A Look At Disc Medicine (IRON) Valuation After Bitopertin NDA Filing And Positive DISC-0974 Phase 2 Data

Disc Medicine (IRON) has attracted investors’ attention after submitting a New Drug Application for bitopertin aimed at accelerated FDA review, alongside Phase 2 results for DISC-0974 that suggest broader use with existing JAK inhibitor therapies.

See our latest analysis for Disc Medicine.

The share price has moved to $80.94 after a 4.63% 1 day share price return. However, the 30 day share price return of a 12.25% decline contrasts with a 14.40% 90 day share price return and a very large 3 year total shareholder return of about 4x. This pattern suggests that momentum has been choppy rather than one directional as investors reassess growth prospects and pipeline risk after the bitopertin NDA and DISC-0974 data.

If Disc Medicine’s update has you looking across the sector, this is a useful moment to scan other healthcare stocks that could fit a similar high impact thesis.

With revenue still at US$0 and a net loss of US$181.11 million, alongside a very large 3-year return and a price well below some analyst targets, you have to ask: is IRON mispriced or already reflecting future growth?

Price to Book of 5.3x: Is it justified?

At a last close of US$80.94, Disc Medicine trades on a P/B of 5.3x, which screens as expensive against the broader US biotech peer group.

P/B compares the market value of the company with its net assets on the balance sheet. It is often used for early stage or loss making biopharma names where earnings are not yet meaningful. For a business with US$0 in revenue and a net loss of US$181.11 million, a higher P/B usually reflects investor willingness to pay a premium for the pipeline and potential future cash flow rather than current fundamentals.

What stands out is that IRON is described as good value when compared with a peer average P/B of 6.2x, yet expensive against the wider US Biotechs industry average of 2.7x. So, within its closer peer set the valuation sits at a discount, while across the industry it carries a premium that implies the market is assigning relatively high expectations to Disc Medicine’s hematology pipeline and forecast 55.5% annual revenue growth.

See what the numbers say about this price — find out in our valuation breakdown.

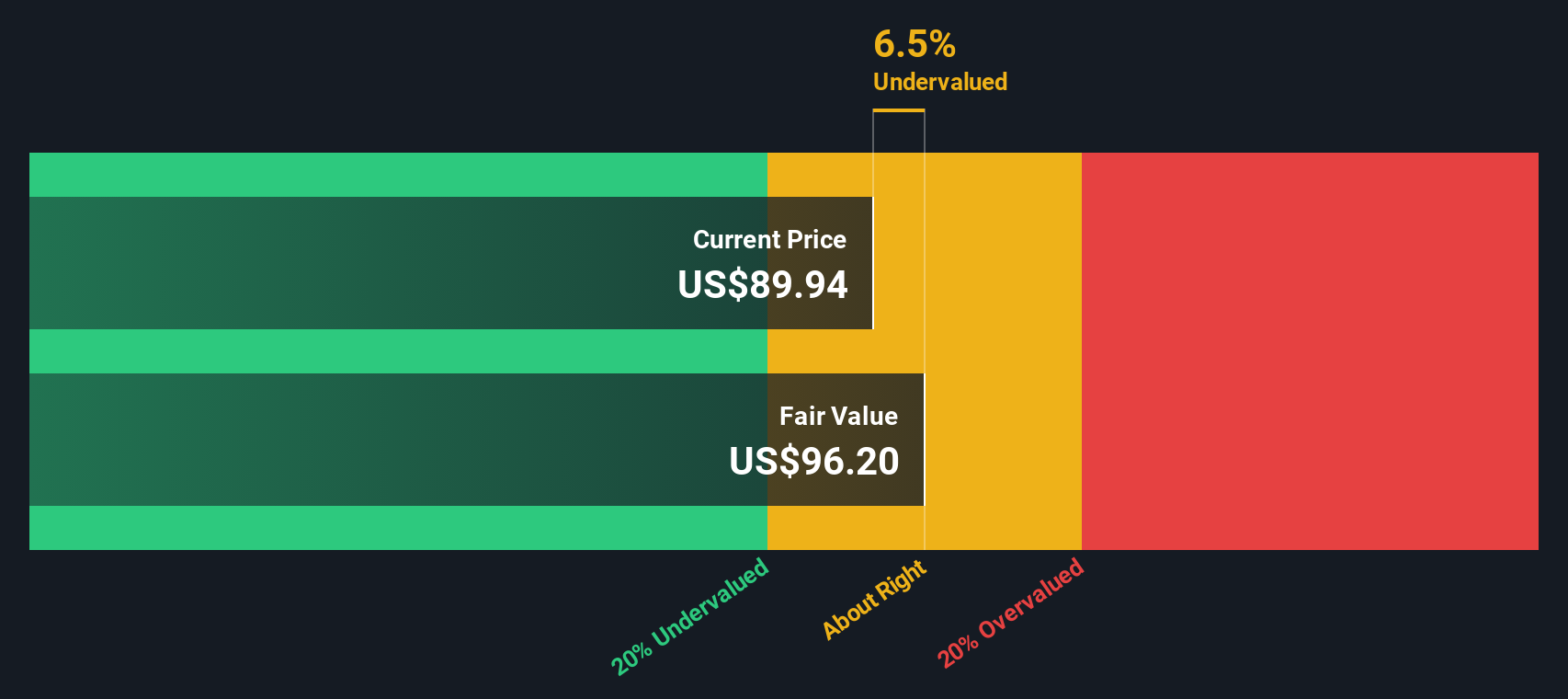

Result: Price-to-book of 5.3x (ABOUT RIGHT)

However, there are clear pressure points, including zero revenue alongside a US$181.11 million loss and heavy reliance on successful outcomes from multiple early stage hematology programs.

Find out about the key risks to this Disc Medicine narrative.

Another View: Our DCF Model Paints A Very Different Picture

While the 5.3x P/B suggests Disc Medicine is priced richly against the broader biotech group, our DCF model reaches a very different conclusion. With estimated fair value at US$586.29 versus a share price of US$80.94, the model flags a very large potential undervaluation. This raises the question: which signal do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Disc Medicine for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Disc Medicine Narrative

If you see the numbers differently or simply prefer to test your own assumptions against the data, you can build a complete view in just a few minutes, starting with Do it your way.

A great starting point for your Disc Medicine research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If IRON has sharpened your thinking, do not stop here, the next move could come from a completely different corner of the market.

- Target potential mispricings with these 879 undervalued stocks based on cash flows that combine solid cash flow profiles with prices that may not fully reflect fundamentals.

- Ride major tech shifts by scanning these 27 AI penny stocks that sit at the intersection of artificial intelligence and fast changing end markets.

- Tap into income opportunities using these 12 dividend stocks with yields > 3% that focus on established payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報