Ferrari (RACE) Valuation Check After Recent Share Price Weakness And Rich P/E Premium

Ferrari stock performance snapshot

Ferrari (RACE) has drawn attention after recent share price weakness, with the stock closing at US$366.81 and showing negative returns over the past week, month, past 3 months and year.

See our latest analysis for Ferrari.

That recent share price softness comes after a weaker patch over several months, with a 1 year total shareholder return of 14.8% decline sitting against a still sizeable 60.3% gain over three years and 71.0% over five years. This suggests momentum has been fading in the short term while longer term holders remain ahead.

If Ferrari’s pullback has you reassessing the auto space, it could be a useful moment to scan other premium car makers using our auto manufacturers and see how they compare.

With Ferrari shares under pressure despite 6.2% annual revenue growth and 7.6% net income growth, you might wonder: Is the current price underestimating its luxury brand power, or is the market already banking on future growth?

Most Popular Narrative: 18% Undervalued

Ferrari’s most followed narrative points to a fair value of about US$447 per share versus the recent US$366.81 close, framing a sizable value gap to test against its assumptions.

Ferrari's expansion of infrastructure and product offerings, including the new e-building and paint shop for enhanced personalization, is expected to increase production flexibility, supporting revenue growth and improved net margins through operational efficiencies.

The launch of six new models in 2025, including the anticipation of the Ferrari full electric, is likely to drive revenue growth, capturing both existing and new customers while expanding Ferrari's electrification journey.

Curious what kind of revenue path, margin lift and future P/E multiple are baked into that fair value, and how buybacks fit in too? The narrative leans heavily on premium pricing, mix and capital returns to justify a valuation usually reserved for much faster growing sectors. Want to see exactly which earnings and multiple assumptions have to land for that US$447 figure to hold up?

Result: Fair Value of $447 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if new model launches dilute Ferrari’s exclusivity, or if supply chain and cost pressures squeeze margins, that US$447 fair value case starts to look more fragile.

Find out about the key risks to this Ferrari narrative.

Another View: Rich Multiples Versus Narrative Fair Value

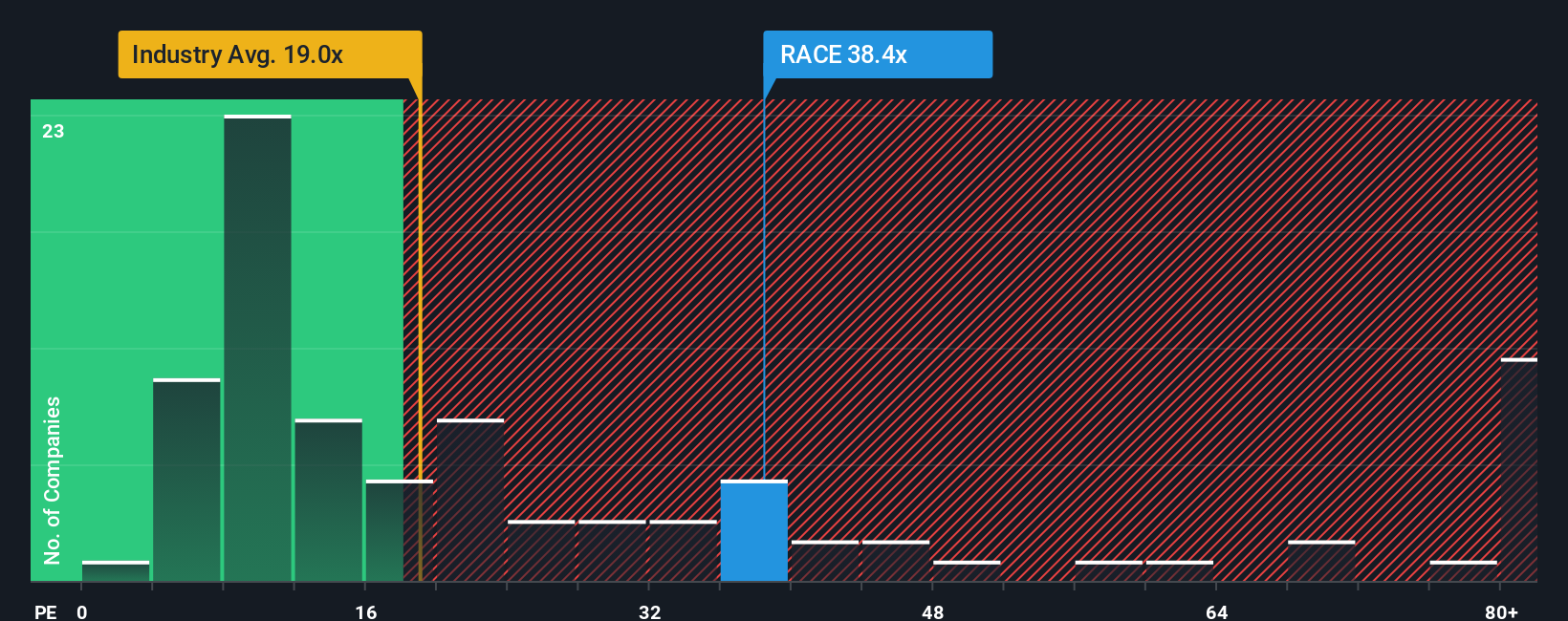

The 18% undervalued narrative is based on that US$447 fair value, but the earnings multiple tells a different story. Ferrari trades on a P/E of about 35x, compared with a fair ratio of 16.5x, the global auto industry at 18.5x and the peer average at 18.3x. This points to a richly priced stock that could move closer to those lower ratios if sentiment cools.

That gap can be read as a valuation premium for brand strength or as downside risk if expectations ease. Which side of that trade are you really on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom Ferrari view in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ferrari.

Looking for more investment ideas?

If Ferrari is on your radar, do not stop there. Use curated stock shortlists to uncover fresh ideas that fit your style before the next opportunity moves.

- Target value opportunities first by scanning these 883 undervalued stocks based on cash flows that may offer more for every dollar you commit.

- Spot growth potential in future-focused themes by running through these 27 AI penny stocks that link real businesses to the AI trend.

- Build income strength into your portfolio by zeroing in on these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報