Atmos Energy (ATO) Valuation Check As Recent Returns Soften But Long Term Performance Stays Solid

Atmos Energy stock: what recent returns say about investor sentiment

Atmos Energy (ATO) is back on investors’ radar after a mixed run in recent months, with the stock showing a small move over the past month and a modest decline over the past 3 months.

See our latest analysis for Atmos Energy.

Over the past year, Atmos Energy’s share price return has been relatively muted compared with its longer run. Its 1 year total shareholder return of 19.9% and 5 year total shareholder return of 117.0% point to stronger compounding over time, suggesting momentum has cooled recently even as long term holders have still fared well.

If this kind of steady utility stock interests you, it can be helpful to compare it with other regulated players by screening a wider set of healthcare stocks.

With Atmos Energy trading near its recent levels, alongside growing revenue and earnings and only a small discount to some analyst targets, you have to ask: is there hidden value here, or is the market already pricing in future growth?

Most Popular Narrative: 3% Undervalued

Against a last close of US$170.47, the most followed narrative points to a fair value of about US$175.73, leaving a small valuation gap that hinges on detailed earnings and growth assumptions.

Major multiyear capital investment programs focused on modernizing and expanding pipeline infrastructure, combined with favorable regulatory mechanisms and frequent rate filings, underpin ongoing rate base growth, translating to stable and predictable long-term earnings and cash flow.

Curious what justifies paying up for a regulated utility? This narrative leans on steady revenue expansion, firm profit margins and a future earnings multiple that needs those forecasts to hold. Want to see exactly how those pieces fit together?

Result: Fair Value of $175.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising capital spending and operating costs, along with Atmos Energy’s reliance on supportive regulation in a handful of states, could quickly challenge that underpriced story.

Find out about the key risks to this Atmos Energy narrative.

Another View: What Market Ratios Are Signalling

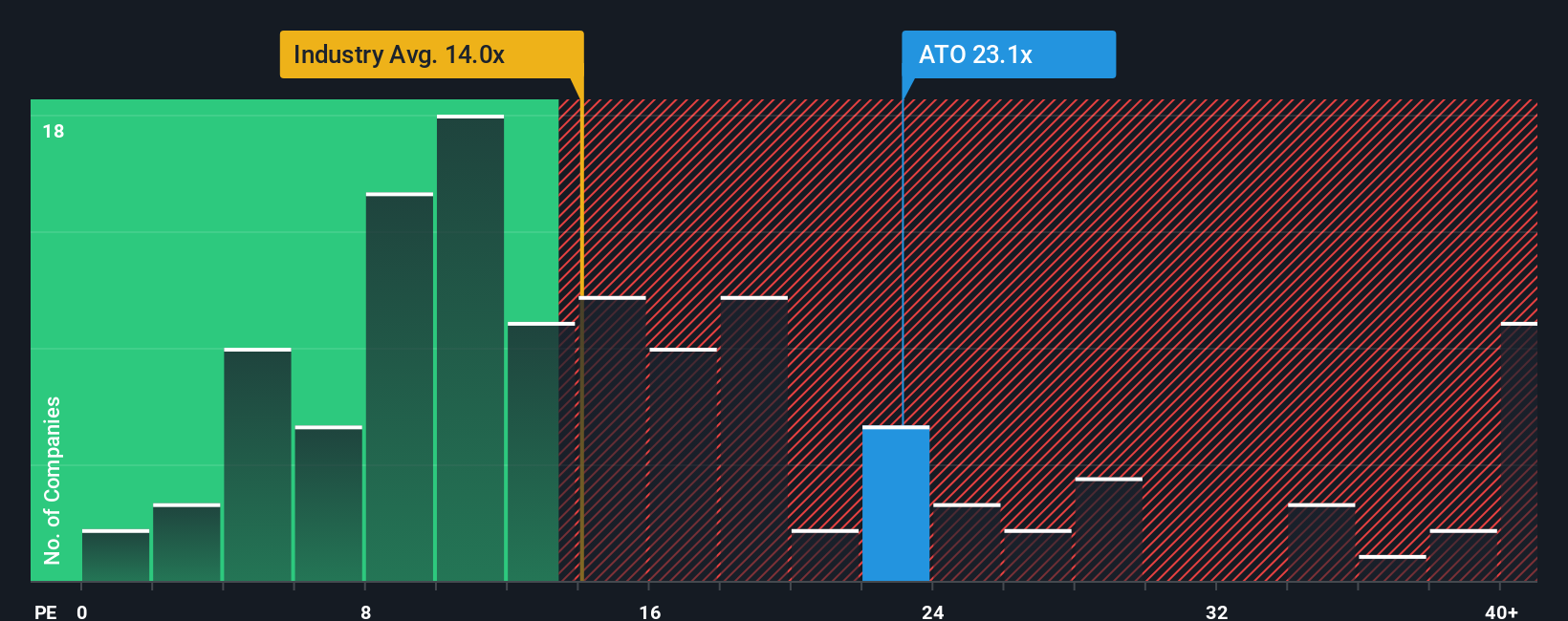

The 3% undervalued fair value narrative sits uncomfortably next to Atmos Energy’s current P/E of 23x. This is higher than the peer average of 18x, the global gas utilities average of 14.4x, and even the fair ratio of 22.7x. That premium suggests less margin for error if expectations do not play out. So is this a quality premium you are comfortable paying, or a valuation risk you want to avoid?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atmos Energy Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Atmos Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Atmos Energy has sharpened your thinking, do not stop here. Put that momentum to work by scanning focused stock ideas that match different styles and themes.

- Spot potential high risk, high reward opportunities early by checking out these 3528 penny stocks with strong financials that already show stronger financial foundations than many peers.

- Position yourself for long term trends in automation and data by reviewing these 24 AI penny stocks that link AI exposure with listed equity opportunities.

- Target potential value ideas by assessing these 871 undervalued stocks based on cash flows where current prices sit below cash flow based estimates on Simply Wall St.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報