MasTec (MTZ) Valuation Check After Recent Share Price Swings

MasTec stock at a glance

MasTec (MTZ) has been drawing fresh attention after recent share price moves, with the stock last closing at US$235.75. That has investors revisiting its infrastructure-focused business and current valuation.

See our latest analysis for MasTec.

Recent trading has been choppy, with a 1-day share price return of a 0.25% decline, a 7-day share price return of 8.46%, and a 90-day gain of 12.21%. Over the longer stretch, total shareholder returns of 60.84% over 1 year and 145.62% over 3 years point to strong momentum, which investors may weigh against MasTec's current valuation and infrastructure exposure.

If MasTec has caught your eye, it could be a moment to see what else is moving and scan aerospace and defense stocks for other infrastructure linked names in related industries.

With MasTec posting solid recent returns and trading only slightly below the average analyst price target, the key question is whether today’s valuation still leaves upside on the table or if the market already reflects future growth.

Most Popular Narrative: 4% Undervalued

MasTec's most followed narrative points to a fair value of about US$246.67, slightly above the last close of US$235.75, which frames the current pricing debate.

Multi-year investments in operational efficiency, technology, and customer framework agreements are driving sequential and year-over-year improvements in EBITDA and net margins across segments; continued execution on these initiatives is likely to further support margin expansion and long-term earnings power, which appears underappreciated by the current stock valuation.

Curious what kind of earnings ramp and margin profile could support that valuation gap, even with a higher discount rate and firm P/E assumptions baked in?

Result: Fair Value of $246.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh the risk that large projects slip or key customers pull back, which could squeeze margins and unsettle the current earnings narrative.

Find out about the key risks to this MasTec narrative.

Another Angle On Valuation

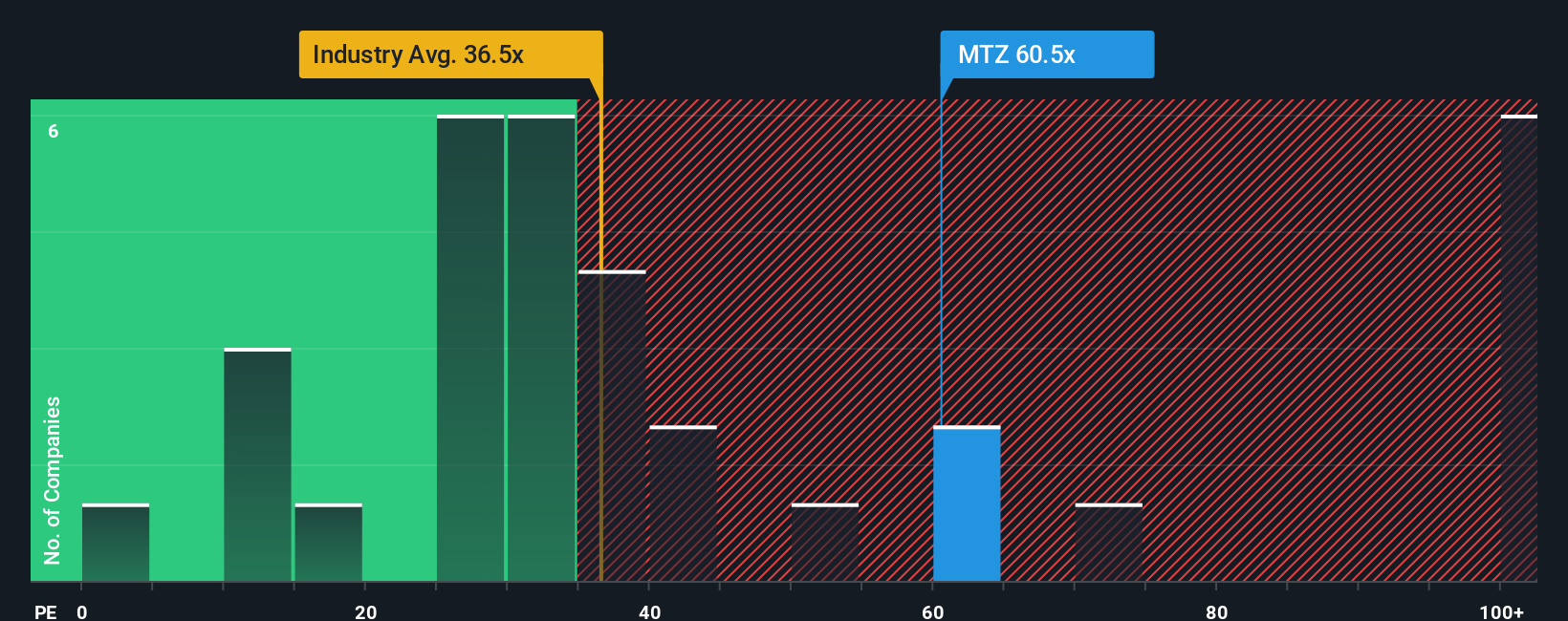

Our fair value estimate suggests MasTec trades only about 1% below intrinsic value, yet the current P/E of 55.3x is higher than both the US Construction industry at 32.5x and a fair ratio of 38.7x. That kind of premium can mean thinner room for error if expectations change. Where would you place more weight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MasTec Narrative

If you see the numbers differently or prefer to work through the assumptions yourself, you can build a custom view in just a few minutes. Do it your way

A great starting point for your MasTec research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more stock ideas?

If MasTec has sharpened your thinking, do not stop there. Take a few minutes now to scan other opportunities before the next move passes you by.

- Spot potential value gaps by checking out these 882 undervalued stocks based on cash flows that may be pricing in more caution than their cash flows suggest.

- Ride powerful tech trends by filtering for these 27 AI penny stocks that are building real businesses around artificial intelligence.

- Boost your income focus by screening these 12 dividend stocks with yields > 3% that combine yield with business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報