Does Pure Storage (PSTG) Still Offer Value After Strong Multi‑Year Share Price Gains

- If you are wondering whether Pure Storage's current share price lines up with its underlying worth, this article is here to walk you through what the numbers actually say about value.

- The stock last closed at US$72.90, with returns of 8.8% over the past 7 days, 9.9% over 30 days, 5.6% year to date, 10.0% over 1 year, 180.3% over 3 years and 217.2% over 5 years. These figures can change how investors think about both potential and risk.

- Recent coverage has focused on Pure Storage as a key player in data storage and flash technology, which helps explain why the share price has drawn fresh attention. Commentary around its role in cloud infrastructure, data management and AI related workloads has given investors more context for the stock's recent moves.

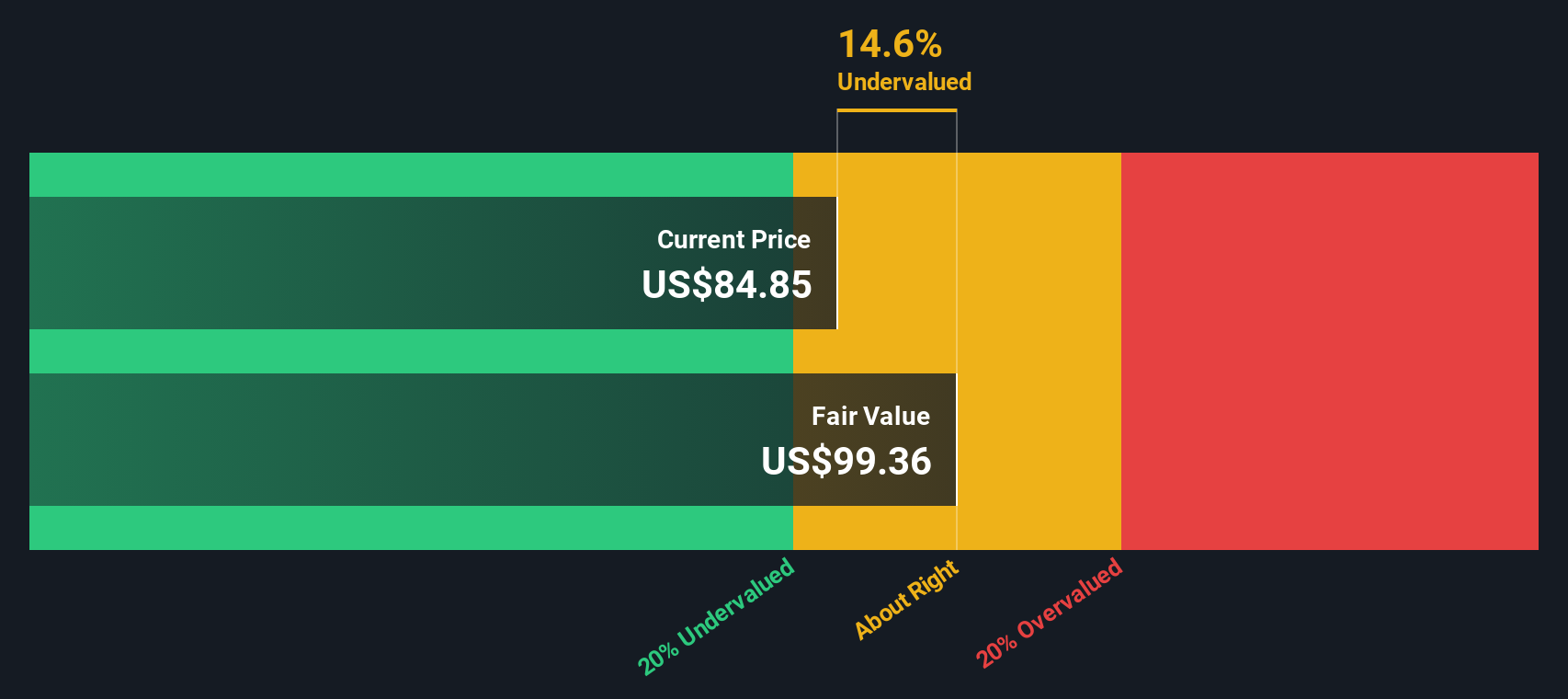

- Pure Storage currently has a valuation score of 3/6. This reflects that it screens as undervalued on three of six checks. Next we will look at how different valuation methods arrive at that result and why a more holistic approach to value at the end of this article can be even more useful for your decision making.

Find out why Pure Storage's 10.0% return over the last year is lagging behind its peers.

Approach 1: Pure Storage Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model looks at the cash Pure Storage is expected to generate in the future and then discounts those cash flows back to today, aiming to estimate what the business could be worth right now.

For Pure Storage, the latest twelve month free cash flow is about $569 million. Analysts have provided projections for the next few years, and these are then extended further by Simply Wall St to build a 2 Stage Free Cash Flow to Equity model. Under this framework, free cash flow is projected to reach $1,255.4 million by 2030, with additional estimates running out to 2035 in the ten year projection set.

When all those projected cash flows are discounted back using the model, the intrinsic value comes out at about $76.38 per share. Compared with the recent share price of US$72.90, the DCF points to the stock trading at roughly a 4.6% discount, which is a relatively small gap that could easily swing either way as assumptions change.

Result: ABOUT RIGHT

Pure Storage is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

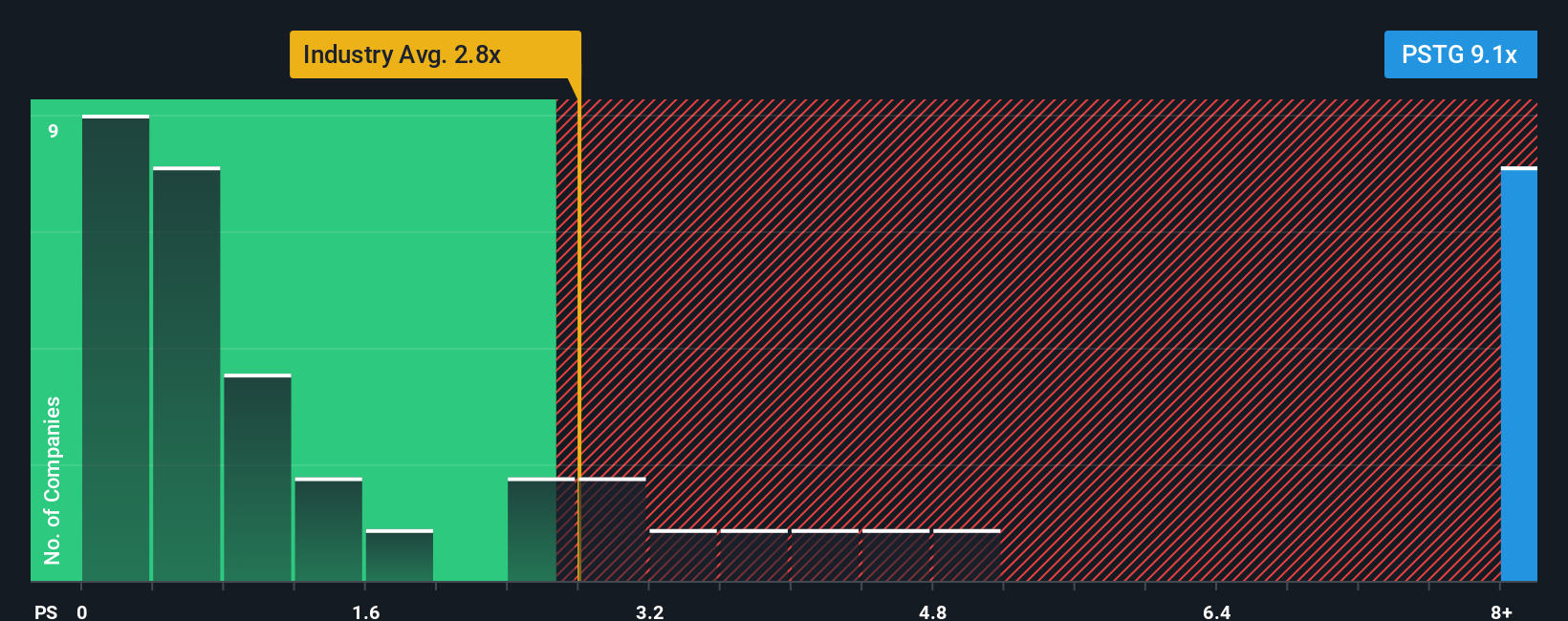

Approach 2: Pure Storage Price vs Sales

For a company like Pure Storage, where investors often focus on revenue and market share, the P/S ratio is a useful way to think about value because it compares what the market is paying for each dollar of sales.

In general, higher growth expectations and lower perceived risk can support a higher “normal” P/S ratio, while slower growth or higher risk usually point to a lower one. Pure Storage currently trades on a P/S of 6.91x, compared with the broader Tech industry average of 1.94x and a peer group average of 3.02x, so the stock sits above both simple benchmarks.

Simply Wall St’s Fair Ratio for Pure Storage is 11.70x. This Fair Ratio is a proprietary estimate of what the P/S might be given factors such as earnings growth, industry, profit margin, market cap and risk. It can be more informative than a straight comparison with peers or the industry because it adjusts for the company’s own profile rather than assuming all Tech names deserve the same multiple. Since the current 6.91x P/S is below the 11.70x Fair Ratio, this framework suggests that the shares may screen as undervalued on a sales multiple basis.

Result: UNDERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pure Storage Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St’s Community page you can use Narratives, which are simple stories investors attach to their own numbers such as fair value, future revenue, earnings and margin assumptions. This means the company’s story links directly to a forecast and then to a fair value that you can compare with the current share price to help you decide whether to buy or sell. Each Narrative updates automatically when new news or earnings are added. With Pure Storage you can already see this in action. One investor Narrative builds a case around AI storage demand, hyperscale opportunities and a fair value of about US$95.16 per share. Another focuses on competition, execution risks and a lower fair value closer to the least bullish analyst target of US$55. This gives you a clear sense of how different perspectives translate into different valuations without needing complex models yourself.

Do you think there's more to the story for Pure Storage? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報