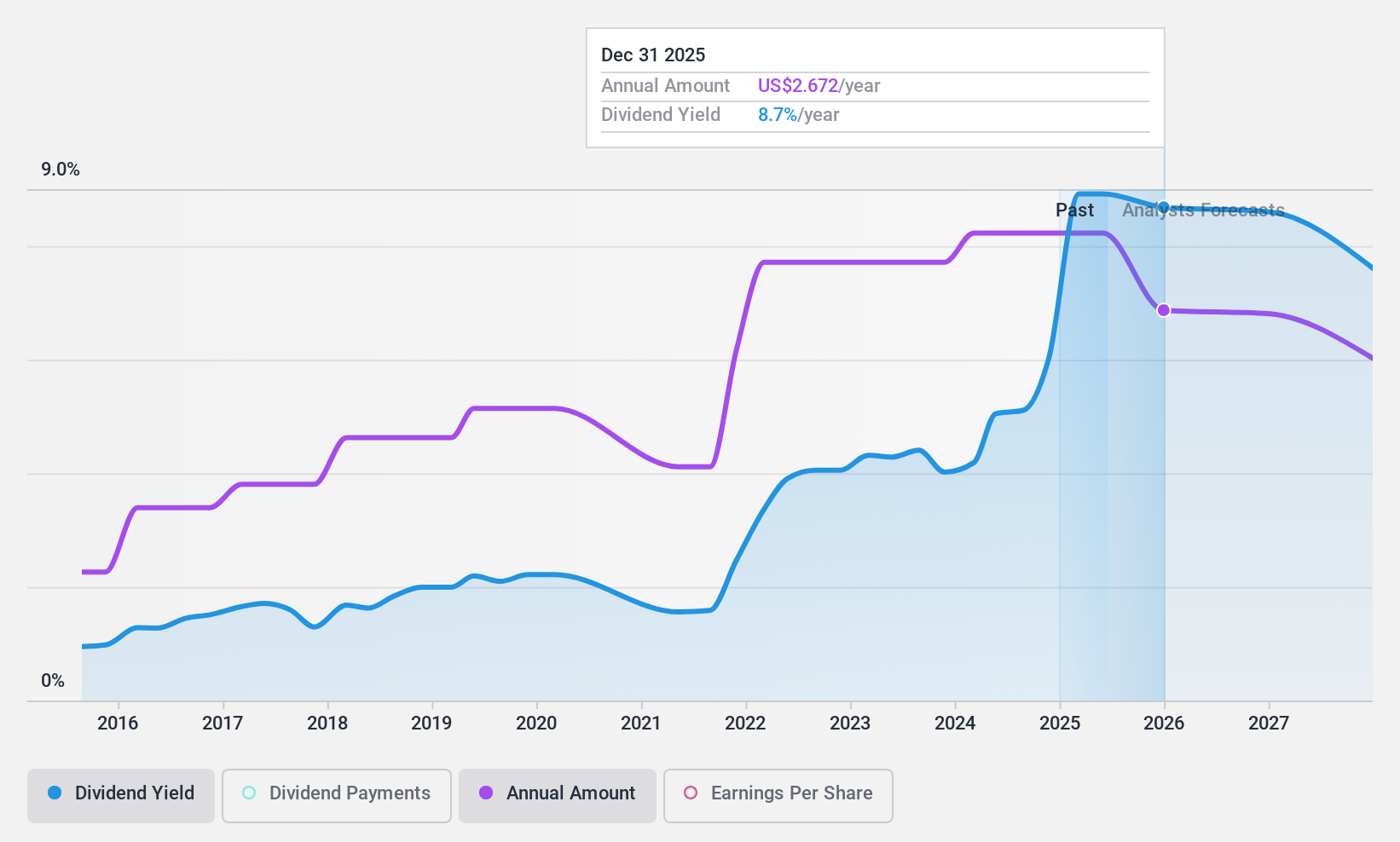

Dividend Yield: 7.5%

Carter's dividend yield of 7.51% places it in the top quartile of US dividend payers, with a payout ratio of 62.5% and cash payout ratio of 47.5%, indicating dividends are covered by earnings and cash flows. Despite a volatile track record, dividends have grown over the past decade. Recent financials show decreased net income to US$61.52 million in Q4 2024 from US$106.51 million a year ago, alongside an announced quarterly dividend of $0.80 per share payable March 28, 2025.

- Click to explore a detailed breakdown of our findings in Carter's dividend report.

- Our valuation report here indicates Carter's may be undervalued.

Dillard's (NYSE:DDS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Dillard's, Inc. operates retail department stores across the southeastern, southwestern, and midwestern United States with a market cap of approximately $5.62 billion.

Operations: Dillard's, Inc. generates revenue primarily through its Retail Operations segment, which accounts for $6.22 billion.

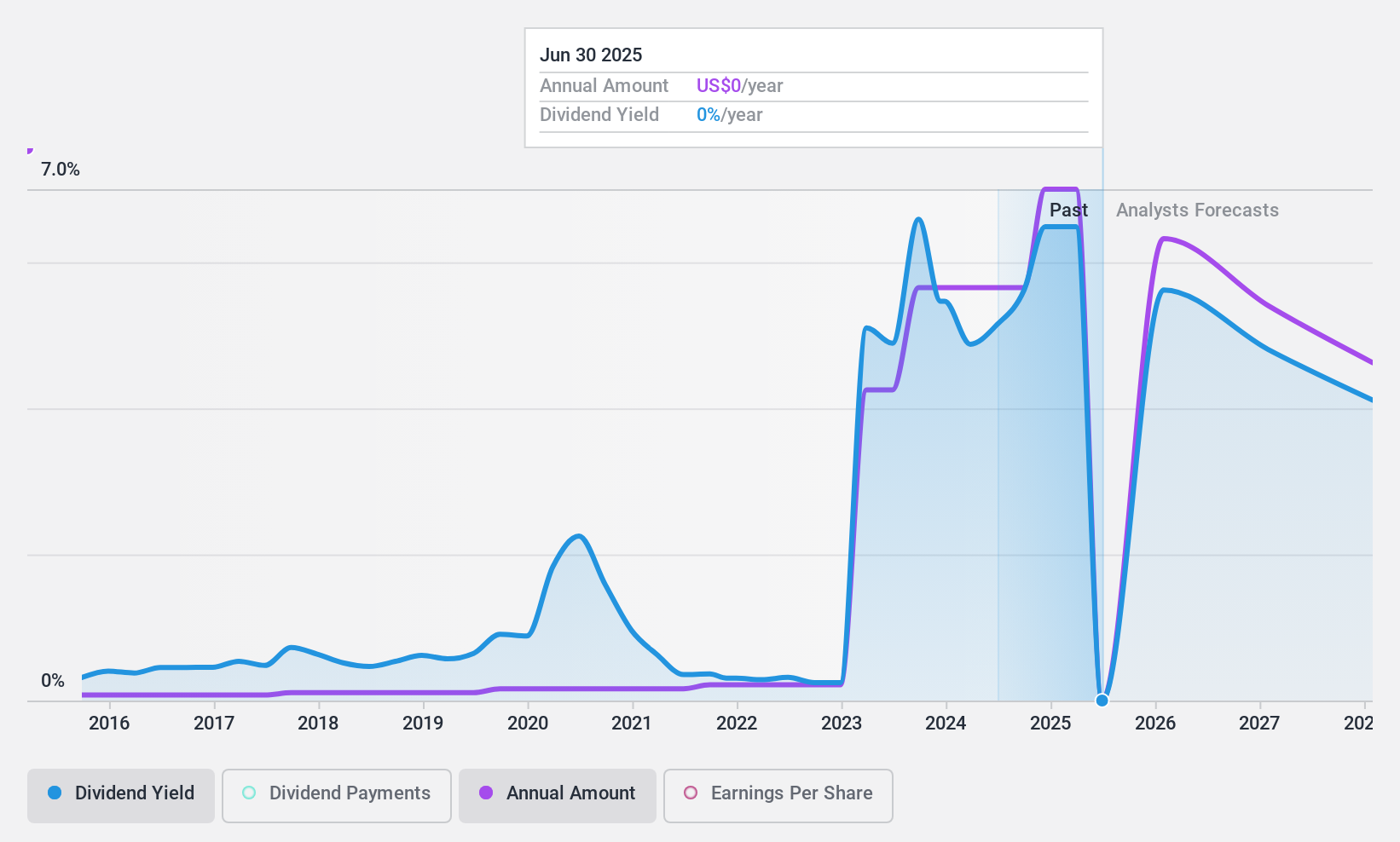

Dividend Yield: 6.9%

Dillard's offers a high dividend yield of 6.95%, placing it among the top US dividend payers, with stable and growing dividends over the past decade. The payout ratio is low at 2.7%, indicating strong earnings coverage, while a cash payout ratio of 67.8% supports sustainability from cash flows. Despite recent insider selling and declining earnings, Dillard’s maintains its dividend reliability, supported by an amended $800 million credit facility for liquidity needs and share repurchases.

- Get an in-depth perspective on Dillard's performance by reading our dividend report here.

- Our valuation report unveils the possibility Dillard's shares may be trading at a discount.

Make It Happen

- Explore the 154 names from our Top US Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal