Edge Foundry Co.,Ltd's (KOSDAQ:105550) 29% Share Price Plunge Could Signal Some Risk

The Edge Foundry Co.,Ltd (KOSDAQ:105550) share price has fared very poorly over the last month, falling by a substantial 29%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

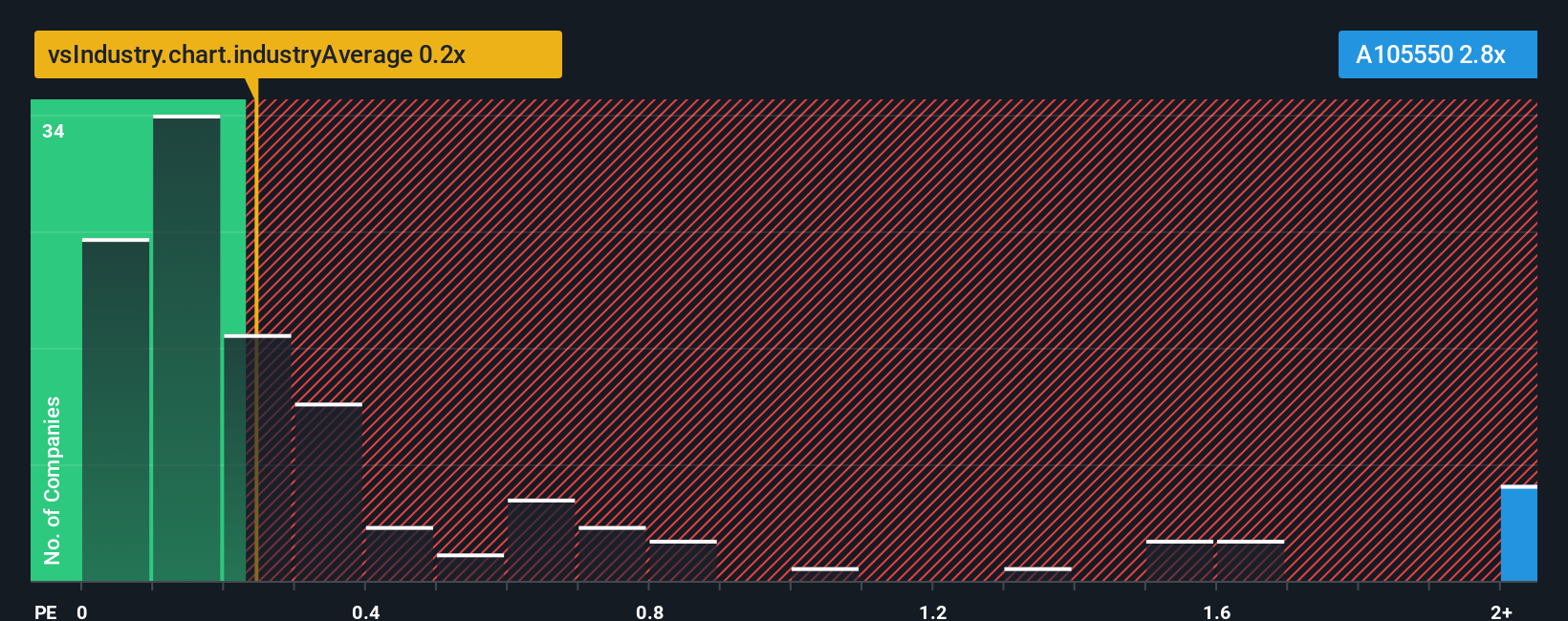

Even after such a large drop in price, you could still be forgiven for thinking Edge FoundryLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 2.8x, considering almost half the companies in Korea's Auto Components industry have P/S ratios below 0.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Edge FoundryLtd

How Edge FoundryLtd Has Been Performing

The recent revenue growth at Edge FoundryLtd would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Edge FoundryLtd's earnings, revenue and cash flow.How Is Edge FoundryLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Edge FoundryLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.0% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 8.5% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that Edge FoundryLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Edge FoundryLtd's P/S?

Edge FoundryLtd's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Edge FoundryLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Edge FoundryLtd (1 is concerning!) that you need to be mindful of.

If you're unsure about the strength of Edge FoundryLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報