Did Expectations of Weaker EPS Amid Rising Sales Just Shift Deere's (DE) Investment Narrative?

- Deere recently saw its shares lag the broader market after past trading sessions, as investors reacted to expectations of a sharp year-over-year earnings-per-share decline despite revenue growth ahead of its upcoming report.

- This tension between anticipated revenue expansion and weaker profitability has sharpened focus on how efficiently Deere is converting rising sales into bottom-line results.

- Against this backdrop of expected earnings pressure despite higher revenue, we’ll now examine what this means for Deere’s existing investment narrative.

Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Deere Investment Narrative Recap

To own Deere, you need to believe that its precision agriculture, automation and financing ecosystem can compound value even through choppy cycles in farm and construction demand. The latest share pullback on expectations of weaker earnings per share despite higher revenue does not materially change that thesis, but it does bring the near term margin pressure and end market volatility in North America into sharper focus as the key catalyst and the main risk right now.

Against this backdrop, Deere’s fiscal 2026 net income guidance of US$4.00 billion to US$4.75 billion and its recent earnings trajectory are especially relevant, as they anchor expectations around how much earnings compression investors are already braced for. The company’s ongoing investment in precision agriculture and automation remains central to the story, but investors will be watching closely to see whether these higher value offerings can offset weaker pricing and incentives in core equipment markets.

Yet while the long term technology story is compelling, investors should be aware of the risk that...

Read the full narrative on Deere (it's free!)

Deere's narrative projects $45.1 billion revenue and $8.6 billion earnings by 2028. This requires a 0.7% yearly revenue decline and an earnings increase of about $3.4 billion from $5.2 billion today.

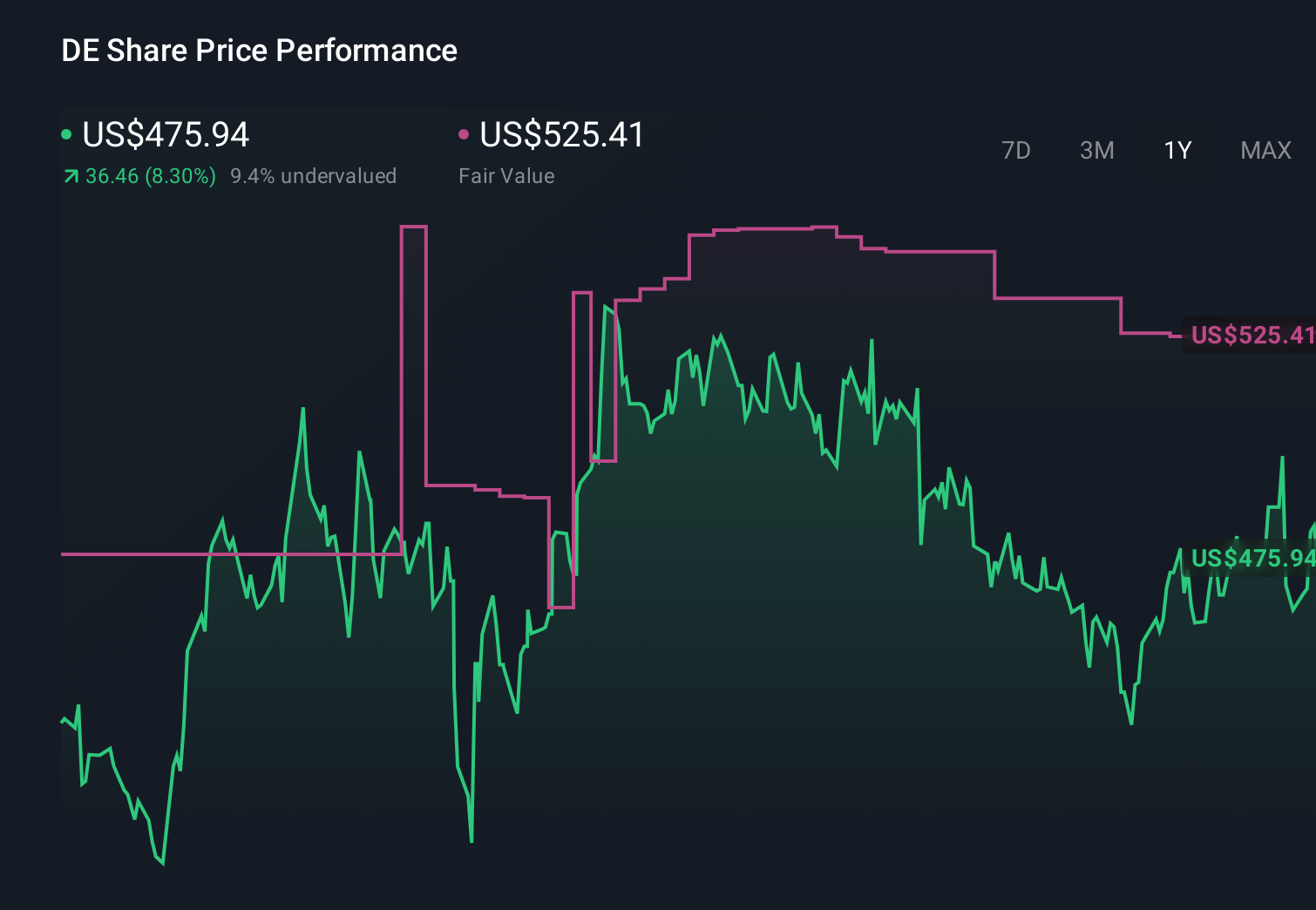

Uncover how Deere's forecasts yield a $526.91 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently place Deere’s fair value between US$430 and about US$627 per share, highlighting a wide spread of individual expectations. You can weigh those differing views against the recent concern that North American end market volatility and softer margins may pressure Deere’s ability to translate revenue into earnings, and decide which assumptions about the company’s performance you find most reasonable.

Explore 5 other fair value estimates on Deere - why the stock might be worth 10% less than the current price!

Build Your Own Deere Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deere research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deere research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deere's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報