A Look At Edwards Lifesciences (EW) Valuation After Analyst Optimism And New SAPIEN M3 FDA Approval

Edwards Lifesciences (EW) is back in focus after a series of upbeat analyst updates and fresh FDA approval for its SAPIEN M3 mitral valve replacement system. This development is one that investors are watching closely.

See our latest analysis for Edwards Lifesciences.

At a share price of $84.83, Edwards Lifesciences has seen short term share price returns move only slightly. Its 12.82% 90 day share price return and 14.40% 1 year total shareholder return indicate that momentum has been building around the recent FDA approval and upbeat analyst commentary.

If advances in heart valve technology are on your radar, it can be useful to see how the wider sector is shaping up, starting with healthcare stocks.

With the shares at $84.83 and trading only slightly below the average analyst price targets, the key question is whether Edwards Lifesciences still offers upside potential or if the recent optimism already reflects future growth.

Most Popular Narrative: 12% Undervalued

With the last close at $84.83 and a narrative fair value of about $95.80, the current price sits below what this widely followed view implies.

The analysts have a consensus price target of $87.731 for Edwards Lifesciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $101.0 and the most bearish reporting a price target of $72.0.

Curious what kind of revenue build, margin profile, and future P/E multiple have to line up to support that higher fair value range? The full narrative spells it out.

Result: Fair Value of $95.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks around tariff related EPS pressure, acquisition related dilution, and intensifying international TAVR competition could all chip away at the upside in this bullish setup.

Find out about the key risks to this Edwards Lifesciences narrative.

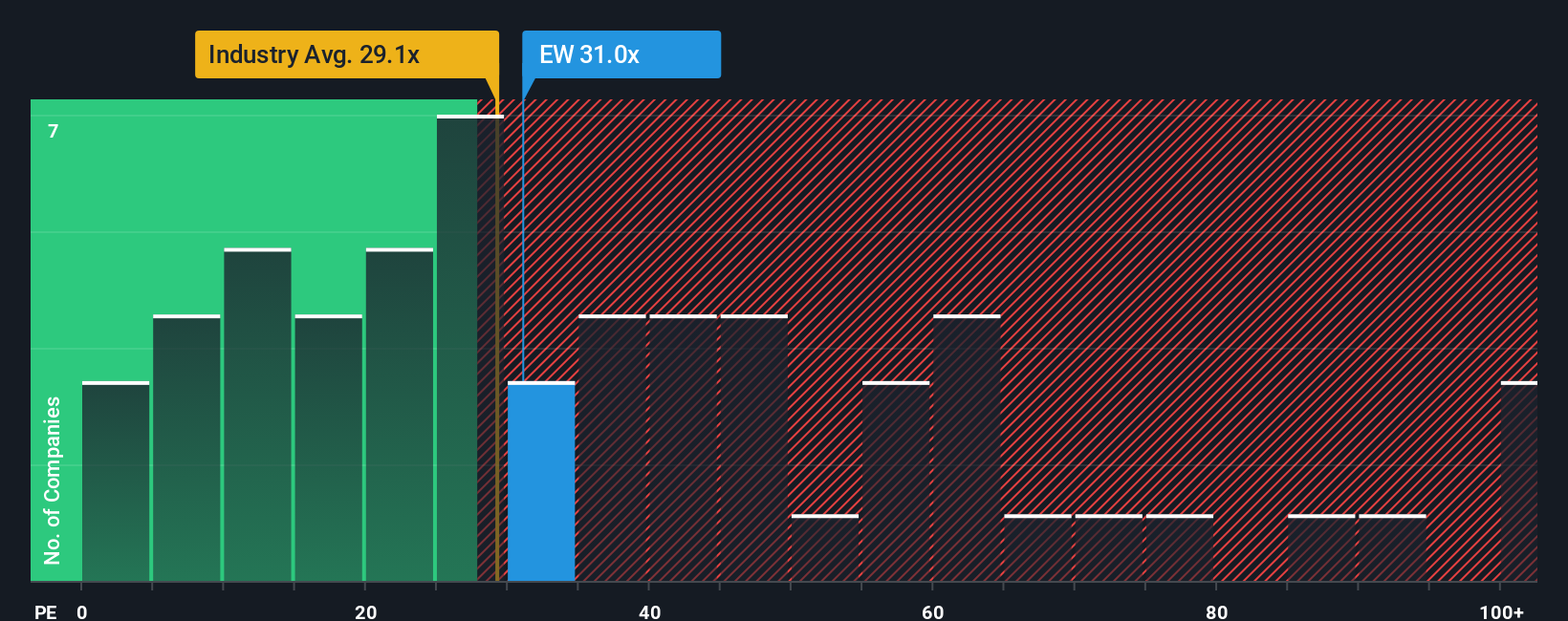

Another View: What The P/E Ratio Is Saying

That 12% narrative undervaluation sits awkwardly beside the current P/E of 36.7x, which is higher than both the US Medical Equipment industry at 30.7x and the estimated fair ratio of 31.9x. In plain terms, you are paying a richer price multiple even though the model suggests upside. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Edwards Lifesciences Narrative

If this view does not quite fit how you see the story, you can review the numbers yourself and develop a custom Edwards Lifesciences thesis here: Do it your way.

A great starting point for your Edwards Lifesciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Edwards Lifesciences is on your radar, do not stop here, you will miss out on other angles that could sharpen your portfolio and widen your opportunity set.

- Spot potential value setups early by scanning these 882 undervalued stocks based on cash flows that may be pricing in more pessimism than their cash flows suggest.

- Tap into fast evolving artificial intelligence themes through these 27 AI penny stocks that tie real businesses to this powerful technology trend.

- Add income focused ideas to your watchlist with these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報