A Look At Luckin Coffee (OTCPK:LKNC.Y) Valuation After Recent Mixed Share Price Performance

What recent returns say about Luckin Coffee

Luckin Coffee (OTCPK:LKNC.Y) has drawn attention after a mixed stretch for shareholders, with the stock showing a 0.6% gain over the past day and 1.2% over the past week, but negative returns over the past month and past 3 months.

See our latest analysis for Luckin Coffee.

That recent 1-day and 7-day share price strength comes after a weaker stretch, with a 30-day share price return of 10.1% and a 90-day share price return of 14.2%. The 1-year total shareholder return of 33.7% and 5-year total shareholder return of about 3x suggest longer term holders have still seen substantial gains, so near term momentum looks more like a pause than a clear reversal.

If Luckin Coffee’s moves have you reassessing your watchlist, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

So with Luckin Coffee trading at $33.90 versus an analyst price target of about $49.63 and showing revenue and net income growth in the mid teens, is this a genuine entry point, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 31.7% Undervalued

Compared with the last close at $33.90, the most followed narrative sees fair value closer to $49.63, setting a very different context for Luckin Coffee.

Ongoing investments in proprietary supply chain infrastructure such as the commissioning of the new Xiamen roasting facility and integration of existing plants are expected to enhance vertical integration, lower cost of materials as a percent of revenues, and drive expansion of gross and net margins over the long term.

Sustained product innovation and menu diversification including newly launched health-focused and low-calorie beverage offerings better align Luckin with shifting consumer preferences around wellness. This enables the company to extend its reach and tap into rising demand for healthier specialty drinks, supporting increased average ticket size and incremental sales.

Curious how margin tweaks, revenue assumptions, and a future earnings multiple combine to reach that fair value gap? The full narrative spells out the numbers.

Result: Fair Value of $49.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, aggressive store expansion and rising delivery related costs could squeeze margins and challenge the earnings path that supports the current undervalued narrative.

Find out about the key risks to this Luckin Coffee narrative.

Another View: When DCF Tells a Different Story

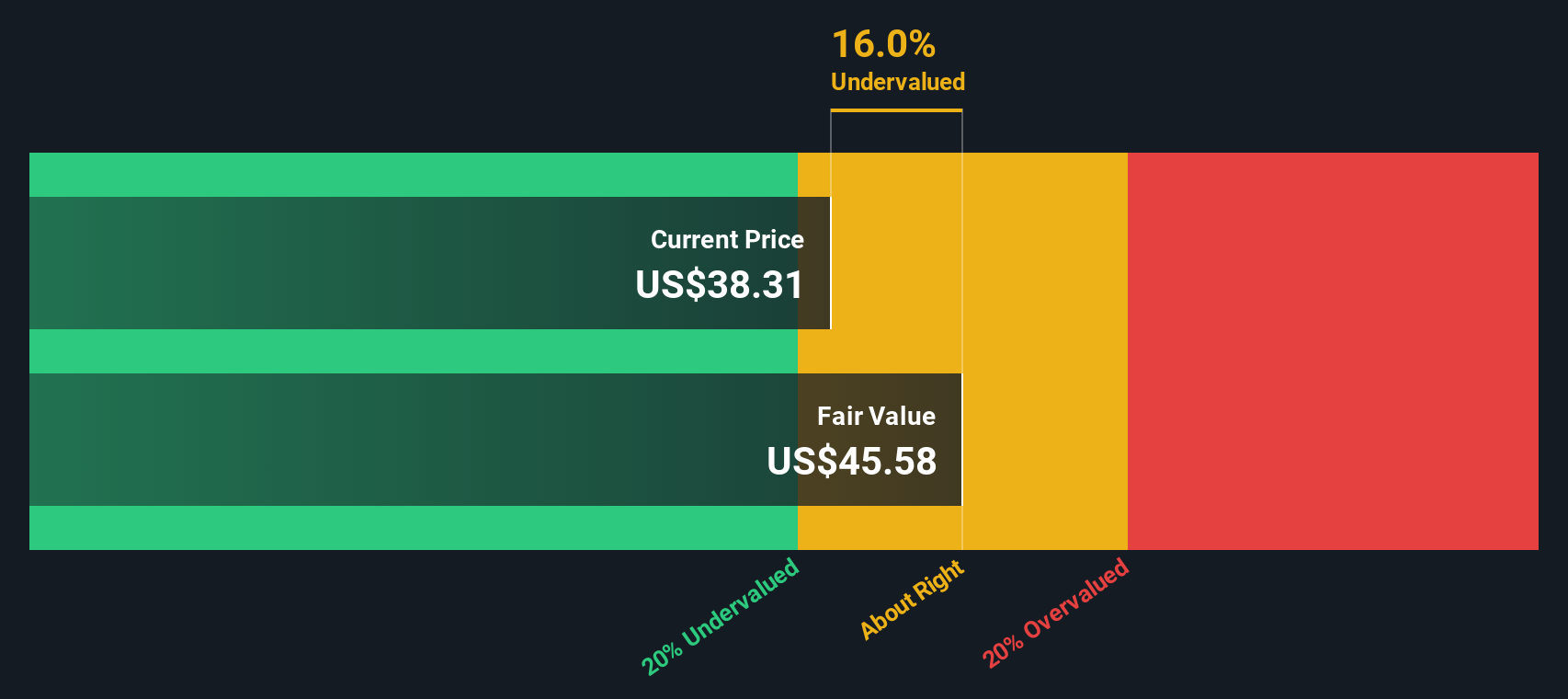

While the popular narrative points to a fair value of $49.63 and labels Luckin Coffee as undervalued, our DCF model suggests something different. Using that approach, LKNC.Y at $33.71 sits above an estimated fair value of $29.47, which points to a degree of overvaluation instead.

This gap between an undervalued narrative and an overvalued DCF result raises a simple question for you as an investor: which set of assumptions about growth, margins, and risk feels more realistic for the next few years?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Luckin Coffee for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Luckin Coffee Narrative

If the story here does not quite match how you see the data, you can stress test the assumptions yourself and build a custom view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Luckin Coffee.

Looking for more investment ideas?

If Luckin Coffee has sharpened your thinking, do not stop here, you will miss potential opportunities if you ignore what other parts of the market are offering.

- Spot potential turnarounds early by checking out these 3543 penny stocks with strong financials that already show stronger financial underpinnings than the typical micro cap name.

- Ride powerful tech trends by scanning these 27 AI penny stocks that connect artificial intelligence themes with accessible share prices.

- Zero in on price gaps by reviewing these 878 undervalued stocks based on cash flows where current cash flow expectations may not fully reflect valuations, based on Simply Wall Street modelling.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報