ASX Dividend Stocks Featuring Three Top Picks

As the Australian market navigates a period of subdued activity, with materials experiencing a notable sell-off despite rising iron ore futures, investors are keenly observing economic signals from China and their impact on local sectors. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to balance risk while capitalizing on consistent returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 7.71% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.18% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.19% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.67% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 5.60% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.56% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 8.04% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.12% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.57% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.45% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kina Securities Limited operates in Papua New Guinea, offering commercial banking, financial services, fund administration, investment management, and share brokerage with a market cap of A$358.88 million.

Operations: Kina Securities Limited generates its revenue primarily from Banking & Finance (Including Corporate) at PGK 441.25 million and Wealth Management at PGK 50.19 million in Papua New Guinea.

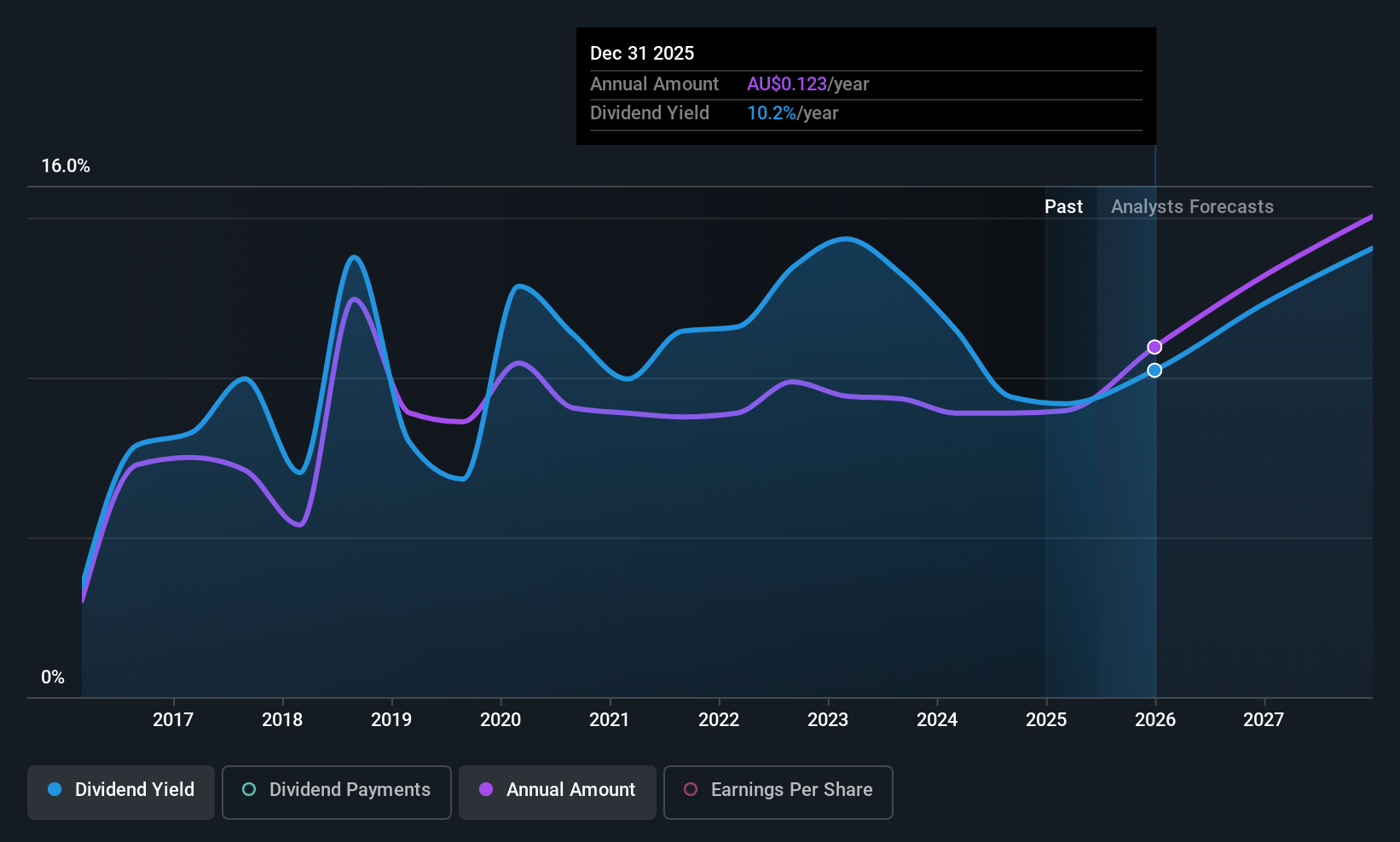

Dividend Yield: 8%

Kina Securities offers a high dividend yield of 8.04%, placing it in the top 25% of Australian dividend payers, though its track record is unstable. The company's dividends are currently covered by earnings with a payout ratio of 69.9% and are forecast to remain covered at 63.2% in three years. Despite trading at good value with a low P/E ratio of 8.9x, concerns include high bad loans at 7.7%.

- Take a closer look at Kina Securities' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Kina Securities shares in the market.

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Super Retail Group Limited operates as a retailer of auto, sports, and outdoor leisure products across Australia and New Zealand, with a market capitalization of A$3.51 billion.

Operations: Super Retail Group Limited generates revenue through its segments: Rebel at A$1.36 billion, Macpac at A$231.40 million, Super Cheap Auto (SCA) at A$1.53 billion, and Boating, Camping and Fishing (BCF) at A$950.70 million.

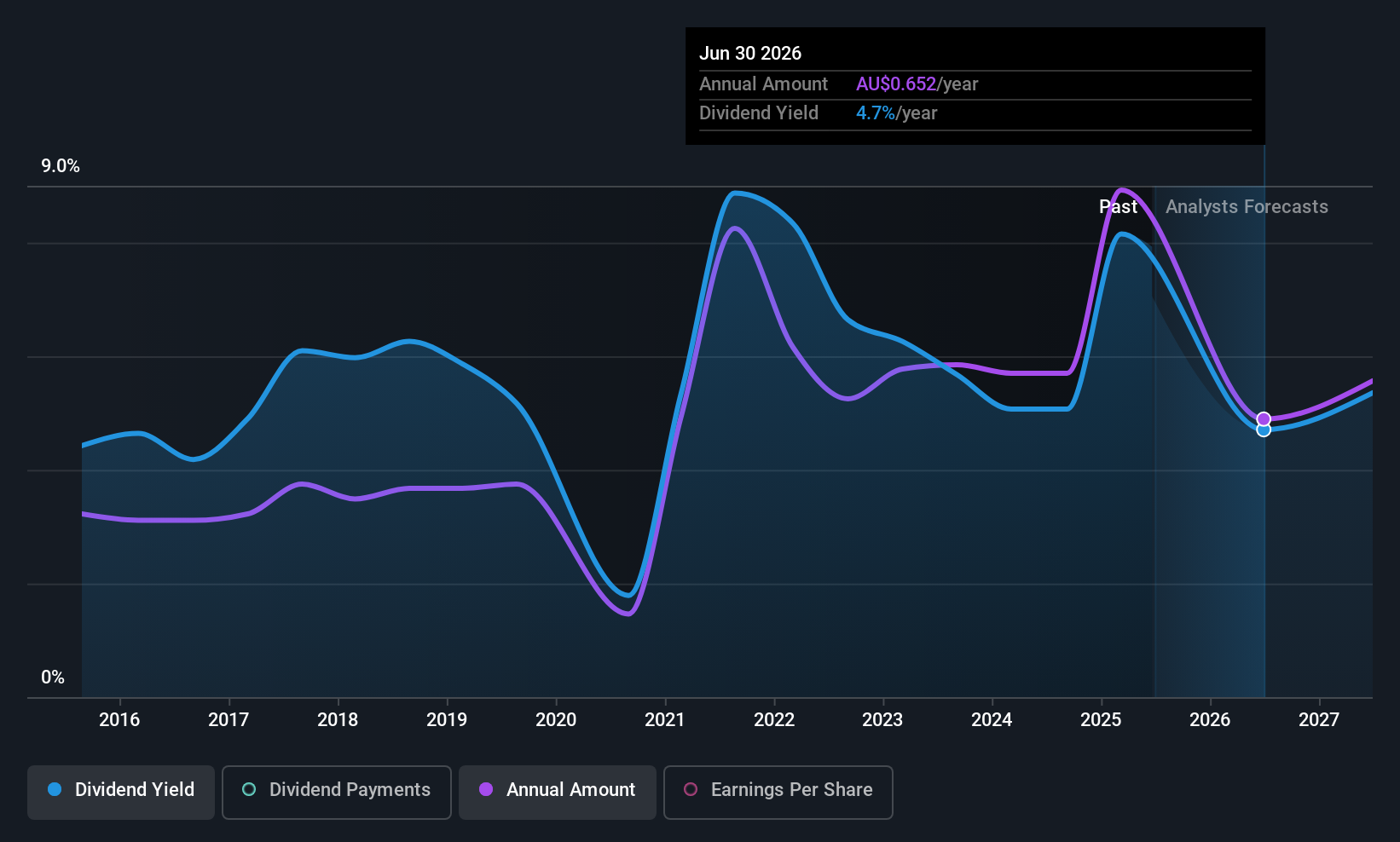

Dividend Yield: 6.2%

Super Retail Group offers a dividend yield of 6.18%, ranking in the top 25% among Australian dividend payers, with dividends covered by earnings (67.2%) and cash flows (52.7%). Despite past volatility in its dividend payments, there has been growth over the last decade. The stock trades at an attractive value, but recent executive changes, including the appointment of Paul Bradshaw as CEO, may introduce some uncertainty to its strategic direction.

- Click here to discover the nuances of Super Retail Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Super Retail Group is priced lower than what may be justified by its financials.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited, with a market cap of A$635.68 million, offers electrical, instrumentation, communications, security, fire, and maintenance services and products across Australia.

Operations: Southern Cross Electrical Engineering Limited generates revenue primarily from the provision of electrical services, amounting to A$801.45 million.

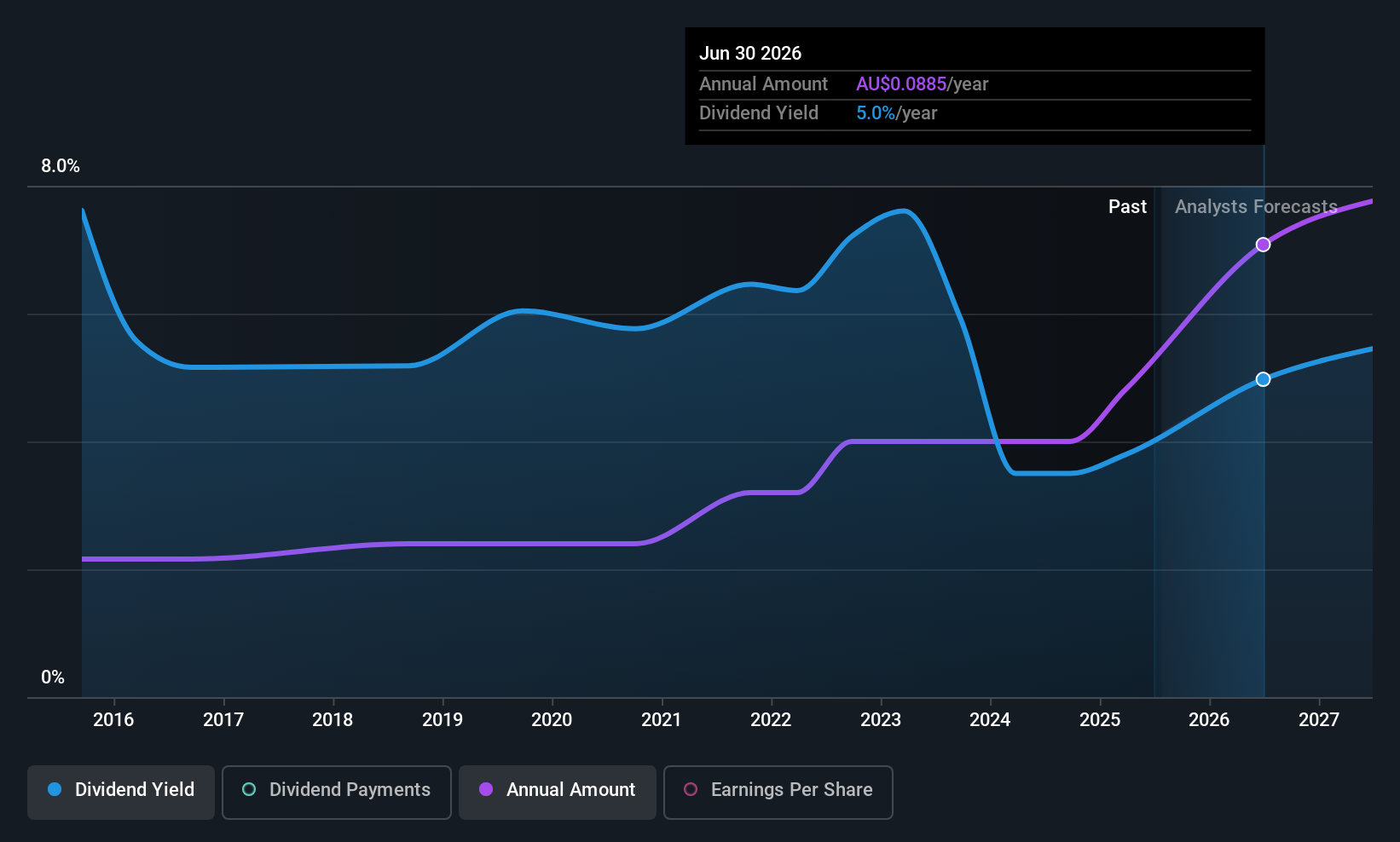

Dividend Yield: 3.1%

Southern Cross Electrical Engineering's dividend yield of 3.14% is below the top 25% of Australian dividend payers, but it is well-covered by earnings (62.5%) and cash flows (33.4%). Despite a volatile dividend history over the past decade, there has been an increase in payments during this period. The stock trades at a discount to its estimated fair value, yet its unstable track record may concern some investors seeking consistent returns.

- Get an in-depth perspective on Southern Cross Electrical Engineering's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Southern Cross Electrical Engineering's share price might be too pessimistic.

Next Steps

- Access the full spectrum of 32 Top ASX Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報