Assessing Intellia Therapeutics (NTLA) Valuation After FDA Clinical Hold On Lead Gene Editing Trial

Why Intellia’s recent clinical hold matters for investors

Intellia Therapeutics (NTLA) recently halted dosing and patient enrollment in its late stage MAGNITUDE studies after a patient death linked to severe liver side effects, prompting an FDA clinical hold on its lead therapy candidate.

See our latest analysis for Intellia Therapeutics.

The clinical hold comes after a steep 90 day share price return decline of 58.69%, leaving Intellia at US$10.13. That setback contrasts with a positive year to date share price return of 9.99%, while longer term total shareholder returns remain deeply negative.

If this kind of event risk has you reassessing biotech exposure, it could be a good moment to broaden your research and look at other healthcare stocks as potential candidates.

With Intellia trading at US$10.13 after a sharp 90 day sell off, yet sitting well below analyst targets and long term highs, are investors looking at a potential mispricing here, or is the market already discounting future growth?

Most Popular Narrative: 54.8% Undervalued

With Intellia last closing at US$10.13 and the most followed narrative pointing to fair value around US$22.43, the gap between price and modelled worth is wide.

The analysts have a consensus price target of $34.083 for Intellia Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $106.0, and the most bearish reporting a price target of just $7.0.

Curious what has to happen for Intellia to justify those numbers? Revenue, margins, and a much higher future earnings multiple are all doing heavy lifting in this narrative.

Result: Fair Value of $22.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also have to weigh real downside triggers, such as further safety setbacks in ATTR or tougher reimbursement for high cost gene editing, which could quickly weaken this upside story.

Find out about the key risks to this Intellia Therapeutics narrative.

Another View: Multiples Point To A Very Different Story

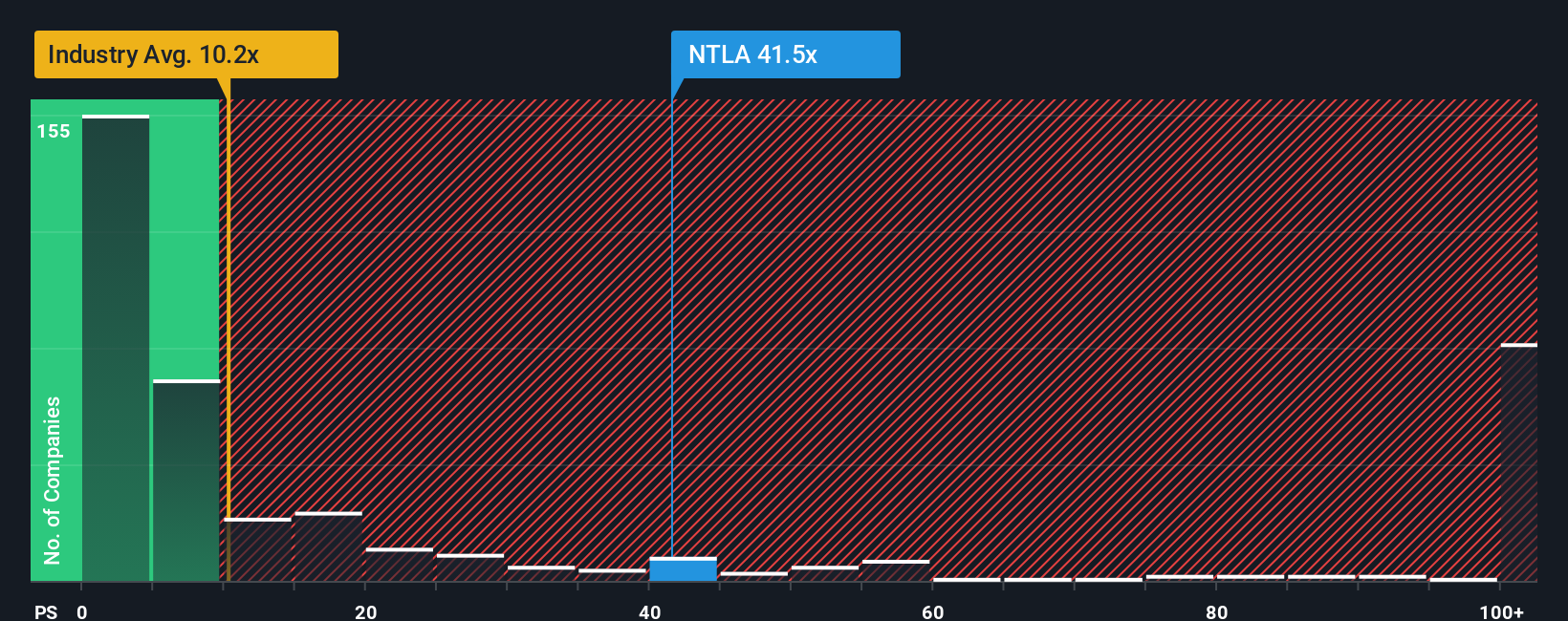

Those fair value models suggest Intellia looks cheap, yet the simple P/S ratio tells a different story. At about 20.4x sales, Intellia trades well above the US Biotechs average of 12.1x and its own fair ratio of 0x, which raises a basic question: is this really a bargain or just a very expensive growth bet with a weak profit track record?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intellia Therapeutics Narrative

If you are not fully on board with this view or simply prefer to work from your own numbers and assumptions, you can build a custom thesis in just a few minutes, starting with Do it your way.

A great starting point for your Intellia Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Intellia has sharpened your thinking about risk and reward, do not stop here. Use this momentum to line up your next set of focused ideas.

- Target smaller companies with big potential by scanning these 3543 penny stocks with strong financials that already show stronger financial foundations than many expect from this corner of the market.

- Ride the push into machine learning and automation by checking out these 27 AI penny stocks that put artificial intelligence at the center of their business model.

- Seek value with a quality tilt by reviewing these 12 dividend stocks with yields > 3% that combine income potential with established track records of shareholder returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報