Cigna Group (NYSE:CI) Leadership Overhaul: New COO and CFO to Accelerate Growth

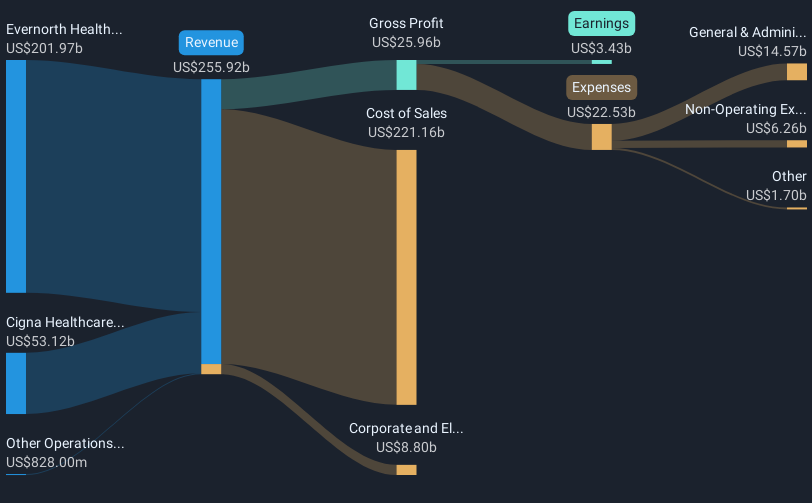

Cigna Group (NYSE:CI) has seen its share price increase by 11% over the last quarter amid various significant events within the company. Recently announced executive changes include Brian Evanko being named President and COO, and Ann Dennison appointed as Executive VP and CFO, which might influence investor sentiment positively. Nicole Jones has expanded her responsibilities, while Eric Palmer's forthcoming departure from a key division is set to initiate a leadership transition that could affect investor perception of stability and continuity. Additionally, financial activities like the increase in quarterly dividends by 8% and extensive share buybacks might have strengthened investor confidence, underpinning this uptrend. The market context showed a recent overall decline of 4%, with technology stocks leading fluctuations. However, Cigna's strong Q4 2024 financial results, including a rise in net income and EPS, possibly reinforced investor optimism compared to broader market challenges, contributing to its share price appreciation.

Review our historical performance report to gain insights into Cigna Group's track record.

The Cigna Group has experienced robust growth, achieving a total return of 129.19% over the past five years. This impressive performance can be linked to its active share repurchase program, where from December 2018 to late February 2025, Cigna bought back 9,163,421 shares totaling US$2.9 billion. The company's strategic partnerships, such as the recent agreement with Professional Group Plans in Illinois to expand health benefit distribution, have also reinforced its market presence. Despite stiff competition, Cigna's efforts to enhance its offerings, as seen in the new fertility services deal with Progyny, have strengthened its product portfolio.

Moreover, Cigna has maintained an ongoing commitment to returning value to shareholders through dividends, evidenced by the January 2025 increase to US$1.51 per share. This period of growth has occurred despite Cigna's underperformance relative to the US market over the last year, illustrating its resilience amid broader market volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal