Has Arm Holdings (ARM) Run Too Far After Recent Share Price Swings?

- If you are wondering whether Arm Holdings at US$115.68 is priced for its story or its fundamentals, you are not alone.

- The stock has had a mixed run lately, with a 5.8% gain over the last 7 days, a 17.2% decline over the last 30 days, a 0.8% return year to date and a 20.3% decline over the last year.

- Recent commentary around Arm has focused on its role in the broader semiconductor and chip design space, as investors weigh how its licensing model fits into long term trends. Market discussions have also highlighted how quickly sentiment can shift around high profile chip related names, which helps explain some of the recent share price swings.

- Right now, Arm Holdings has a valuation score of 0 out of 6. Next, we will look at what traditional valuation methods say about that score, and then finish with a framework that can help you make even more sense of the numbers.

Arm Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Arm Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of the cash a company could generate in the future and then discounts those cash flows back to today to arrive at an estimated intrinsic value per share.

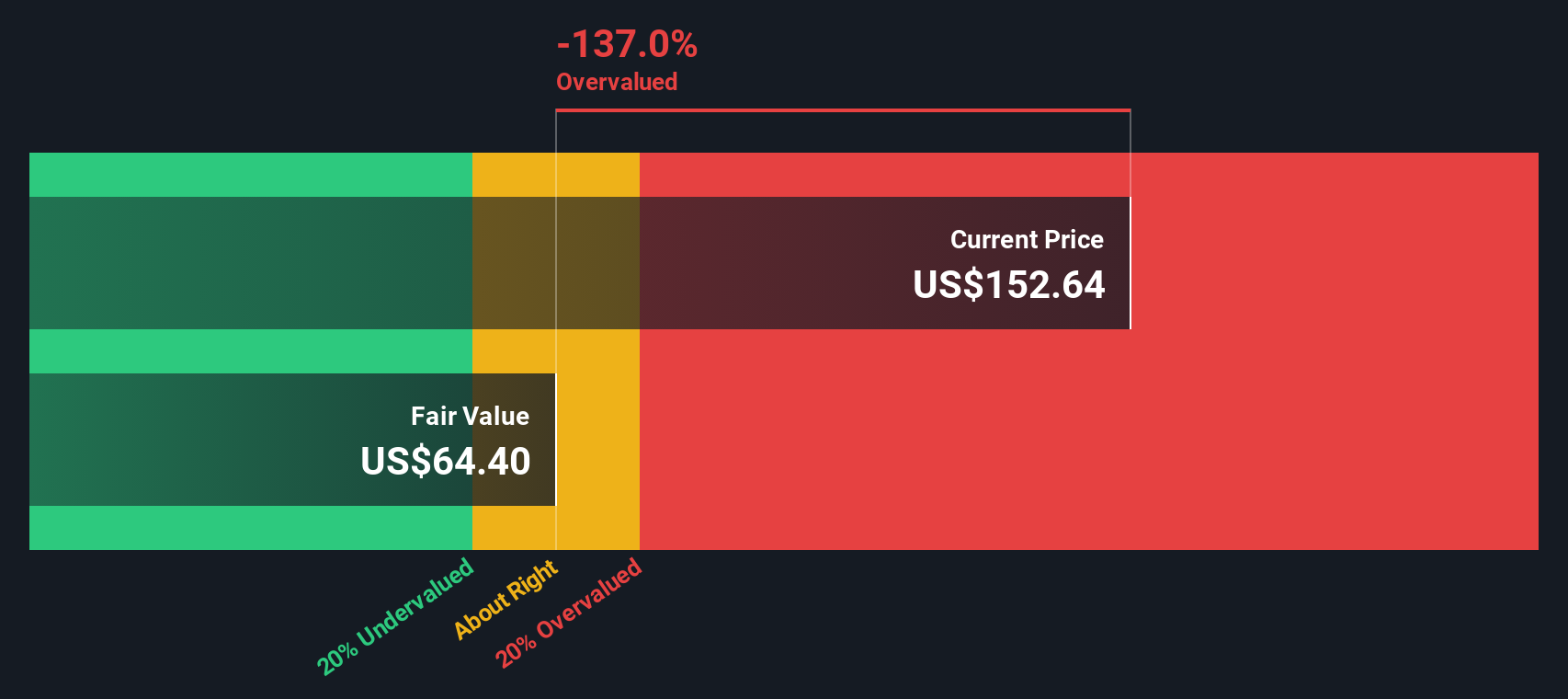

For Arm Holdings, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is about $1.29b. Analyst and extrapolated projections used in this model show free cash flow reaching around $5.27b by 2030, with a series of annual estimates between 2026 and 2035 that are discounted back to today to reflect risk and the time value of money. All of these figures are in US$.

When all projected and discounted cash flows are added up, the model produces an estimated intrinsic value of about $63.35 per share, compared with the current share price of $115.68. That gap implies the stock is around 82.6% above the DCF estimate, so on this measure Arm screens as expensive rather than cheap.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arm Holdings may be overvalued by 82.6%. Discover 883 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Arm Holdings Price vs Earnings

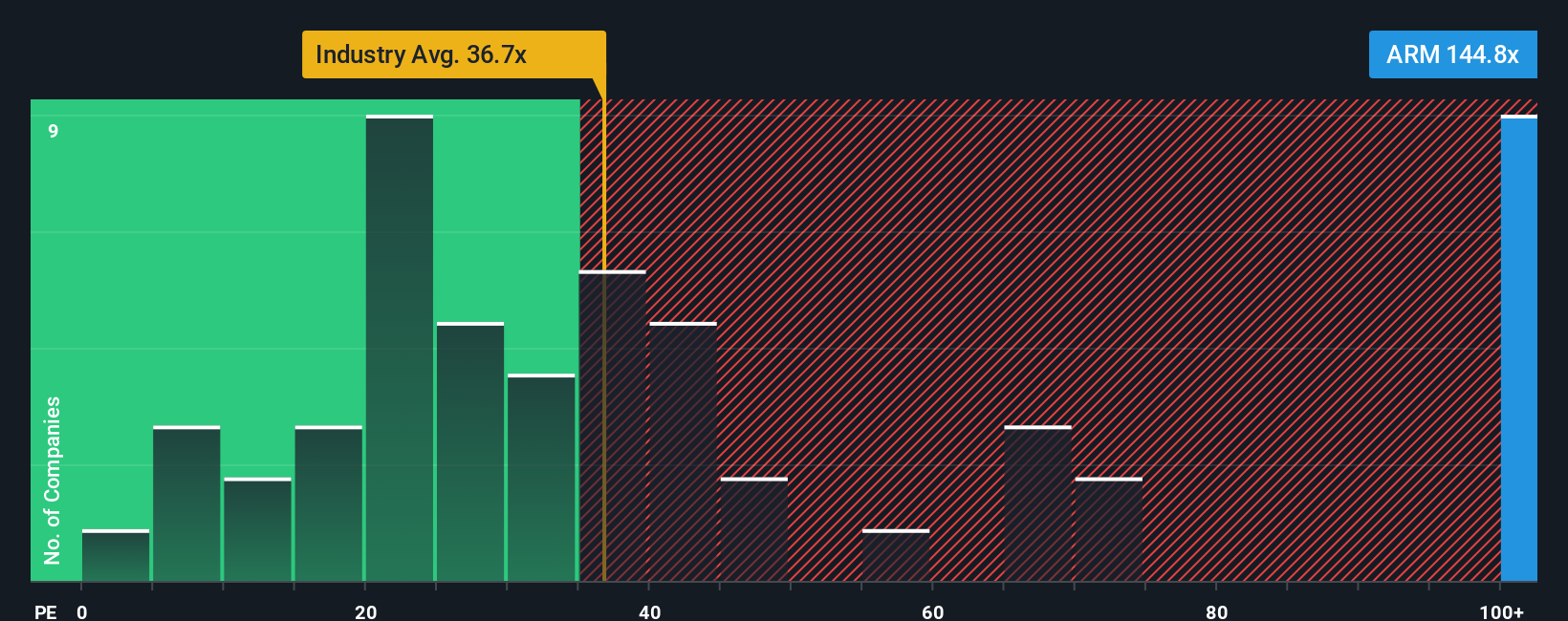

For profitable companies, the P/E ratio is a useful yardstick because it links what you pay for each share to the earnings that business is currently generating. Investors usually accept a higher P/E when they expect stronger earnings growth or see the business as lower risk, and a lower P/E when growth expectations are more modest or risks are higher.

Arm Holdings currently trades on a P/E of 147.88x. That is well above the Semiconductor industry average of 42.34x and the peer group average of 40.12x, so on simple comparisons the shares look expensive.

Simply Wall St’s Fair Ratio framework goes a step further. It estimates what a more tailored P/E might look like by factoring in elements such as Arm’s earnings growth profile, profit margins, industry, market capitalization and risk characteristics. For Arm, this Fair Ratio comes out at 52.00x, which is still far below the current 147.88x. On this metric, the shares screen as overvalued relative to what the model suggests could be a more balanced P/E.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arm Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which simply means you set out your story for Arm Holdings, link that story to specific assumptions for future revenue, earnings and margins, and arrive at a fair value you can compare to the current share price on Simply Wall St’s Community page, where millions of investors share views that update automatically as new news or earnings arrive. One investor might build a cautious Arm Narrative with a fair value near US$56, while another might build a very optimistic Narrative that supports a fair value closer to US$210. By seeing where your own view sits between those extremes, you can judge whether the current price looks high or low relative to your fair value and decide if the stock belongs on your watchlist, if you want to research adding exposure, or if you prefer to wait for a better entry point.

For Arm Holdings however we will make it really easy for you with previews of two leading Arm Holdings Narratives:

Fair value in this bullish narrative: US$164.85 per share.

Implied discount to that fair value versus the current US$115.68 share price: about 29.8% undervalued using ((164.85 - 115.68) / 164.85).

Assumed annual revenue growth: 22.13%.

- Focuses on AI related licensing and rising royalty rates across newer Arm platforms as the key drivers behind higher long run earnings and margins.

- Highlights a broad and sticky ecosystem across data centers, IoT, automotive and edge devices that supports recurring revenue and earnings stability.

- Factors in higher R&D spending and business model evolution but still arrives at a fair value above US$160 based on consensus growth and profitability assumptions.

Fair value in this more cautious narrative: US$70.00 per share.

Implied premium to that fair value versus the current US$115.68 share price: about 39.1% overvalued using ((115.68 - 70.00) / 115.68).

Assumed annual revenue change: 4.25% decline.

- Anchors valuation to an earnings yield framework linked to the 10 year U.S. Treasury, which points to a materially lower intrinsic value than the current market price.

- Argues that recent trading in the US$120 to US$140 range reflects sentiment moving ahead of fundamentals, with the share price more exposed to shifts in rates or risk appetite.

- Flags the possibility of higher prices in a speculative phase, but treats that as a low margin of safety scenario that depends heavily on continued AI enthusiasm and liquidity.

Seen together, these Narratives show how reasonable investors can look at the same company and reach very different conclusions. Your task is to decide which assumptions feel closer to your own view of Arm’s earnings power, risk profile and acceptable valuation, and then position your portfolio size and time horizon accordingly.

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for Arm Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報