A Look At Sony Group (TSE:6758) Valuation As PlayStation And Acquisition Concerns Resurface

Sony Group (TSE:6758) has completed a share buyback tranche, repurchasing 7,128,800 shares for ¥30,343.82 million, while fresh debate builds around the long term prospects of its PlayStation console business and recent acquisitions.

See our latest analysis for Sony Group.

Despite the recent buyback and noise around the PlayStation division and past acquisitions, Sony Group’s 1-month share price return of an 8.73% decline and 90-day share price return of an 11.90% decline contrast with a 1-year total shareholder return of 27.73% and 3-year total shareholder return of 88.51%. This suggests that longer term momentum has been stronger than the latest pullback.

If this mix of gaming, devices, and media has you thinking about what else might be out there in tech, it could be a good moment to scan high growth tech and AI stocks for other ideas.

So with Sony’s shares pulling back over 1 month and 3 months but longer term returns still strong, is the recent weakness hinting at undervaluation, or is the market already factoring in all the future growth it can see?

Most Popular Narrative: 24.3% Undervalued

Compared with Sony Group’s last close of ¥3,930, the most followed narrative points to a fair value of ¥5,191.60, built on detailed long term earnings and margin assumptions.

The analysts have a consensus price target of ¥4638.75 for Sony Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5350.0, and the most bearish reporting a price target of just ¥4000.0.

Curious what earnings path, margin uplift, and future P/E level are being used to argue for that higher value? The full narrative lays out those assumptions in black and white.

Result: Fair Value of ¥5,191.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change if geopolitical pressure affects sensor and hardware supply chains, or if big-budget games and entertainment releases fall short of expectations.

Find out about the key risks to this Sony Group narrative.

Another View: Our DCF Model Points To Limited Upside

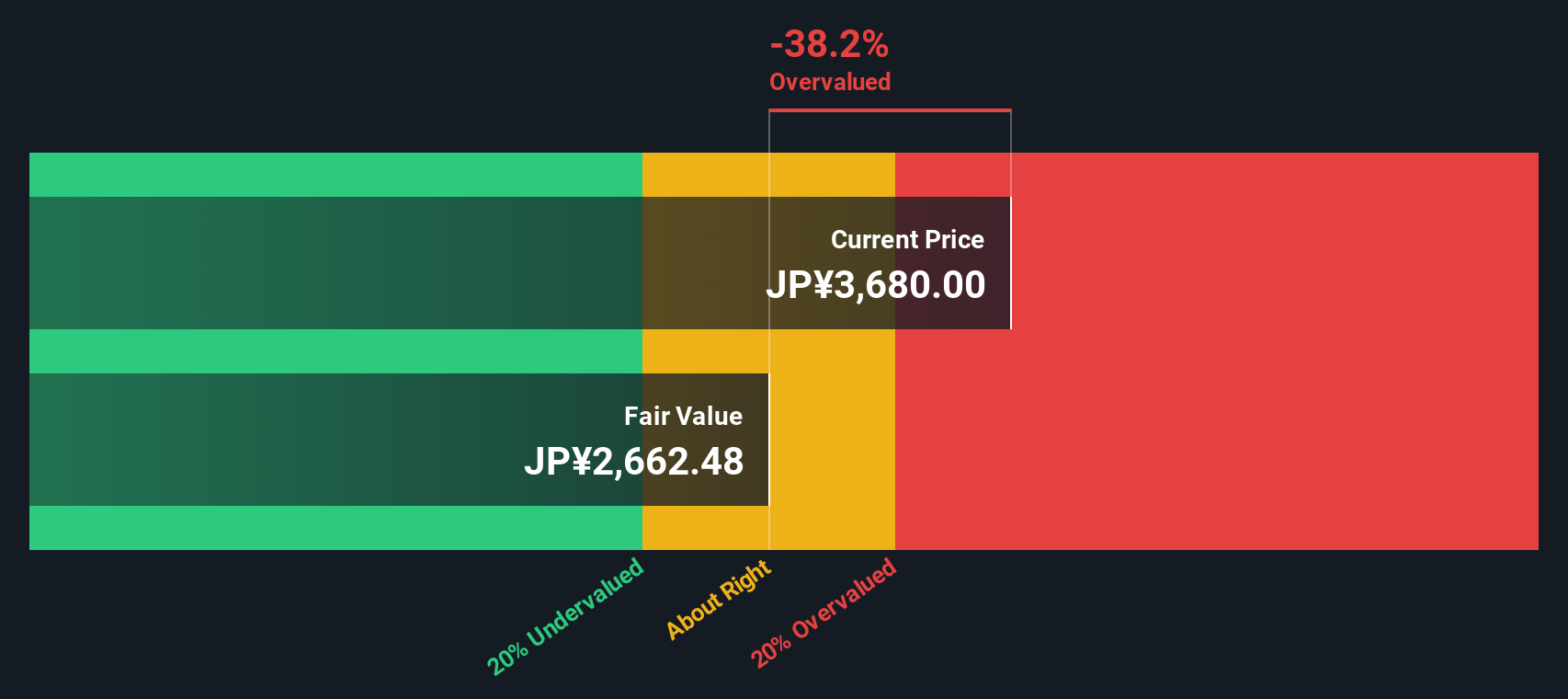

While analyst models suggest Sony Group is 24.3% undervalued, our DCF model points the other way. Using this approach, Sony's fair value sits around ¥3,213.76, compared with the current ¥3,930 share price. This implies the stock could be priced ahead of those cash flow assumptions. Which perspective do you think aligns more closely with your expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sony Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sony Group Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom Sony thesis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Sony Group.

Ready To Hunt For Your Next Idea?

If Sony has you thinking more broadly, do not stop here. Use this momentum to scan fresh ideas so you are not the one catching up later.

- Spot potential mispricings early by filtering for these 883 undervalued stocks based on cash flows that might not yet be on everyone’s radar.

- Ride major technology shifts by zeroing in on these 27 AI penny stocks pushing practical applications of artificial intelligence across different industries.

- Position ahead of possible market themes by checking out these 79 cryptocurrency and blockchain stocks tied to blockchain, digital payments, and related infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報