Citigroup (C) Valuation Check As Turnaround Progress And Divestitures Draw Fresh Analyst Attention

Citigroup (C) is back in focus after years of restructuring, with investors reacting to cleaner operations, divestitures such as its Russian unit, and a stronger capital and shareholder return story.

See our latest analysis for Citigroup.

Recent moves, including the planned exit from Russia and new senior hires in APAC investment banking, have come alongside strong momentum, with a 30 day share price return of 11.43% and a 1 year total shareholder return of 70.27%, suggesting sentiment has shifted meaningfully.

If Citi’s rebound has caught your attention, it could be a useful moment to widen the lens and look at solid balance sheet and fundamentals stocks screener (None results) for other banks with balance sheets that stand out.

After a 70% total return in 1 year and the share price now sitting around $121, with some intrinsic value estimates implying a 21.55% discount, you have to ask yourself: is there still a mispricing here, or is the market already baking in the next leg of Citi’s turnaround?

Most Popular Narrative: 47.9% Undervalued

According to ChadWisperer, the narrative fair value of about $233 sits well above Citi’s last close of $121.37, framing a wide valuation gap for investors to think about.

The Citi Token Services platform, expanding into more markets and applications like tokenized deposits and crypto custodial solutions, is expected to unlock entirely new, high-margin revenue streams by redefining cross-border payments and liquidity management for its vast institutional client base. Simultaneously, sustained share gains in Investment Banking, propelled by strategic talent investments and a focus on high-growth sectors like tech and healthcare, will add significant fee income.

Curious how a bank-focused story leans on digital assets, higher margins and richer fee pools to support that gap to fair value? The narrative pulls together growth in institutional payments, wealth and Investment Banking with a profit multiple that is usually reserved for faster growing franchises. Want to see which revenue and margin assumptions sit behind a near doubling of implied value and how a discount rate of 7.61% shapes the result? Read on to see the full set of numbers behind this $233 call.

Result: Fair Value of $233.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can quickly change if digital asset regulation shifts unexpectedly or if Citi’s transformation and cost discipline efforts take longer or prove more expensive than planned.

Find out about the key risks to this Citigroup narrative.

Another Way To Look At Value

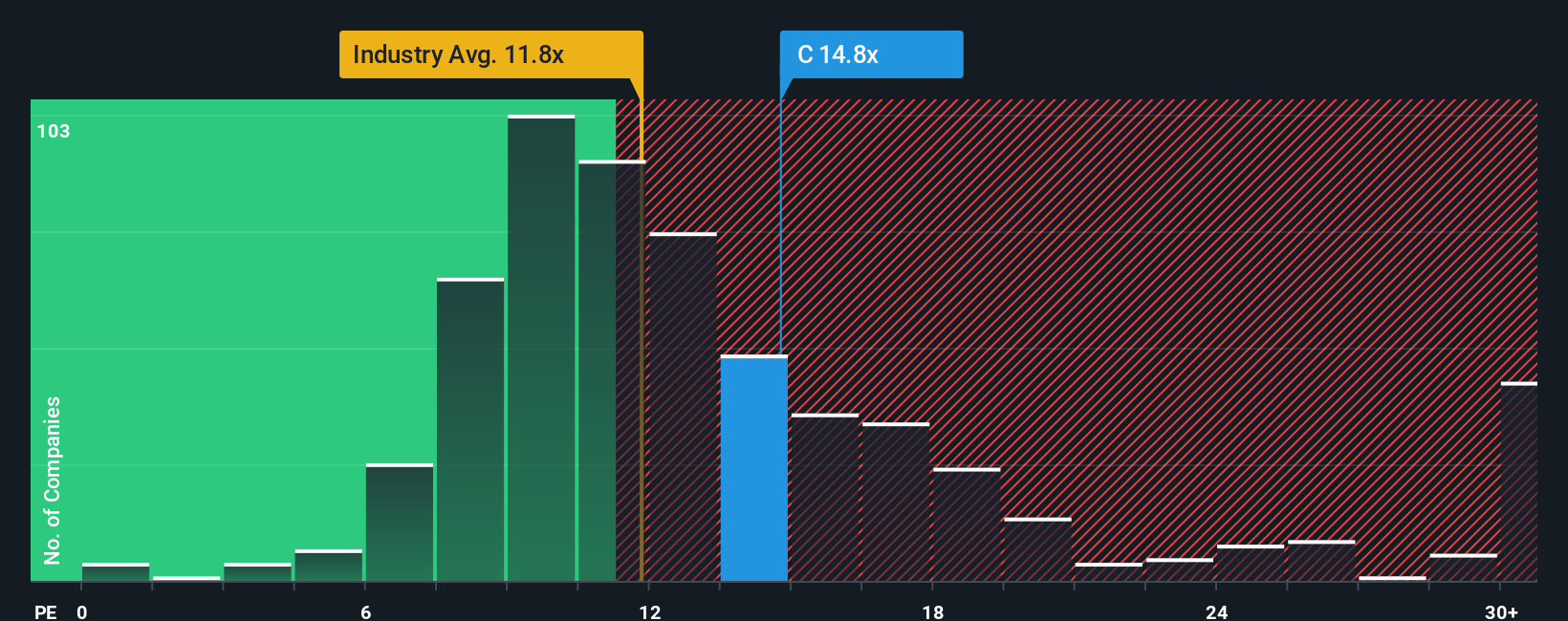

ChadWisperer’s narrative points to a fair value of about $233, almost double Citi’s recent price, but our P/E work paints a cooler picture. Citi trades on 16.2x earnings, richer than both US banks at 11.9x and its peer average at 13.9x, and only slightly below its 17.4x fair ratio. That tight gap can mean less room for error if the upbeat story does not fully play out. Which version of “value” do you lean on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Citigroup Narrative

If you look at these numbers and come to a different view, or simply want to test your own assumptions, you can build a full Citi story yourself in just a few minutes. To begin, start with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Citigroup.

Looking for more investment ideas?

If Citi has you thinking bigger, do not stop here. Broaden your watchlist with fresh angles on where capital and themes are lining up next.

- Spot potential fast movers early by checking out these 3543 penny stocks with strong financials that pair low share prices with stronger fundamentals than you might expect.

- Consider major tech trends by scanning these 27 AI penny stocks that are tied to artificial intelligence themes across different parts of the market.

- Look at price and quality together by reviewing these 883 undervalued stocks based on cash flows that currently screen as inexpensive based on their forecast cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報